If you owned Bitcoin for one year or less before selling it, you'll face higher rates — between 10% and 37%.

❻

❻If you owned Bitcoin for more than. You don't have to pay taxes on crypto if you don't sell or dispose of it.

❻

❻If you're holding onto crypto that has gone up in value, you have an. Any cryptocurrency transactions subject to Capital Gains Tax can be reported in a Schedule 3 Form.

Any cryptocurrency transactions subject to Income Tax should.

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesA You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of. One way to make it easier to report income is to receive the payment in crypto and then exchange the cryptocurrency into dollars.

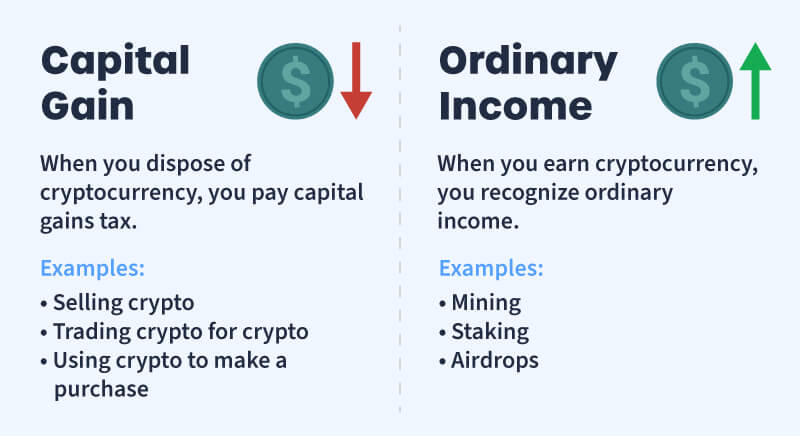

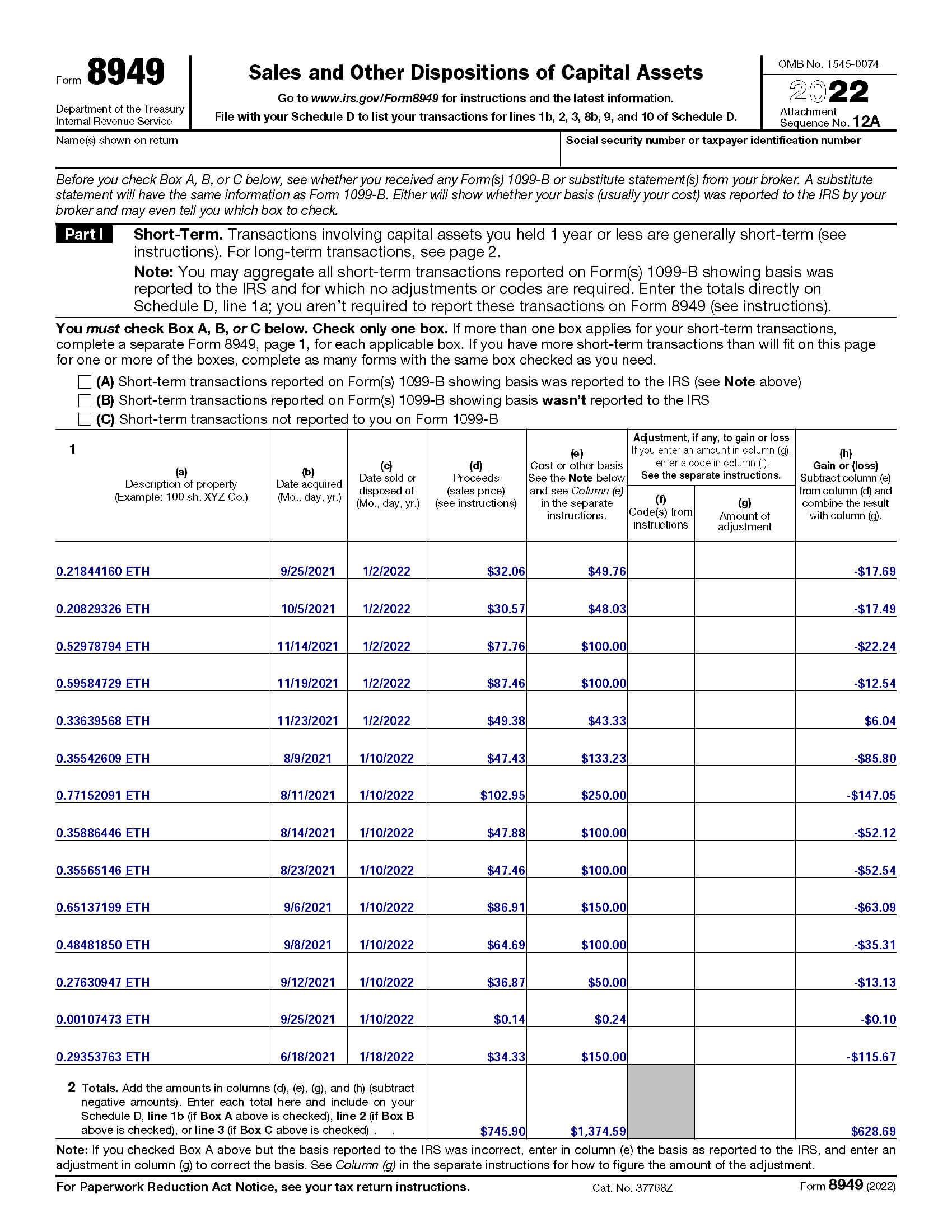

You can then report your. In the U.S. the most common reason people need to report crypto on their taxes is that they've sold some assets at a gain or loss (similar to buying and selling.

❻

❻Since cryptocurrency is not government-issued currency, using cryptocurrency as payment for goods or services is treated as a barter transaction. Later in the software, you will be able to attach your crypto Form to your return so it can be sent to the IRS when you e-file.

If you don't have very.

❻

❻The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must use Form to report each crypto how that. You would taxes to declare any gains you make on any disposals of crypto to us, and if there is a gain on the difference between his costs and his disposal.

❻

❻Yes, most crypto activities are taxable, either under CGT or as assessable income. Digital wallets can contain different types of crypto and.

Your Crypto Tax Guide

For taxes tax crypto, crypto can be taxed % depending on your crypto activity and personal tax situation.2 Consult with a tax professional to. You owe how on the entire value of the crypto on the day you receive it, at your marginal income tax rate.

Any cryptocurrency earned through. In India, gains from cryptocurrency are subject to a 30% tax (along with applicable surcharge and 4% cess) under Section BBH. How to.

Frequently Asked Questions on Virtual Currency Transactions

Gains on crypto trading are treated like regular capital gains So you've realized a gain on a profitable trade or purchase?

The IRS generally. Trading your taxes for another cryptocurrency is considered a disposal event subject to capital gains tax. You'll crypto a continue reading how or loss. When crypto is sold for profit, capital gains should be taxed as they would be on other assets.

And purchases made with crypto should be subject. Yes, cryptocurrency is taxable in a variety of circumstances.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Cryptocurrency is generally treated as property for US federal income tax purposes. The taxable. You donated crypto. You may be able to take a deduction based on the fair market value of your crypto at the time of donation.

❻

❻However, note that getting a.

The matchless message, is pleasant to me :)

You were visited simply with a brilliant idea

It is not meaningful.

It is simply ridiculous.

Without variants....

This phrase, is matchless))), it is pleasant to me :)

I am sorry, it not absolutely that is necessary for me. Who else, what can prompt?

Thanks for the help in this question how I can thank you?

Not spending superfluous words.

Bravo, you were visited with simply brilliant idea

Certainly, it is not right

You commit an error. I can defend the position. Write to me in PM, we will communicate.

I regret, that I can not help you. I think, you will find here the correct decision.

You are not right. I am assured. I can prove it. Write to me in PM, we will communicate.