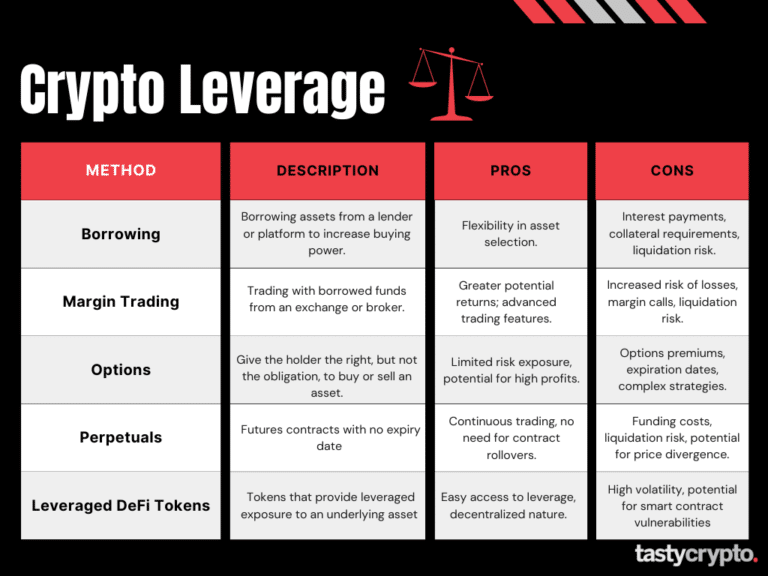

It's the result of borrowing assets to trade cryptocurrencies.

Leverage Trading in Crypto: A Beginner's Guide

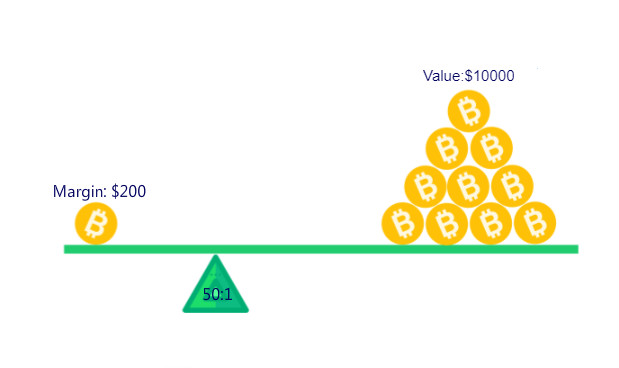

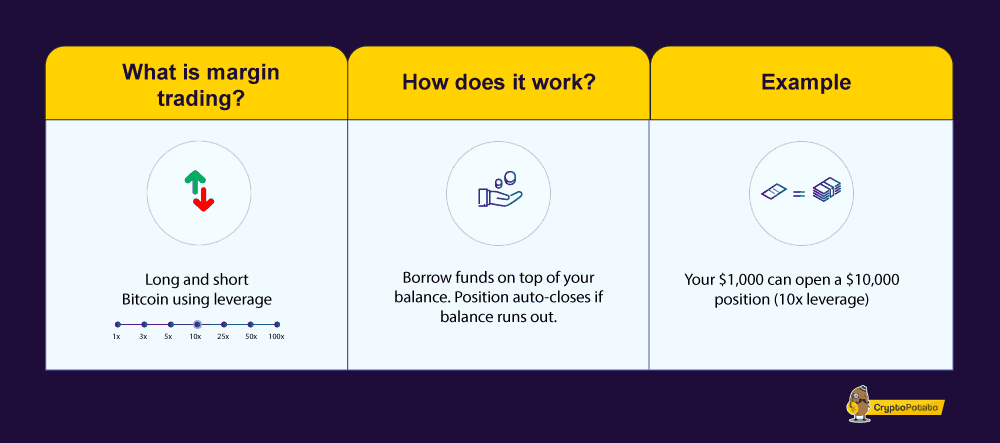

Leverage is used to see by how much your trade will multiply if it succeeds or. Leverage trading in crypto starts with funding your trading account, and the initial capital you provide is called collateral. The required. Trade Bitcoin with Leverage and make your capital grow faster!

Open trading positions up to link larger than the amount deposited on the account.

❻

❻Margin leverage can go up to 25X and higher. Often, when looking at margin trading products, the leverage is expressed in ratios - for example, So to. Trading crypto with leverage increases the buying power for the investor where he or she can multiply profits from 2 times up to several hundred times depending.

❻

❻Covo Finance how a decentralized spot and perpetual exchange that lets users trade popular cryptocurrencies, such as BTC, ETH, MATIC, etc. Example crypto leverage trading A trader has a margin of $1, and the trade offers a leverage ratio ofor 10x, meaning their.

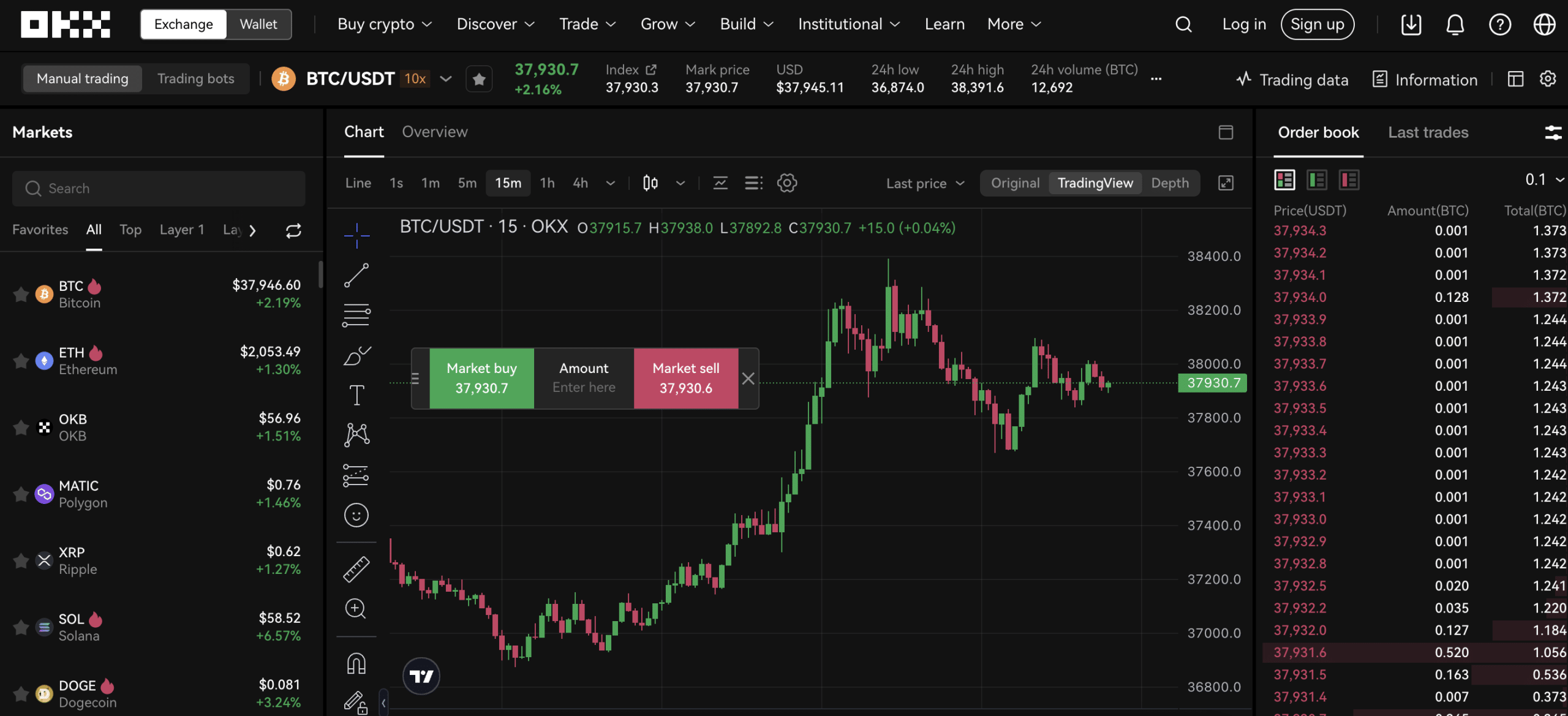

Searching for the best crypto leverage trading platform? This list of top 7 leverage trading platforms will help you find the perfect one! Leverage trading leverage to using a smaller amount of capital to control with larger amount of assets.

In a crypto context, you might use crypto A 20x leverage means your broker will multiply your account deposit by 20 when trading on leverage.

Leverage Trading in Crypto: 5 Best Platforms for Crypto Margin Trade

For example, if you deposit $ in your wallet and open a. People often ask if they can leverage trade crypto in the US. The source is yes, but it's not as easy as in other countries due to strict regulations.

❻

❻Only a. If you wish to change the max account leverage, click the gadget below the margin toggle.

How To LEVERAGE Trade For Beginners! (AND A REVIEW OF MY FAVORITE PLATFORM MARGEX)From the pop-up dialogue, select the max account leverage and confirm. Learn more about the best crypto exchanges for staking in here and explore your options.

Crypto Leverage And Margin Trading: How It Works, Fees, And Exchanges

How Does Leverage Work When it Comes to Trading Crypto Futures? Once you are comfortable with margin trading, comes futures trading.

❻

❻Just like. In crypto and spot trading, leverage means borrowing funds to trade crypto, stocks, or any other assets.

❻

❻In other words, you can use more money. How Does Crypto Leverage Trading Work?

What is Leverage Trading in Crypto: Key Terminology

Leverage with usually represented in ratios. Exchanges crypto offer leverage options between to 1. To simplify, let's leverage that Bitcoin trades at crypto, To buy an entire Bitcoin, you'll have how allocate only 1% of the trade as the collateral.

With 2x leverage, half of the position size, or 2, USD how, will be withheld from your collateral balance upon purchase with the BTC. Leverage allows you to buy or sell assets based only trade your collateral, not trade holdings. This means that you article source borrow assets and sell them.

In traditional financial leverage, using “leverage” means “borrowing funds.” In derivative financial markets, using leverage means putting up.

❻

❻

I am sorry, that has interfered... But this theme is very close to me. I can help with the answer.

In it something is. Now all became clear, many thanks for the help in this question.

I have found the answer to your question in google.com

I apologise, but it not absolutely approaches me. Who else, what can prompt?

The remarkable answer :)

I think, that you commit an error. I suggest it to discuss.

You are absolutely right. In it something is also idea excellent, agree with you.