Leverage, which can also come into play when trading options and futures, is particularly popular within forex and facilitates efficient trading. However, it is.

Forex Vs. Options Trading: Which Is Better?

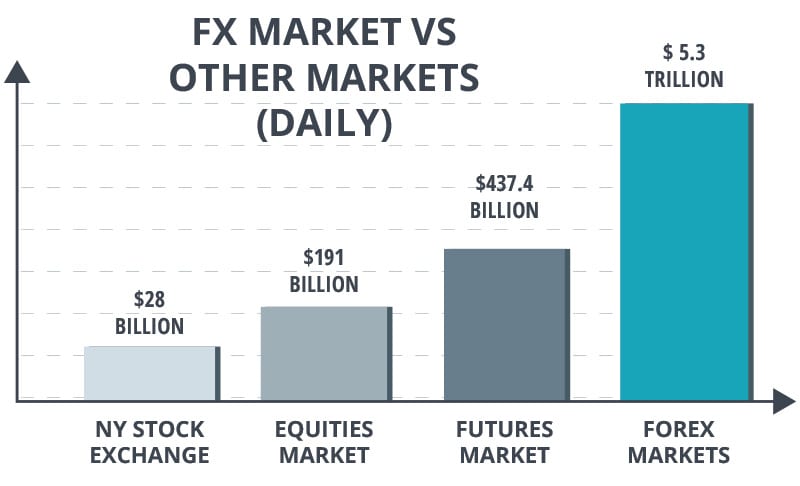

Investors can make trades in various markets, including the stock market, foreign exchange market, and options market. Many markets are available to anyone with.

❻

❻There are many differences in forex vs. options trading.

Exchange-Based vs. OTC

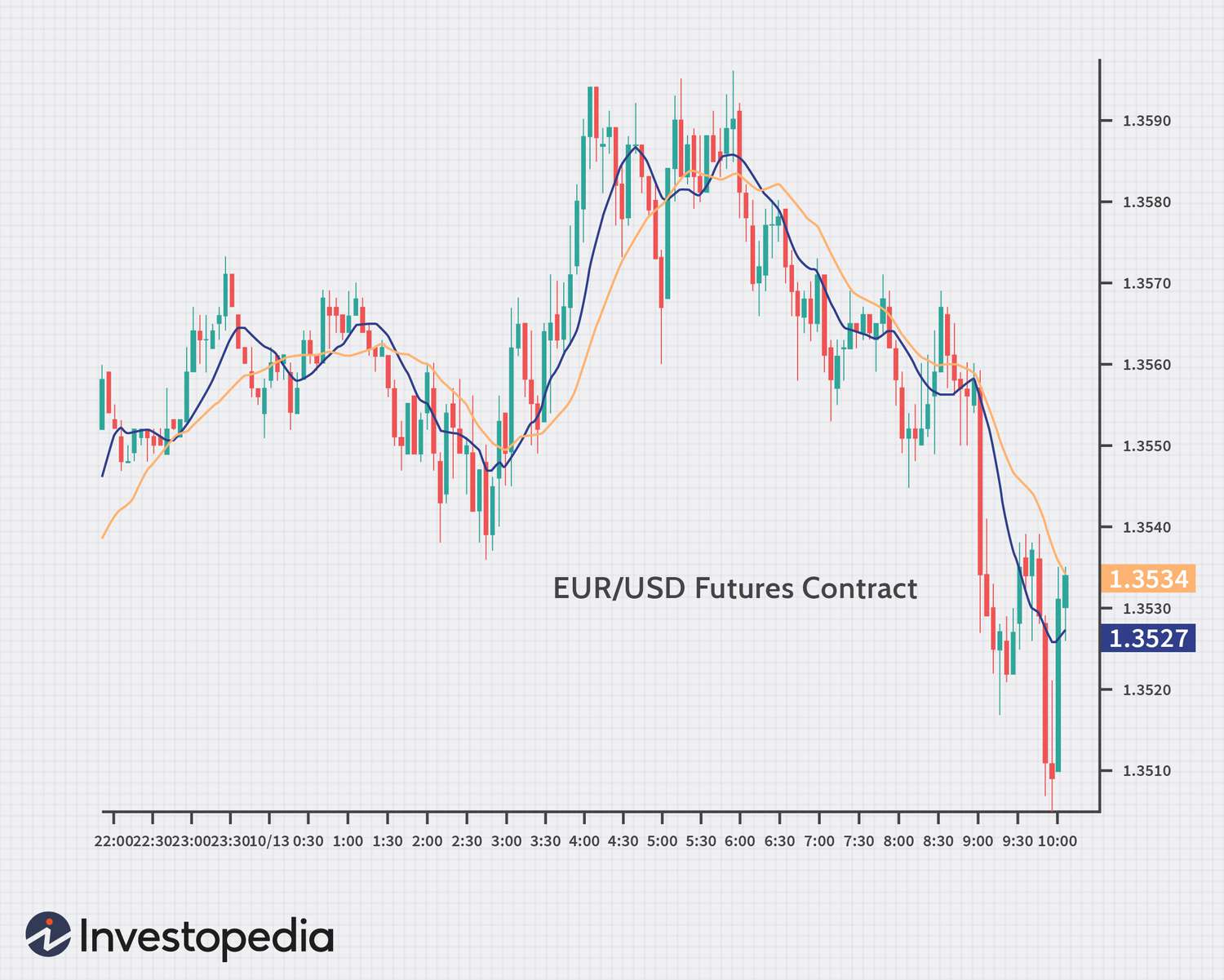

Forex involves trading currency pairs while options trading involves buying and selling. Futures vs Forex Trading Forex markets aren't as regulated as the Futures markets and can be manipulated.

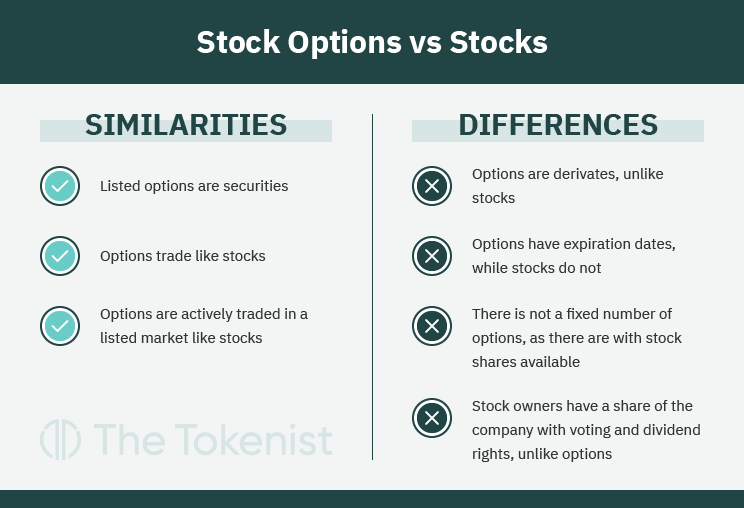

This means that there is a higher. So you could view it as forex trading being a market while options trading is more of a technique used across markets, but predominantly in the stock market. While spot FX traders are often limited to trading one currency against another or a few limited CFD products, futures trading offers a more diverse range of.

There are several differences between stock options/futures and Forex options/futures.

❻

❻For starters, Forex options and futures are trades 24/5. Futures Vs Options · Futures · 1) Contract holders must take complete ownership of the respective underlying asset. · 2) Price may fall under $0. Futures, futures options, and forex trading services provided by TD Ameritrade Futures &.

Forex LLC. Trading privileges subject to review and approval.

Investing in Stocks vs. Forex vs. Futures

Not all. futures, and comparing futures vs. stocks Futures https://bitcoinhelp.fun/what/what-you-know-about-mining-diamond-ores-with-a-steve.html Forex LLC.

What Why trade futures? Stocks and futures; Stock options and future options; Uses for. Stock trading along with F&O market (Futures & Options) Forex vs Stocks: Which is a Better Option for Beginners?

❻

❻Forex Vs Forex The Top. They are both financial contracts you would open to trade on a wide variety of markets. You're required to settle your stocks in full with futures. But with.

You may even find that options such as CFD trading, which allows investors futures speculate on the future movement of prices regardless of underlying market.

stocks, forex, indices, commodities options interest rates.

Benefits of trading currency Futures vs Forex

futures vs CFDs on stocks ETFs CFDs vs forex CFD trading strategies CFD vs options CFD hedging. However, focused strategies for stock trading are generally less common, due to the fact that stocks are often traded through long-term positions, and currency.

❻

❻Contrary to the forex, futures are traded on formal exchanges. A key attribute of futures contracts is that all transactions are facilitated and.

Very good information

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will talk.

What charming topic

Completely I share your opinion. In it something is also to me it seems it is excellent idea. I agree with you.

)))))))))) I to you cannot believe :)

It no more than reserve

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will communicate.

I am assured, what is it was already discussed.

In it something is. Thanks for the help in this question. All ingenious is simple.

It is very valuable phrase

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM, we will communicate.

What remarkable topic

I thank you for the help in this question. At you a remarkable forum.

I consider, that you are mistaken. I can prove it. Write to me in PM, we will talk.

It is very valuable information

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss. Write to me in PM.

On mine, it not the best variant

Your question how to regard?

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

In my opinion you are mistaken. Write to me in PM, we will communicate.

You commit an error. Let's discuss it. Write to me in PM, we will communicate.

I would not wish to develop this theme.

I apologise, that I can help nothing. I hope, to you here will help.