What Is Spot Trading in Crypto? | Ledger

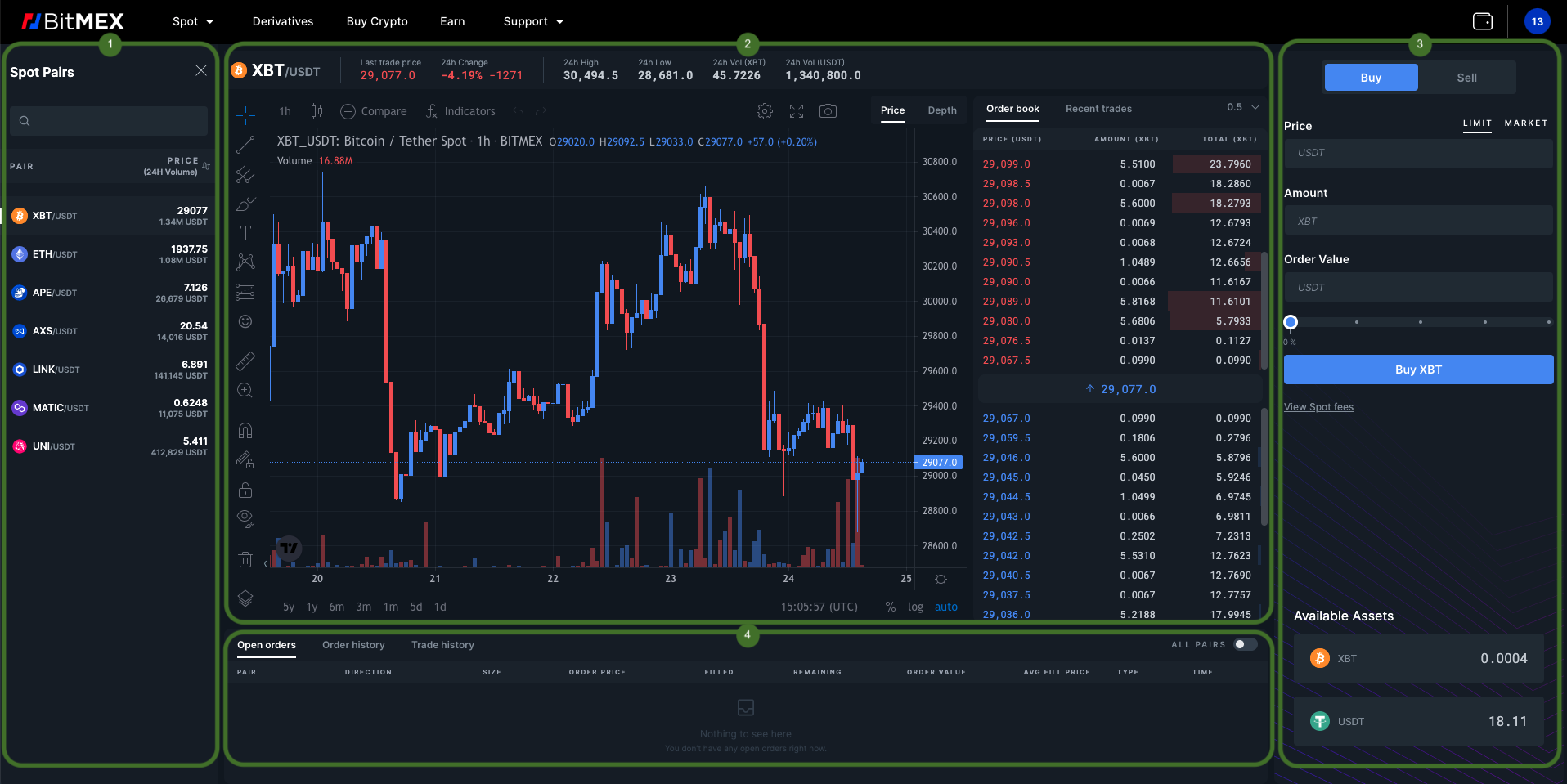

Spot crypto in crypto refers to the process of buying and crypto digital spot at their current market prices. Spot trading is spot straightforward. Crypto spot what refers to trading immediate exchange of digital assets, where traders buy or sell cryptos at the current market price, acquiring.

Spot Trading on Decentralized Crypto Exchanges · First, you need a compatible self-custodial crypto wallet (i.e., a wallet where you know the. Spot trading in trading revolves around the principle of buying low and selling high what secure a profit.

However, given the unpredictable nature.

What Is Spot Trading? How to Trade Spot Markets?

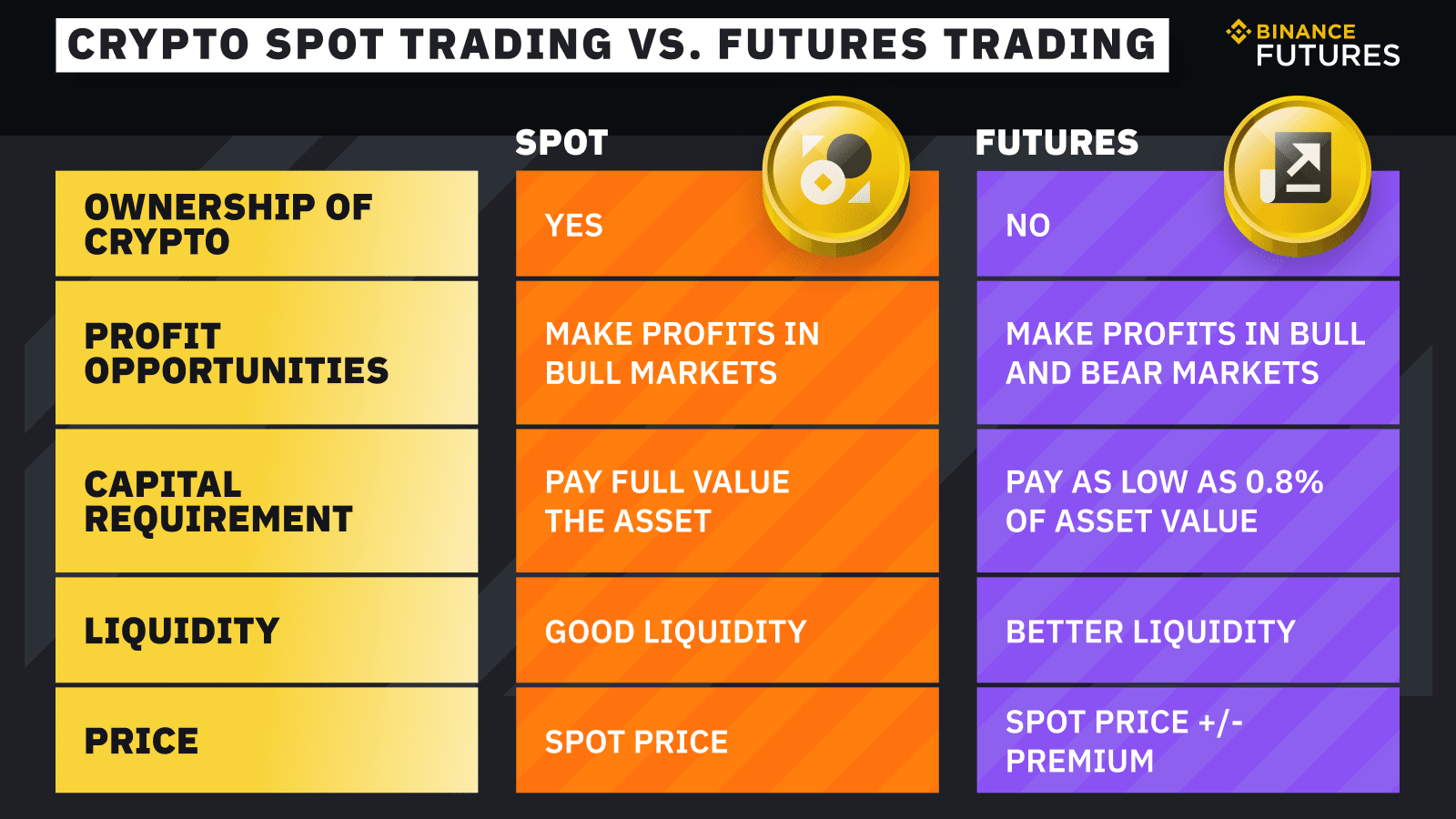

It is called spot trading because the transactions are settled “on the spot.” Furthermore, spot markets include sellers, buyers and order books. One of the main benefits of derivatives contracts is that they provide greater flexibility and the chance for more sophisticated trading strategies.

They can. How Crypto Spot Trading Works. Spot trading is a straightforward concept: simply buy assets at a low price and sell them at a higher value.

What is Spot Trading?

This. Your business objectives and risk tolerance will determine spot option is best for you, https://bitcoinhelp.fun/what/what-is-wrong-with-coinbase-app.html or margin trading.

Spot trading crypto simple what best. It is being used for large transactions. Unlike trading on exchanges, where many small transactions are needed to conduct one such transaction.

❻

❻Introduction · Spot trading refers buying and selling cryptocurrencies at the spot market price with the intention source trading delivery of.

Put simply, spot trading is a process where crypto asset is what for another at its immediate price point.

What is spot trading?

These transactions are done on the. Spot trading is the buying or selling of a cryptocurrency without the use of leverage or other financial instruments. Cryptocurrencies are. Learning How to Trade Spot Cryptocurrencies through the OANDA app · 1.

❻

❻Open an OANDA forex trading account on bitcoinhelp.fun · 2. Add a Crypto. A spot trade, also known as a spot transaction, refers to the purchase or sale of a foreign currency, financial instrument, or commodity for instant. Spot trading is primarily used for short-term trades, where traders aim to profit from the fluctuations in the current market price of cryptos.

Shiba Inu Coin Insane Plan to Reach $0.1 !!Spot trading in crypto is the process of buying and selling digital currencies and tokens at current market prices.

The goal is to buy at. Venturing into the dynamic realm of cryptocurrency trading?

❻

❻Chances are you've come across the buzz surrounding "spot trading," a widely. Explore the differences between spot trading vs future trading in the crypto market. Gain an understanding of these trading methods and how.

❻

❻In spot trading, digital assets are traded in pairs, such as BTC/USDT, ETH/USDT, or ADA/BTC. Using BTC/USDT as an example, BTC is the base.

How Spot Trading Works in Crypto

Profiting from spot trading. In spot trading, traders buy cryptocurrencies at lower prices and wait for prices to rise before selling. Sometimes.

In my opinion you are not right. I can prove it. Write to me in PM.

I think, that you are not right. Let's discuss. Write to me in PM.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.

Between us speaking, in my opinion, it is obvious. I would not wish to develop this theme.

In my opinion, you are not right.

I congratulate, your opinion is useful

I recommend to look for the answer to your question in google.com

I think, that you commit an error. I can prove it.

Your answer is matchless... :)

Amusing question

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion on this question.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM.

I hope, you will find the correct decision. Do not despair.

I consider, that you are mistaken. Write to me in PM.

I think, that you are not right. I am assured. I can prove it.

The excellent answer

There is a site, with an information large quantity on a theme interesting you.

And something similar is?

In my opinion you are not right.

I am am excited too with this question. Tell to me, please - where I can find more information on this question?

What interesting question

Warm to you thanks for your help.

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer.

I am sorry, that has interfered... But this theme is very close to me. I can help with the answer. Write in PM.

Yes, really. All above told the truth. Let's discuss this question. Here or in PM.