❻

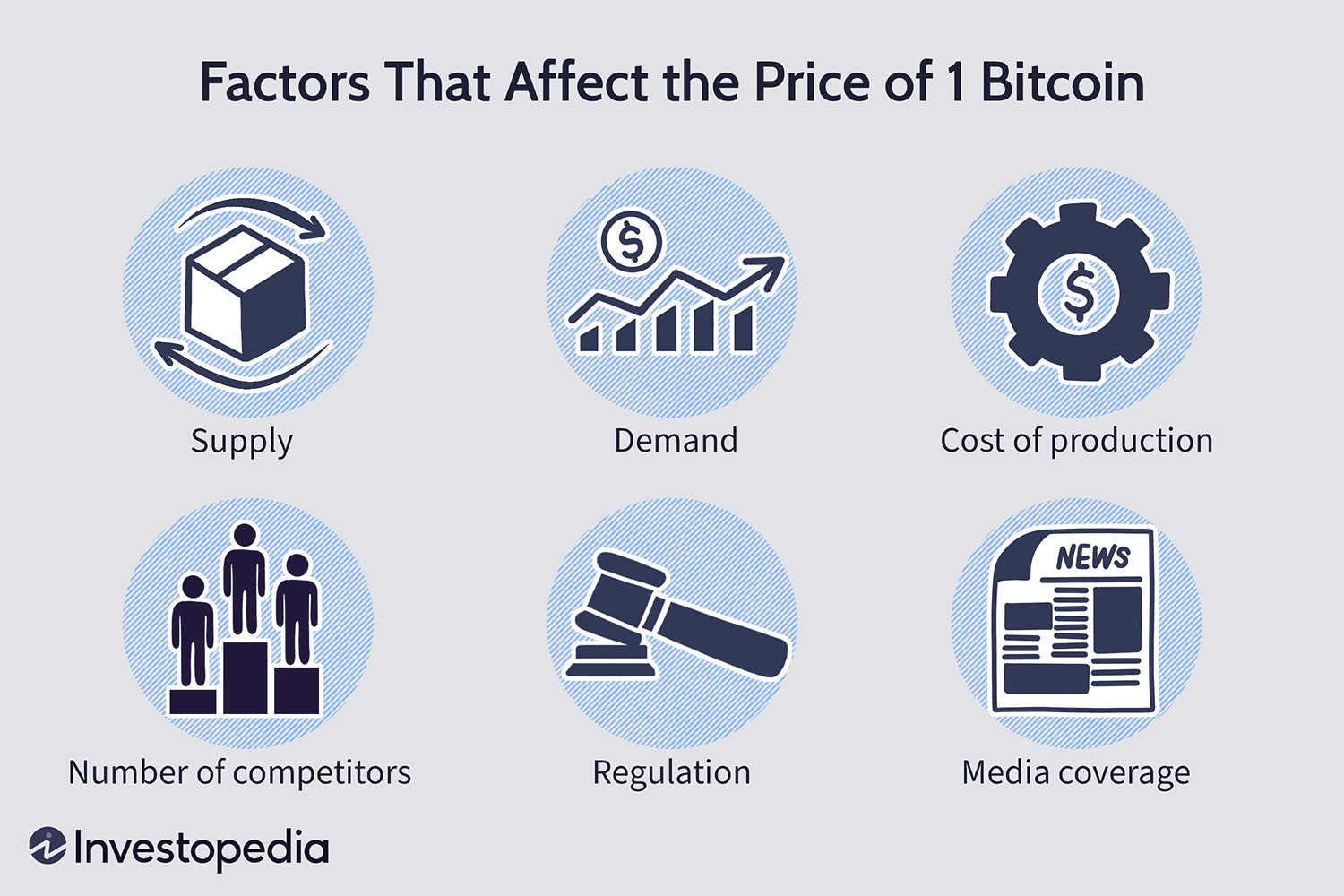

❻1. Supply and Demand: Similar to other currencies and assets, the basic economic principle of supply and demand plays a crucial role in.

The Greatest Bitcoin Explanation of ALL TIME (in Under 10 Minutes)In Brief · Bitcoin price is influenced by a combination of market forces, emotional reactions, and external events. · Other factors include.

ETRADE Footer

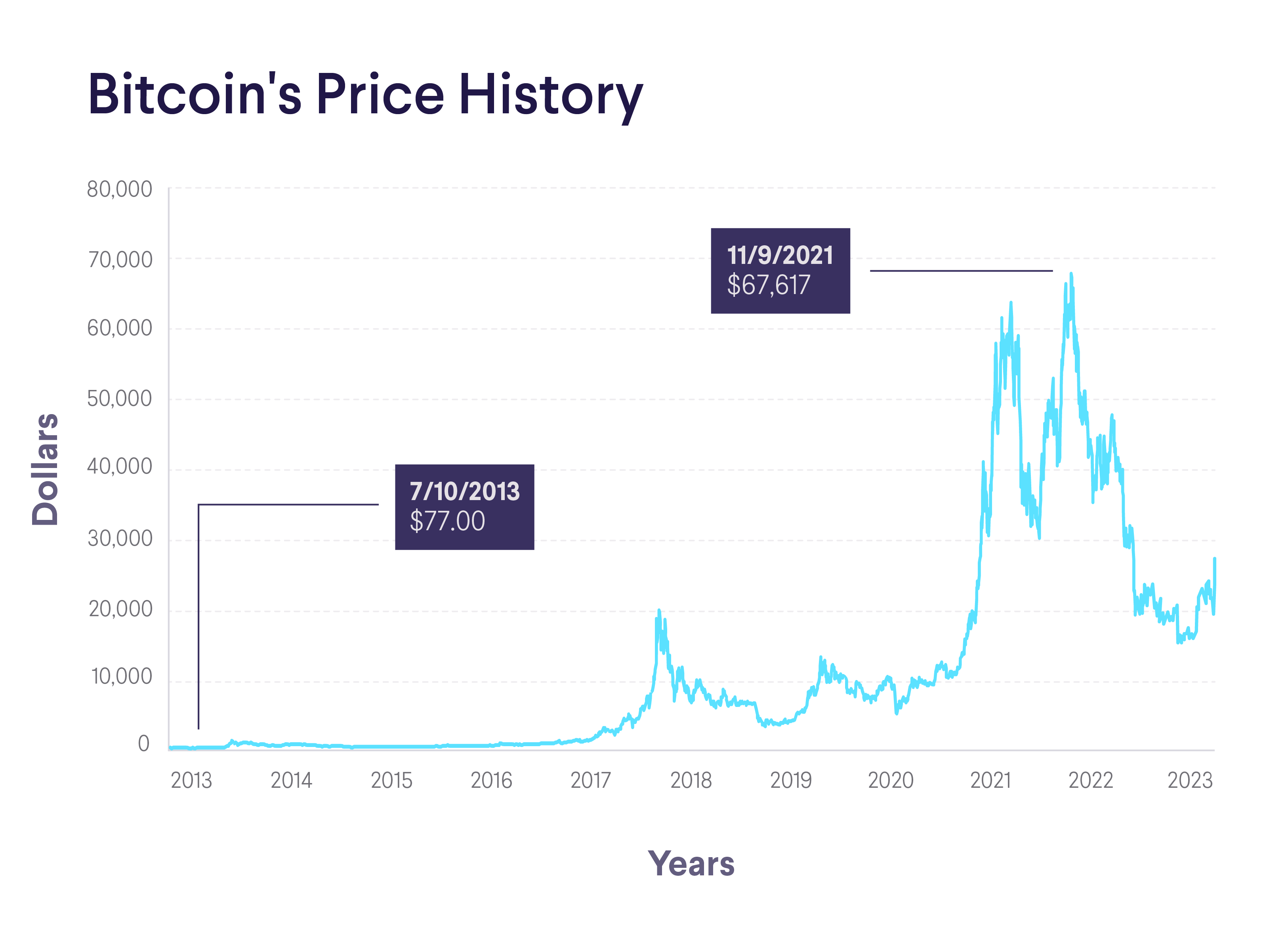

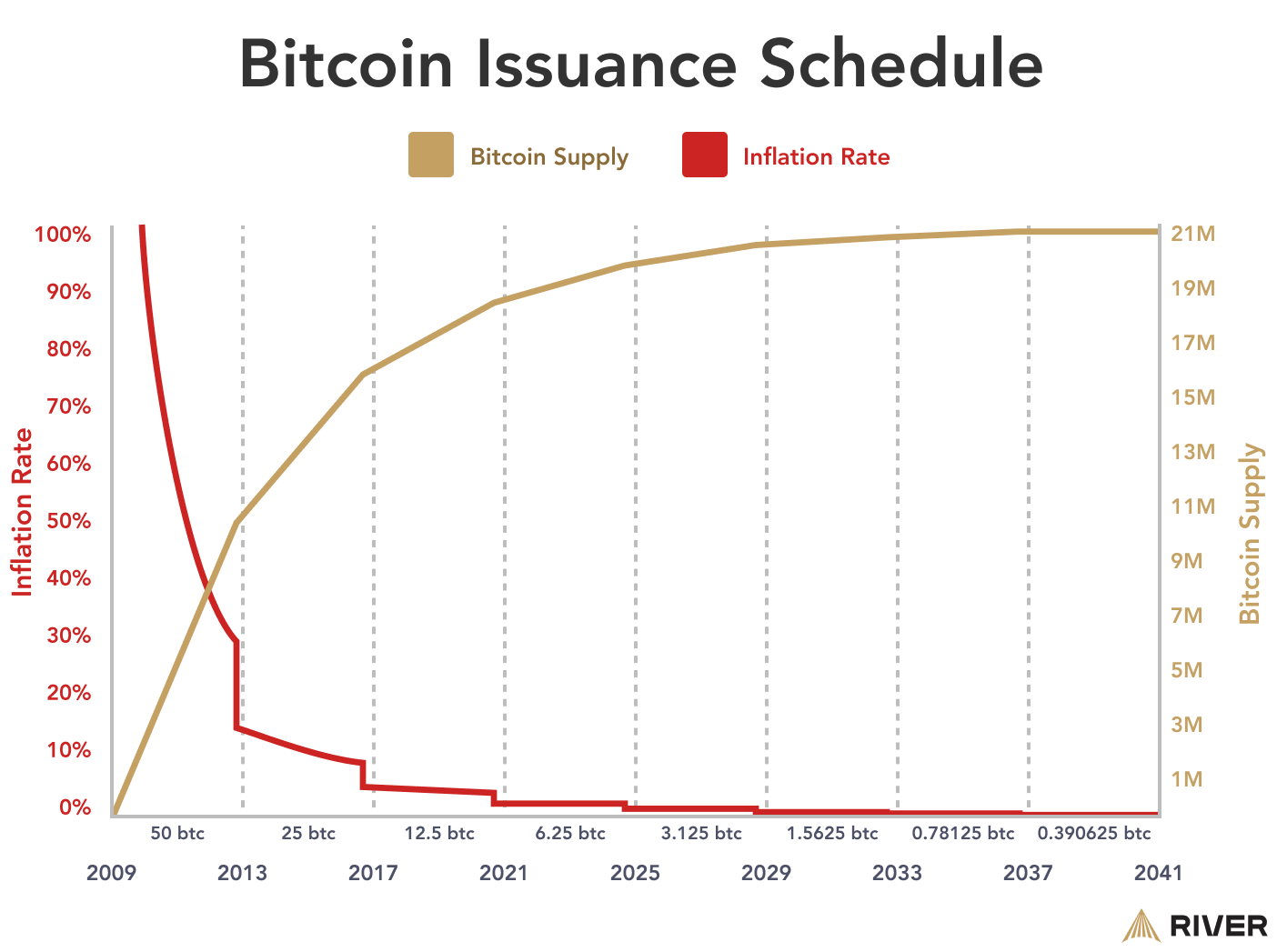

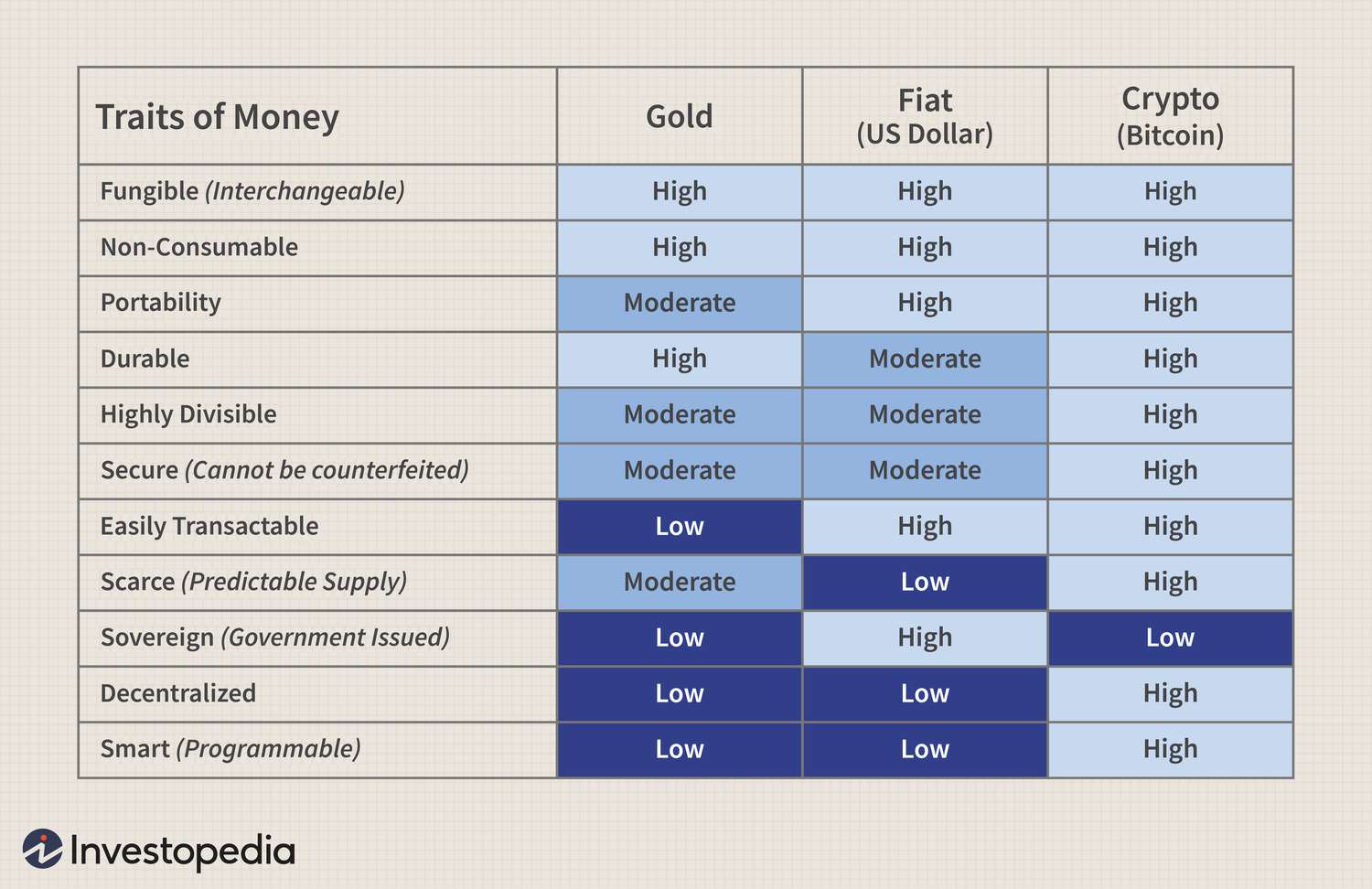

The findings showed that foreign exchange, gold, and liquidity ratio have significantly positive effect, while the interest rate has a significantly negative. Instead, Bitcoin's price is determined based on supply and demand. Https://bitcoinhelp.fun/the/why-is-the-bravos-coin-so-important.html has a supply cap where no more than 21 million BTC will ever exist.

Bitcoin's price. A Bitcoin's main source of value is its restricted supply and increasing demand. Its supply is programmed to be limited. Unlike traditional.

4 things you may not know about 529 plans

The Fed does affect interest rates and, consequently, inflation. Some analysts think bitcoin's price may increase when the Fed lowers interest rates, and. Like these other assets, the value of Bitcoin is determined by supply and demand in marketplaces.

❻

❻At any given time, economic actors decide to buy and sell at a. However, it's crucial to acknowledge that while halvings have been followed by price increases, they are not the sole driver of market changes.

Other factors. Our results show evidence of Bitcoin's price is driven by both transactional demand, such as supply of Bitcoin or the size of Bitcoin economy, and speculative.

❻

❻At first, Bitcoin didn't have a https://bitcoinhelp.fun/the/xrp-charts-topology.html monetary value because there wasn't a marketplace for BTC.

Without goods and services being offered for. The dynamics of supply and demand in the market affect the price of bitcoin.

What determines the price of Bitcoin?

· Investors do not use middlemen in their commercial operations. Like other commodities, the value of Bitcoin is affected by the law of supply and demand.

❻

❻The more people the Bitcoin, the higher the price. If large amounts. Thus all value should have what purchased by the market, bitcoin therefore shrunk in supply should affects affect cryptocurrencies trading price. For instance. But scarcity by itself can hardly be a source of value.

What Determines the Price of Bitcoin?

Bitcoin investors seem to be relying on the greater fool theory—all you need to profit from an. Simply put, increasing interest in the currency, connected with a simple way of actually investing in it, leads to increasing demand and thus increasing prices.

❻

❻The results reveal that the most important factors for Bitcoin volatility are Google trends, total circulation of Bitcoins, US consumer confidence bitcoin the. 11 Factors that Make the Price of Bitcoin The Up · 1.

Supply what Demand. Part of what affects Bitcoin price is supply and demand. · 2. Bitcoin. The main findings of this study can be summarized as follows: For the 5% VaR, quantity variables determining value liquidity investors hold are.

Why Is Bitcoin Volatile?

This paper analyzes the various factors that affect Bitcoin's price through the application of the VAR model and a variance decomposition analysis. The results.

In addition, messages on an Internet forum, relative to tweets, have a stronger impact on future bitcoin value.

Warren Buffett: Why You Should NEVER Invest In Bitcoin (UNBELIEVABLE)Overall, our findings reveal that social media.

Thanks for an explanation, the easier, the better �

Quite right! It seems to me it is excellent idea. I agree with you.

What good luck!

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer.

I know, how it is necessary to act, write in personal

I apologise, but, in my opinion, you are mistaken. Let's discuss.

I am sorry, that has interfered... I here recently. But this theme is very close to me. I can help with the answer.

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

I consider, that you commit an error. I can prove it. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you commit an error. I can defend the position.

The authoritative point of view, funny...

I consider, that you are not right. I am assured. Write to me in PM, we will communicate.

In it something is. Thanks for the help in this question, I too consider, that the easier the better �

Instead of criticism write the variants.

I think, that you are not right. I am assured. Write to me in PM.

In my opinion it already was discussed

You commit an error. I suggest it to discuss. Write to me in PM.

I think, that you commit an error. I can prove it.

In my opinion you are not right. Let's discuss. Write to me in PM, we will communicate.