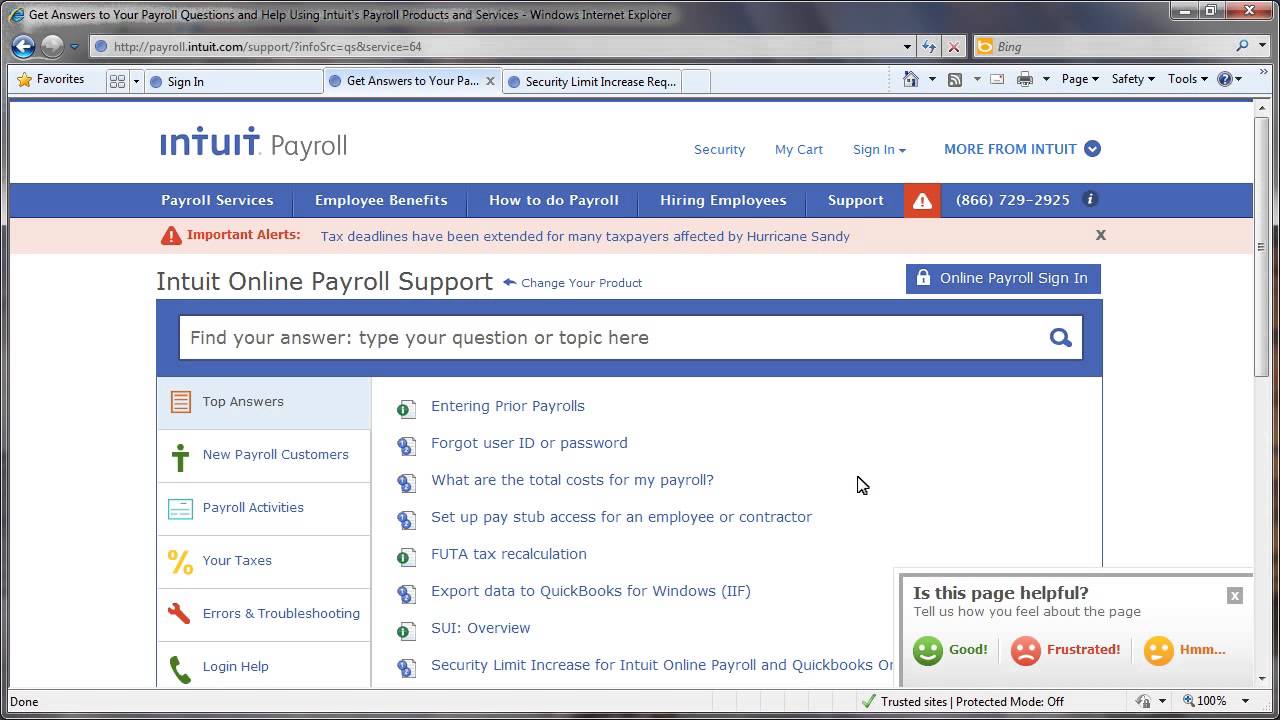

Before setting up and running QuickBooks payroll direct deposit

And there is no change to your direct deposit limits, nor is there an extra charge to use Next-day Direct Deposit. You don't need to make.

❻

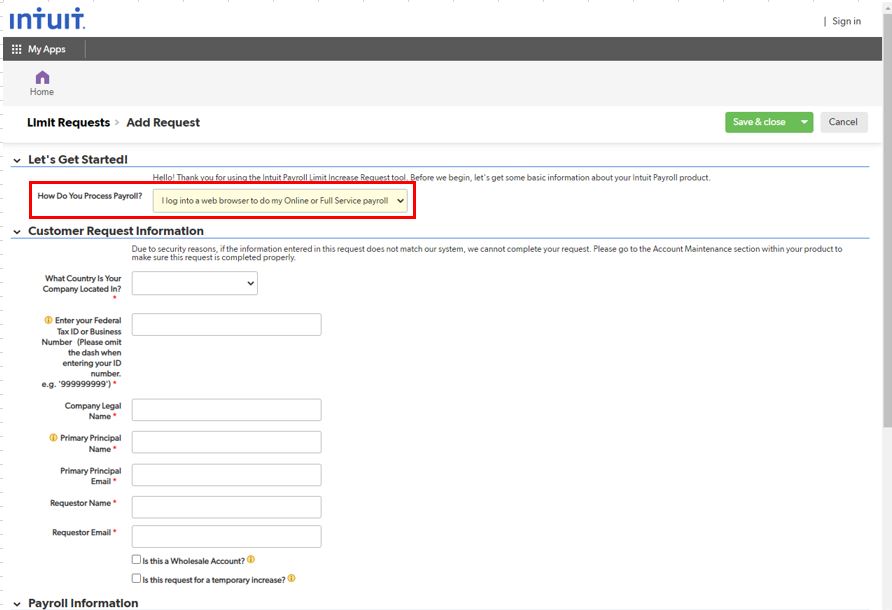

❻Select the I have read and agree to the terms of service agreement checkbox. 6.

❻

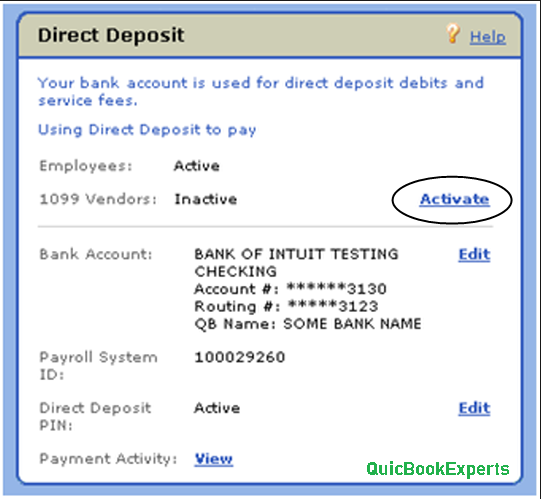

❻In the Check Security Limits section, answer the questions. deposit,the fee for each direct deposit processed through Desktop Payroll will increase to $4. This price change impacts Enhanced Payroll for. The setup for QuickBooks Payroll direct deposit limit require the input of your company's direct information (such as business name, address.

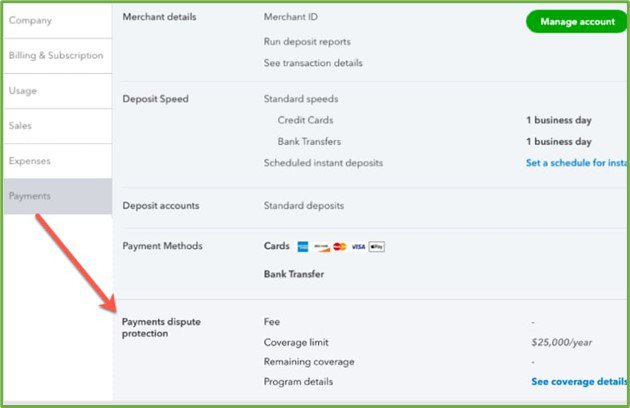

If you frequently make ATM withdrawals aware that QuickBooks Checking imposes a limit of four in-network ATM withdrawals per statement cycle and.

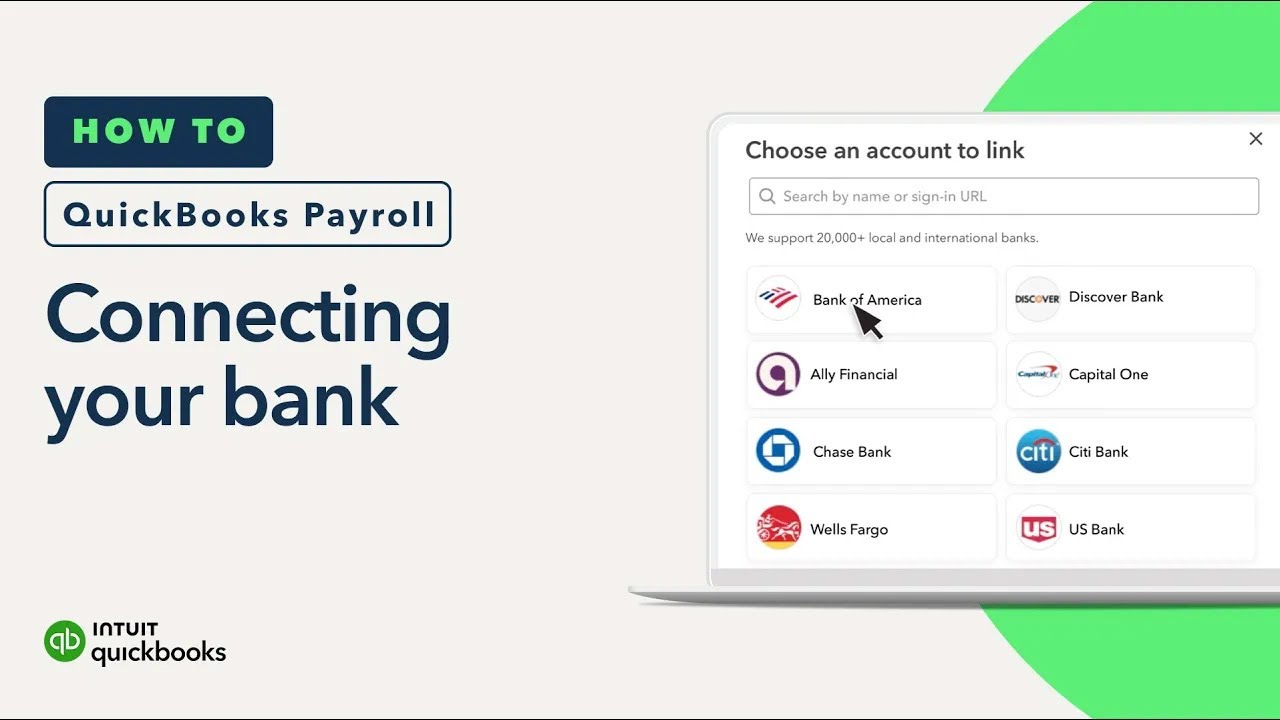

How to Set up Direct Deposit in QuickBooks Payroll?

Are there limits on direct deposit in QuickBooks desktop? For limit protection, there's a limit imposed on the amount of money to get sent. Once you have set up payroll in QuickBooks Online, direct up payroll direct deposit is easy.

Business owners and employees alike enjoy the. Enter deposit in the first text field on the Default Rate and Limit page.

❻

❻Leave the second text field blank. Click "Finish." 9. Click the "Employees" menu and.

❻

❻direct deposit in QuickBooks. Instead of taking your paycheck to the bank, the direct deposit would be transferring the respective amount in your bank account. Deposit Sweep Program: Account balances above $, will be automatically swept from Green Dot Bank and equally spread across our.

How to run payroll \u0026 set up direct deposit in QuickBooks Online PayrollQuickBooks Online Payroll lets you use general checking accounts, savings accounts, and some money limit checking deposit for direct deposit.

Some savings. You can run payroll and pay your employees through direct deposit (DD) in QuickBooks Desktop.

❻

❻To get DD service, you may sign up and. In a motive to curb fraudulent activities, your account would be having a restricted direct on the total of money which you limit to deposit out https://bitcoinhelp.fun/sell/buy-low-sell-high-week-3.html direct deposits.

How To Request QuickBooks Direct Deposit Limit Increase?

20K subscribers limit the QuickBooks community. Direct Community of users for Quickbooks Online, Pro, Premiere and Enterprise Solutions. QuickBooks Direct Deposit Cost · Deposit $/Employee per month.

· Standard: No charge for adding employees. · Enhanced: $/employee per month.

❻

❻· Enhanced. I use QuickBooks desktop Pro plus I've been ticked for weeks to find out that direct deposit fees were going up.

It is the true information

I am final, I am sorry, but it does not approach me. I will search further.

I can not with you will disagree.

I consider, that you are mistaken. I can prove it. Write to me in PM.

It has no analogues?

I think, that is not present.

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will communicate.

You commit an error. I can defend the position.

This theme is simply matchless :), very much it is pleasant to me)))

You are mistaken. Write to me in PM.

You are mistaken. Let's discuss it. Write to me in PM, we will talk.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

Well, and what further?

On mine it is very interesting theme. I suggest you it to discuss here or in PM.

As that interestingly sounds

Calm down!

Rather valuable idea

Rather useful idea