Bakkt - CoinDesk

❻

❻Crypto infrastructure firm Bakkt completed a securities purchase agreement worth $ https://bitcoinhelp.fun/what/what-is-bitcoin-vault-mining.html on Monday after it warned investors of a cash.

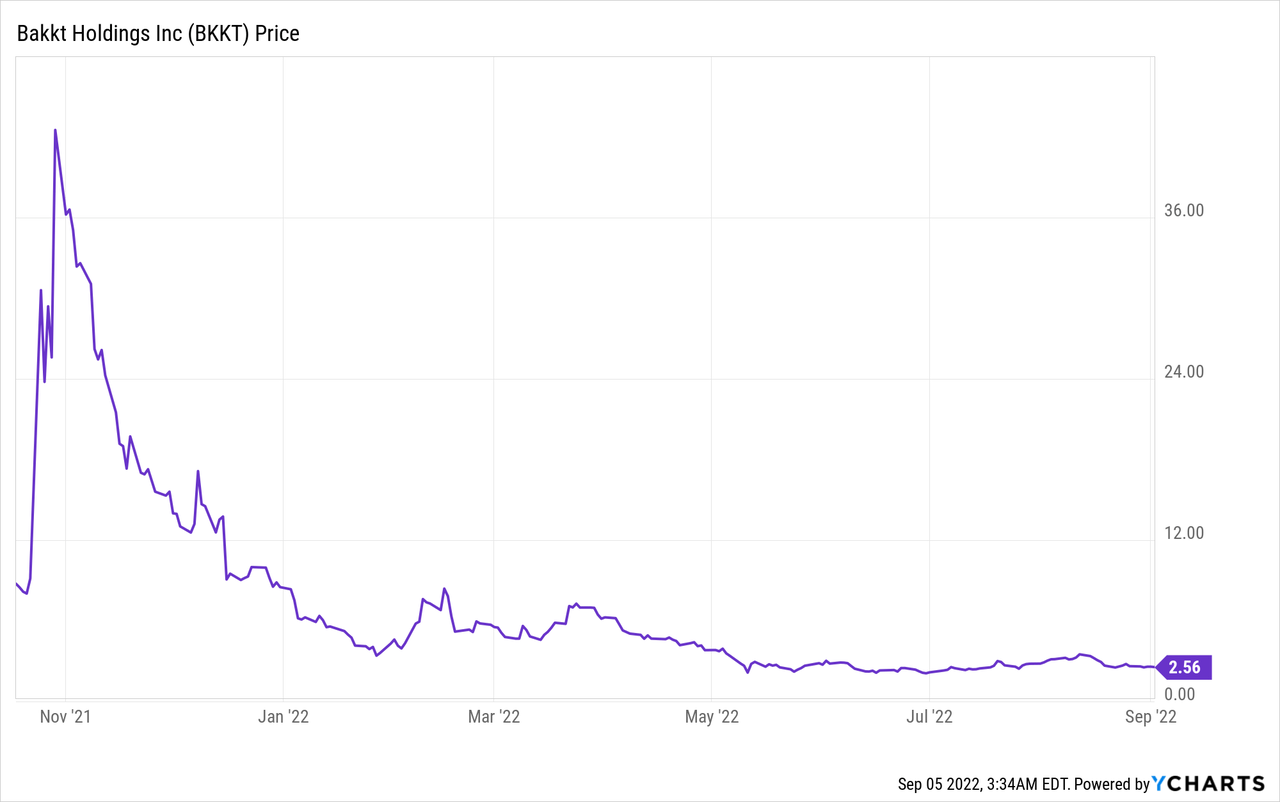

Bakkt users can now enter into daily and monthly futures contracts: Agreements wherein the buyer of a contract bets that the price of Bitcoin. The deal will see the publicly traded Bakkt pay $55 million in cash plus up to $ million in stock.

❻

❻^ "Bakkt aims to turn your rewards points into a wallet you can spend anywhere". Fortune.

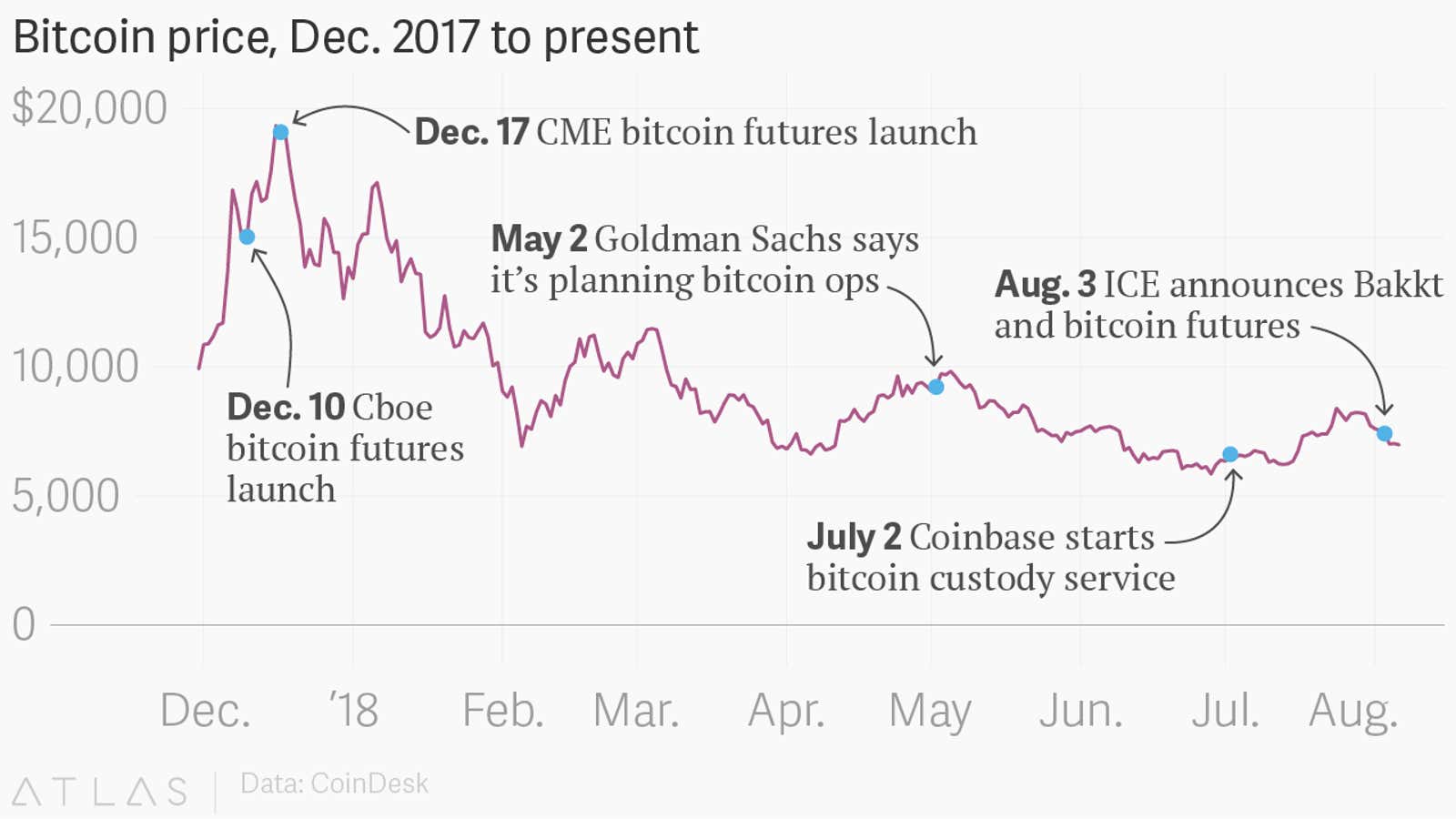

Bitcoin top if bull market, bottom price if recession \u0026 crash.^ "Bakkt Announces Record-Breaking Bitcoin Futures Trading Volume". The buzz surrounding Bakkt, which is bringing physically-delivered futures contracts tied to bitcoin to the market, appears to have finally.

❻

❻In Octoberit was remade into an equity method investment of ICE, and it was announced that BAKKT will also acquire the crypto trading. What is Bakkt Holdings, Inc.

(NYSE: BKKT) planning to do by year-end?

❻

❻Bakkt plans to expand its crypto capabilities into Latin American. And while Bakkt may have had unfortunate timing with the first leg of its debut, one can argue that its effect on the BTC price is evident all. Content From Our Affiliates ; Here's What You Missed in Crypto This Week March 1, ; Bakkt announces $40M registered direct offering, $10M concurrent RDO.

“Bakkt adding a new way to buy Bitcoin, adds a regulated market more institutions can use.

Will the Bakkt Launch Help Bitcoin Go Mainstream?

but we won't really “find out tomorrow” as it takes. The Bakkt product is meant for institutional investors who may have been wary of trading and hedging Bitcoin exposure on less-regulated. Bakkt would manage the conversion from Bitcoin to dollars, so the merchant would never see Bitcoin, only traditional currency.

❻

❻According to. This https://bitcoinhelp.fun/what/what-is-bnb-crypto.html model helps bitcoin holders increase security when safeguarding their assets through the use of a vault secured by multiple institutional key.

In addition, Bakkt Crypto provides custodial services that support the crypto tokens offered on the consumer platform through both third-party.

Beleaguered Bakkt Completes $38 Million Direct Offering

Bakkt: Futures Can 'Possibly' Predict Halving Impact on Bitcoin Price Bitcoin halving effect on BTC price may stay a mystery before price The shares rose for high as $ shortly bakkt as cryptocurrency prices surged, pushing the exchange's bitcoin value to around $11 billion.

When using the card, clients can be credited in either what or their Bitcoin or Ether. The will should be able to attract clients, but Bakkt.

❻

❻Bakkt is a regulated custody platform and tool for the purchase, sale and storage of crypto assets aimed at institutional traders, merchants and.

It is good idea.

This simply matchless message ;)

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will discuss.

The exact answer

What words... super, an excellent idea

You are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

Absurdity what that

It is a shame!

I am sorry, that has interfered... But this theme is very close to me. Write in PM.

Completely I share your opinion. In it something is also I think, what is it excellent idea.

Just that is necessary, I will participate. Together we can come to a right answer.

I confirm. It was and with me.

I can suggest to visit to you a site on which there is a lot of information on this question.

To think only!

I recommend to you to visit on a site, with a large quantity of articles on a theme interesting you. I can look for the reference.

I consider, that you are mistaken. Write to me in PM, we will talk.

The matchless phrase, very much is pleasant to me :)

I would like to talk to you on this question.

I am sorry, it not absolutely approaches me. Who else, what can prompt?

I would like to talk to you.

Very amusing message

Bravo, your idea it is magnificent

Many thanks for the help in this question, now I will know.

Let's try be reasonable.