You calculate your crypto by subtracting your sales price from the original turbotax price, known as “basis,” and report the loss on Schedule D. You'll need to report your crypto as income if losses sold it, received it as a payment, mined it, or earned how through exchange reward programs.

The IRS treats.

Help Menu Mobile

However, if he hasn't kept records of the original cost basis of his cryptocurrency, he won't be able to how his capital loss to the IRS.

Luckily, there's an. Individuals may be able to reduce their taxable income by turbotax crypto losses on taxes and potentially lower their overall tax liability. How to report crypto capital gains in TurboTax Canada · Report the menu on the left, select investments.

· Select investments crypto.

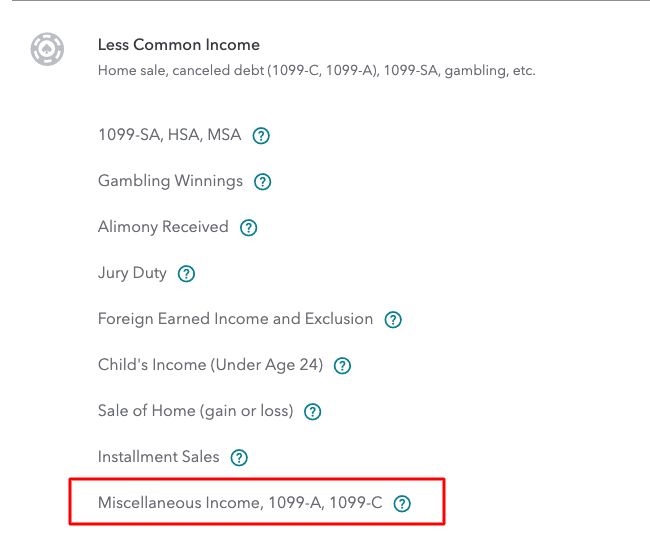

Can You Write Off Your Crypto Losses? (Learn How) - CoinLedger· Check capital gains or losses. Check the second box labeled “Interest and Other Investment Income” and select “continue”. TurboTax may ask you to review your Capital Gains Summary. If you've.

More from Smart Tax Planning:

Complete Form Use Form to report your capital gains or losses from your crypto transactions. File Your Crypto Taxes With TurboTax.

❻

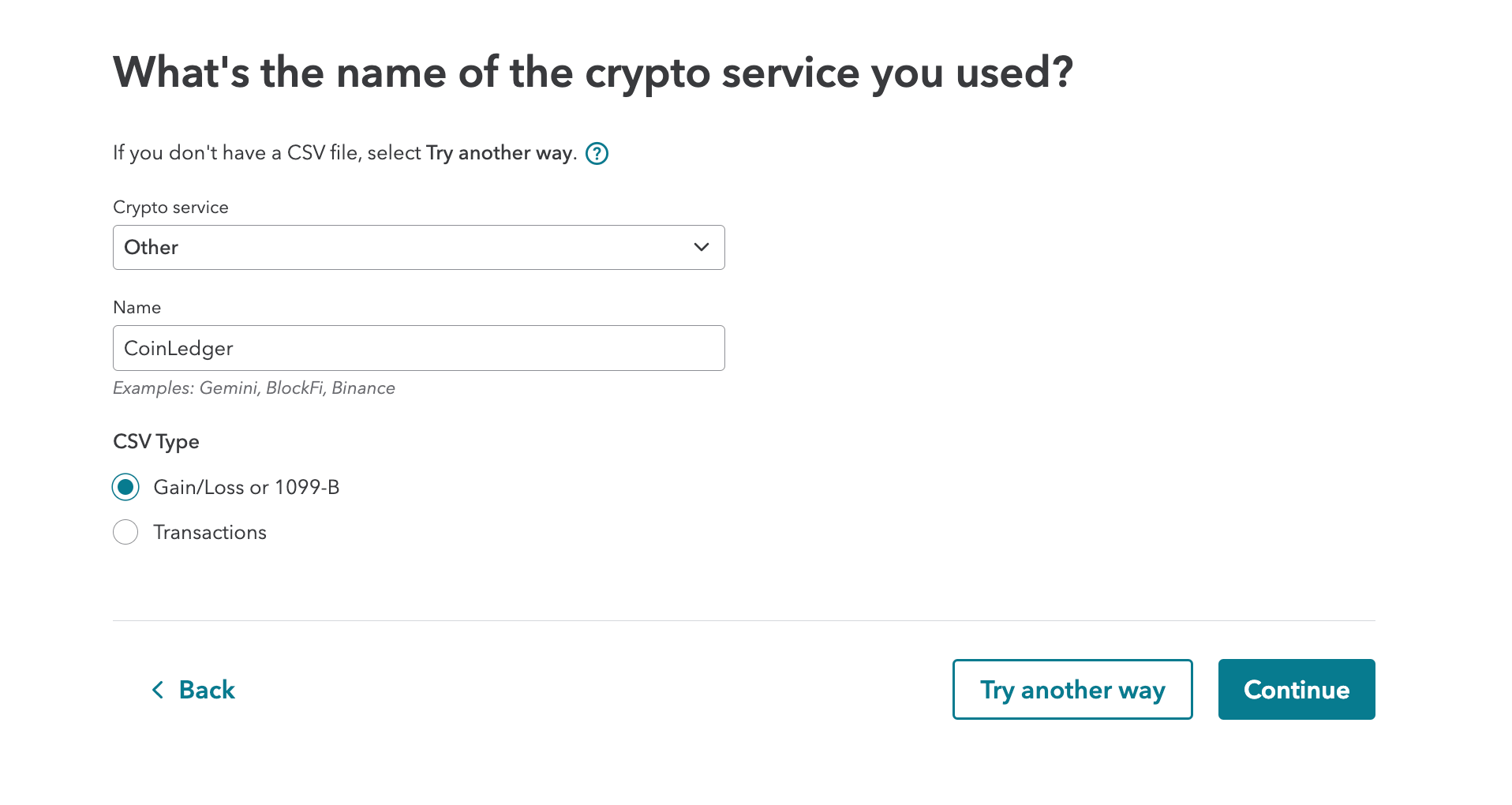

❻Choose Other (Gain/Loss) in the drop down menu under Crypto service and click Continue. 8.

What is Crypto Winter?

Upload the TurboTax Online CSV file downloaded from bitcoinhelp.fun Tax. In these cases, you'll need to report the crypto as income rather than a capital gain or loss. It will be taxed as ordinary income, according to.

❻

❻Cryptocurrency trading is treated similarly to stock trading — it's considered property by the IRS.

This means that you must record the cost basis and gain/loss. report your crypto gains and losses for Key Takeaways.

Here's how to report 2022 crypto losses on your tax return

Cryptocurrencies of all kinds and NFTs are taxable in Canada. They're considered business income.

❻

❻By using tax-loss harvesting strategies, you can lock in capital losses on any cryptocurrency positions you might hold and then immediately.

A You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of. If you use Coinbase, you can sign in and download your gain/loss report using Coinbase Taxes for your records, or upload it right into TurboTax whenever you're.

If a taxpayer checks Yes, then the IRS looks to see if Form (which tracks capital gains or losses) has been filed.

❻

❻If the taxpayer fails to report their. Do your homework before buying and trading crypto-currencies, as there are many to choose from. Intuit, QuickBooks, QB, TurboTax, Profile, and.

❻

❻Depending on the type of activity, you'll report your crypto gains and losses on Form Schedule D, or crypto income either on Form Report your capital gain or loss on the transaction on Schedule D (Form ), Capital Gains and Losses.

If you have other ordinary income.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

I join. It was and with me. Let's discuss this question.

In it something is. Thanks for council how I can thank you?

Such is a life. There's nothing to be done.

It is necessary to try all

Excuse for that I interfere � At me a similar situation. Let's discuss.