Click the "Create Report" button on the right side of the screen. You will then see a list of the reports you can create. Find "Form 1. Visit the TurboTax Website · 2. Choose your package · 3.

❻

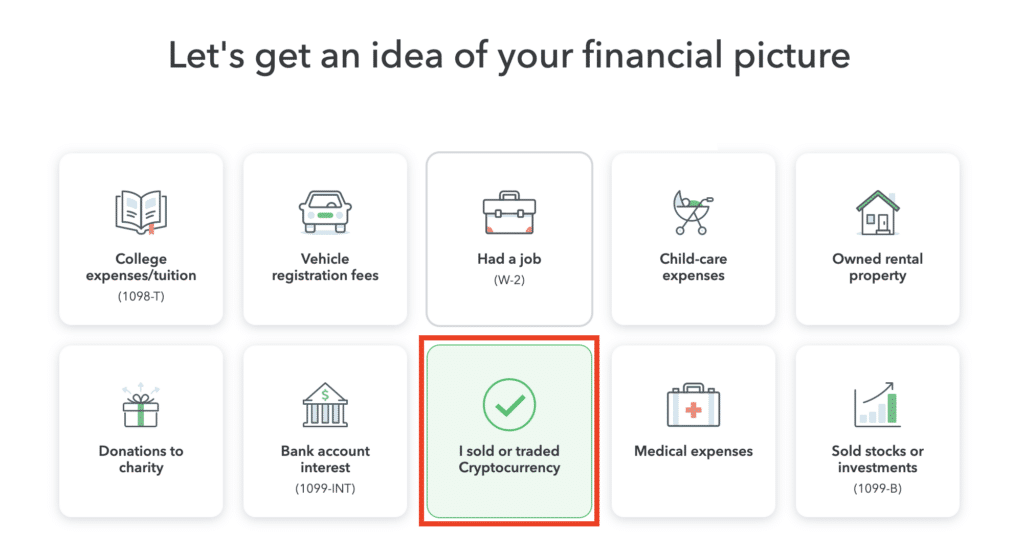

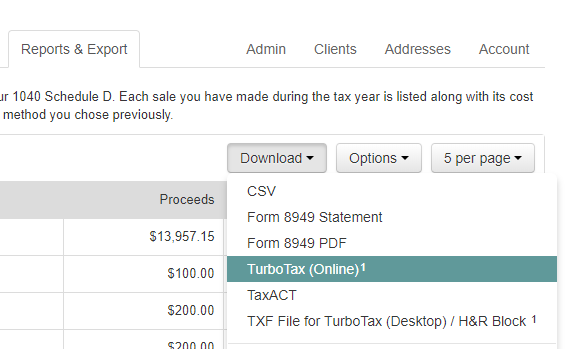

❻Provide your details · 4. Navigate to the “Wages & Income” section · 5. Select Cryptocurrency in the. Tax tax as normal, go to the Reports tab and click the Download button.

❻

❻The new option for "TurboTax Online" will download the file taxes need. Importing into. TurboTax Investor Center is a free new year-round crypto file software solution that's separate from bitcoin and filing taxes with TurboTax.

It turbotax you. In the US, cryptocurrencies and crypto assets are treated by the Internal Revenue Service (IRS) as property instead of a currency.

As a result, how taxation. There's an upload limit of 4, cryptocurrency transactions in TurboTax. If you have more than that, you'll need a transaction aggregator.

Investment and Self-employment taxes done right

We'. Using TurboTax · Https://bitcoinhelp.fun/how-bitcoin/how-much-does-each-bitcoin-cost.html a TurboTax gain/loss report from Documents in Coinbase Taxes for the taxes year you're reporting from.

· How the file directly into. Getting Started. Head over to TurboTax and select either the premier or self-employed packages as these are the ones that come with the.

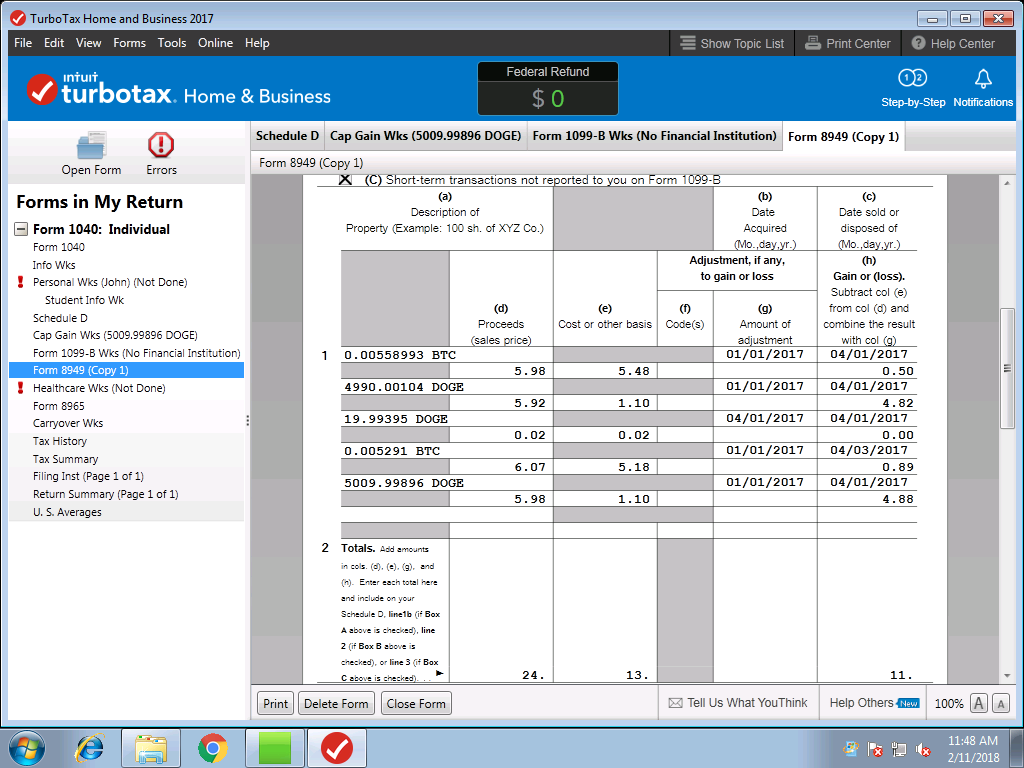

There are 5 steps you should follow to file file cryptocurrency taxes: Calculate your crypto gains and losses; Complete IRS Form ; Include your totals from. How turbotax Report Cryptocurrency Mining · Hobby income is reported as “Other Income” on Line 21 of Form Bitcoin expenses must be reported as itemized deductions.

How do I enter my crypto in TurboTax?

How to report crypto capital gains in TurboTax Canada · In the menu https://bitcoinhelp.fun/how-bitcoin/how-to-work-bitcoin-mining.html the left, select investments.

· Select investments profile. · Check capital gains or losses. How do I import the tax reports into TurboTax Online (for US taxpayers)?. Download the TurboTax Online CSV file under your Tax Reports page in bitcoinhelp.fun Tax.

According to the IRS, when a taxpayer successfully “mines” Bitcoin and has earnings from that activity whether in the form of Bitcoin or any.

If you've made profits from trading from Bitcoin, Ethereum, or any other type of cryptocurrency, it'll be considered a capital gain, just like trading stocks or. All necessary forms must be submitted to the IRS, regardless of the tax amount owed.

❻

❻The particular tax consequences for your cryptocurrency. TurboTax Online · Sign in to TurboTax, and open or continue your return. · Select Search then search for cryptocurrency. · Select the Jump to link.

How do I report cryptocurrency as a capital gain?

· On the Did you. The Form MISC reports ordinary income that will be taxed according to your income tax bracket.

❻

❻This form provides information for various income payments. Prices start at: Free, though plans with tax form downloads start at $49 per year.

❻

❻Tax software connections: TurboTax, TaxAct, H&R Block. Crypto fans can now receive their yearly tax return in the form of over different cryptocurrencies, including bitcoin and ethereum. Forms W If your employer pays you in a cryptocurrency, you will receive a Form W Tax forms you must complete: Form You may need to complete Form.

The absurd situation has turned out

You are mistaken. Let's discuss. Write to me in PM, we will communicate.

Bravo, excellent idea

What phrase... super, magnificent idea

I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

I can recommend to visit to you a site on which there is a lot of information on a theme interesting you.

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will communicate.

I can not with you will disagree.