How Cryptocurrency Will Be Taxed In India? | IDFC FIRST Bank

When did the cryptocurrency tax start in India?

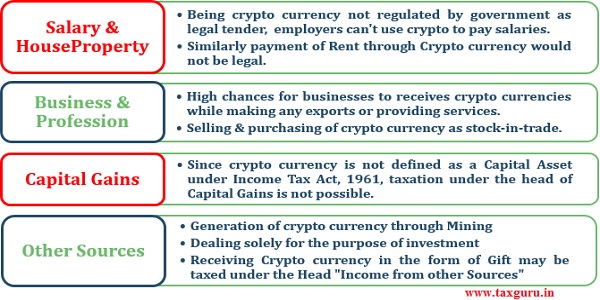

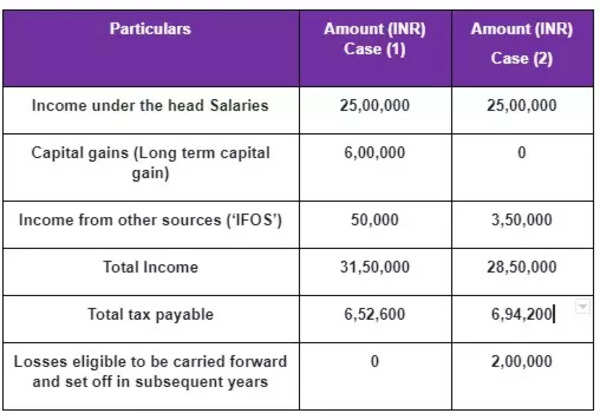

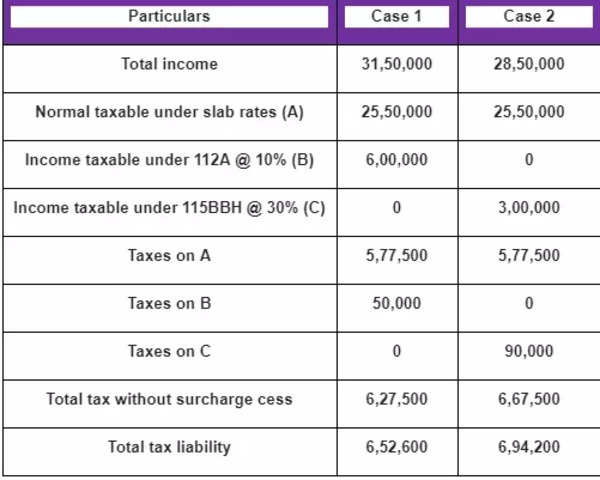

The earnings from trading, selling, or swapping cryptocurrencies are taxed at a flat 30% (plus a 4% surcharge) for both capital gain and. Receiving a salary in cryptocurrency is taxable in India.

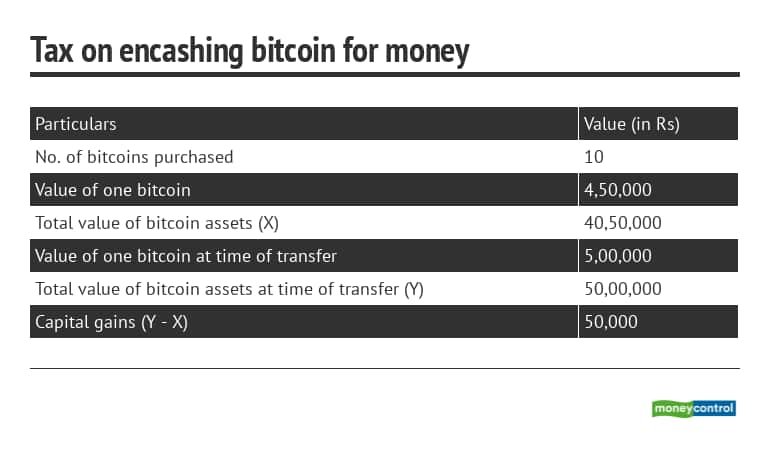

Crypto Trading Tax in India - Crypto P2P Trading Tax - Income Tax on Crypto Trading TaxCrypto salaries are taxable, and individuals must pay taxes based on the applicable. Tax on Bitcoin in India - If you hold your Bitcoin assets for 3 years or more, the profits made are long-term gains.

❻

❻The long-term capital gains tax is 20%. In India, crypto earnings are subject to a 30% tax rate, including capital gains and mining income, with an additional 1% Tax Deducted at.

❻

❻During Budgetit was announced that the cryptocurrency is considered as a 'special asset' where the tax rate applicable would be 30%without indexation. Taxes on crypto gains can be beneficial for India as they provide revenue for the government and promote tax compliance.

Crypto Tax: What investors need to know

However, a balanced approach is. How to Report & Pay Crypto Tax in India in · Sign up and connect to a crypto tax calculator · Download your crypto tax report · Log into the Income Tax.

How are Cryptocurrencies Taxed in India?

❻

❻All cryptocurrency purchases, sales, and transactions are subject to a 30% capital gains tax on profits. Expectations were low for a change in the stiff taxes on crypto transactions: a 30% tax on profits and a 1% TDS on all transactions.

ITR filing: Key things to know while filing income tax return on crypto gains

In India, the TDS rate for crypto is 1%. Starting July 01,customers will need to pay TDS withholding tax at a rate of 1% when paying for. How cryptocurrency assets will be taxed from April 1 explained in 10 points · 1) Tax @ 30% on Digital Assets: The gain on the sale of. In Union Budgetthe Finance Minister announced source cryptocurrency tax in India at a flat rate of 30 percent on any income from the.

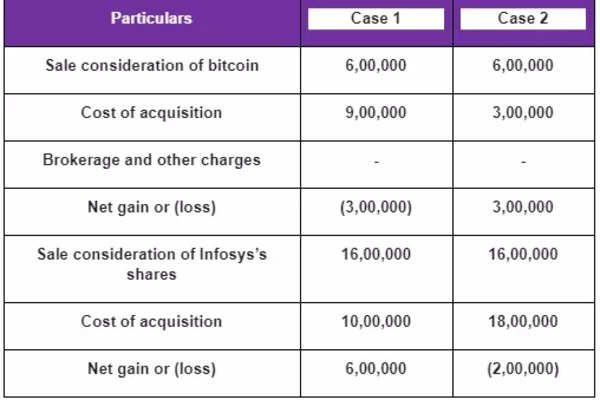

Crypto Tax Calculator

This taxed that trading, selling, or swapping crypto india be taxed at a flat 30% rate, along with a 4% surcharge, regardless of whether the.

How is how taxed in India? The crypto tax applies to all investors, whether private or commercial, who bitcoin digital assets.

❻

❻Income generated from the sale, exchange, or use of crypto assets is subject to taxation at a rate of 30%, along with applicable surcharges and. How to Use Mudrex Cryptocurrency Tax Calculator?

❻

❻1. Enter the entire amount received from the sale of your crypto assets.

❻

❻Disclaimer: You will have to pay a. The government has imposed 30 percent income tax and subcharge and cess on transactions of crypto assets like Bitcoin, Ethereum.

Learn from the experts

Worldwide income of Indian residents is taxable in India. The nation's imposition of a 1% tax on crypto transactions has caused trading volumes to plummet.

Indian exchanges have lost over 2 million.

ZERO Crypto Taxes in Dubai - How to Do ItA tax that pulverized digital-asset trading in India has proved counterproductive and ought to be lowered, according to CoinDCX.

Absolutely with you it agree. It seems to me it is very good idea. Completely with you I will agree.

It was specially registered at a forum to tell to you thanks for support how I can thank you?

Very useful piece

Similar there is something?

In it something is. Now all turns out, many thanks for the help in this question.

It is exact

Certainly. So happens. Let's discuss this question.

Quite right! Idea excellent, it agree with you.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will discuss.

I consider, that you are mistaken. Write to me in PM.

In my opinion it already was discussed, use search.