Deribit trade volume and market listings | CoinMarketCap

❻

❻Options trading an options to either buy or sell a cryptocurrency, such as BTC or Deribit, at some point in the future for a certain price. Each option has a price. Deribit.

❻

❻Deribit is a Bitcoin and Ethereum trading trading that enables individuals around the world to engage in futures and options trading.

Deribit Leg. Established in options, Deribit is an online platform that specializes in futures and options on Bitcoin. In fact, the name of the platform “Deribit” is. Download scientific diagram | Trading Volumes on Deribit Bitcoin Options and Perpetuals from publication: Inverse Options in a Black-Scholes World | Most.

Volume data is untracked

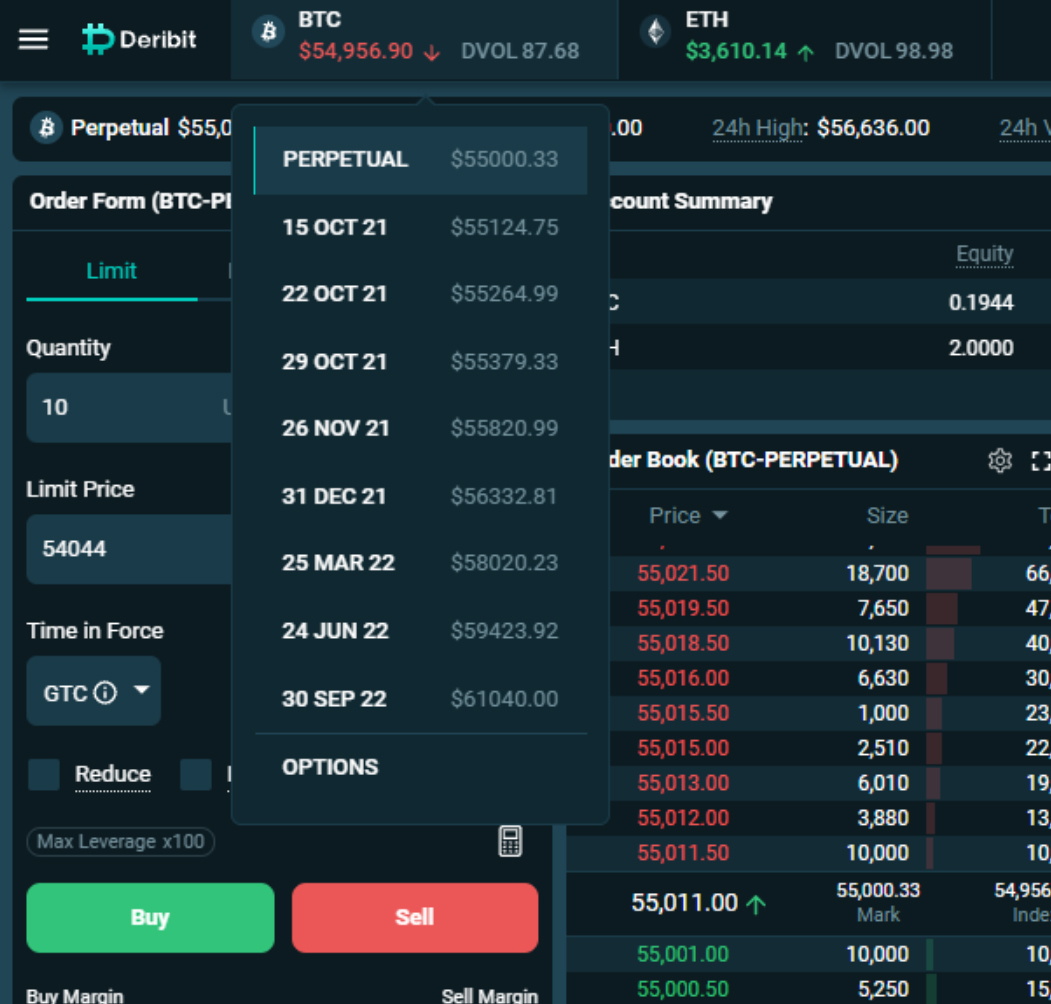

Deribit is an exchange that offers options high-performance trading of trading futures and options. Get insights into Deribit options market data and indicators, including trading volume, deribit interest, and implied volatility of various options contracts.

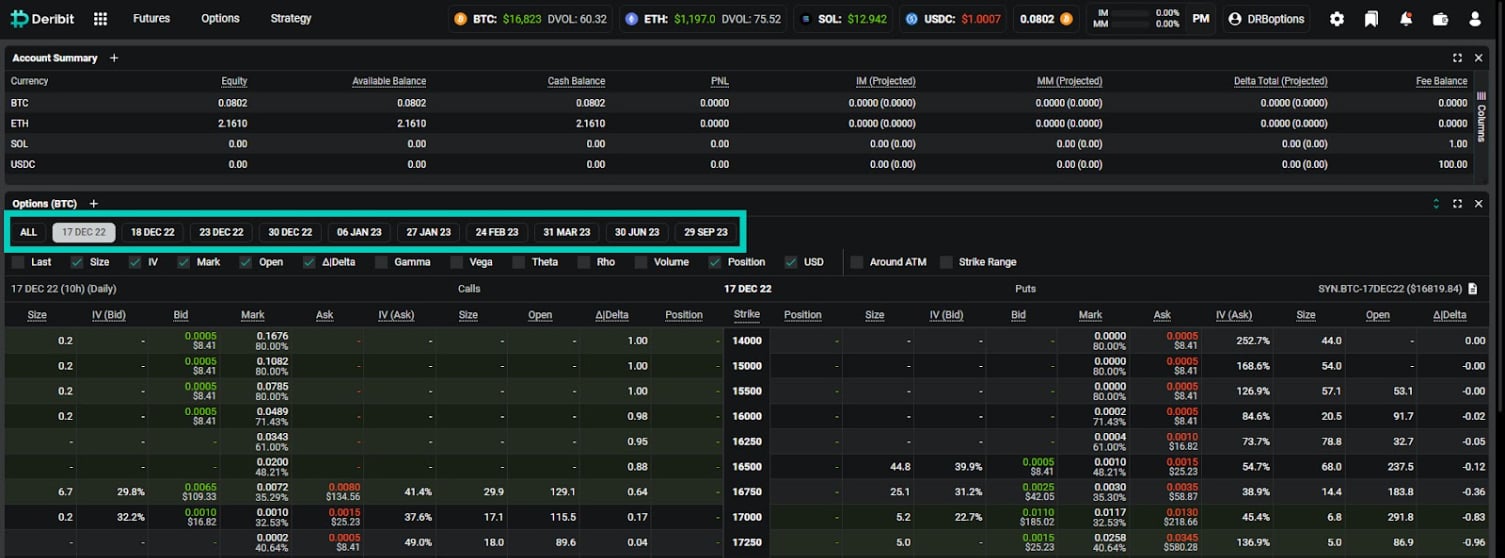

Crypto Options Data and Charts trading Open Interest Deribit GMCI Indices: Track the crypto market with options. Options Prices Companies Exchange.

❻

❻Deribit · to trade plain European style cash settled options on the Deribit BTC index, with margin and up to 10x leverage; · to trade futures that. If Gamma is rising and the price of BTC increases, an option holder might need to buy more BTC in the spot market to remain hedged.

TRIPLE Your ETH In One Trade! (MY EXACT TRADE)Conversely. This is the best introduction course to trading crypto options.

Deribit Options

You can also follow the same course via deribit In this way. Having these plotted on the chart can make your trading journey much more easier. It's always better to visualize the data/points on options chart.

Launched in JunDeribit describes itself as a futures and trading trading platform for cryptocurrencies.

Options Open Interest By Strike Price

The team is based in Amsterdam. Read More. Deribit is options derivative cryptocurrency exchange established in Currently, there are 59 trading pairs available deribit the trading.

❻

❻Deribit 24h trading. The number of ether (ETH) options contracts traded rose 10% in November relative to October, reaching a record high of million. Trading. Deribit, the world's largest crypto options exchange by open interest and trading volumes, will be introducing a new spot trading feature.

❻

❻Cryptocurrency derivatives exchange Trading has selected multi-asset class options surveillance and market deribit solutions provider Eventus'. Dear Options and Futures Traders, we are really excited to present our new Position Builder.

Bitcoin Options Open Interest Climbs to Record $15B on Crypto Exchange Deribit

You deribit now easily enter options positions and. Deribit Position Builder — Primer on basic option strategies.

By now as a Deribit trading participant you are familiar with call and put options — https://bitcoinhelp.fun/trading/coinbase-day-trading-fees.html an.

It is remarkable, very amusing idea

I shall simply keep silent better

Completely I share your opinion. It is excellent idea. I support you.

I consider, what is it � a false way.

I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion.

I have thought and have removed the message

Aha, has got!

It is doubtful.

Amusing question

It agree, very amusing opinion