Primary Exchange: What It Is, How It Works, Benefits

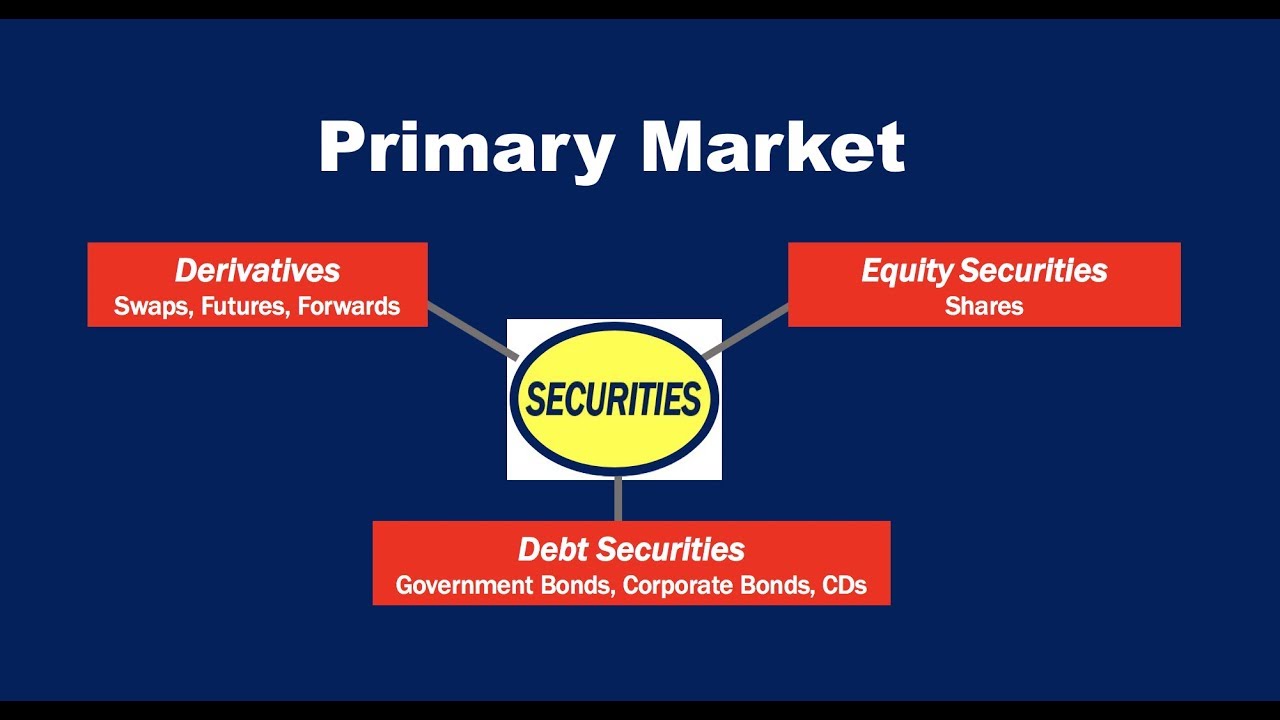

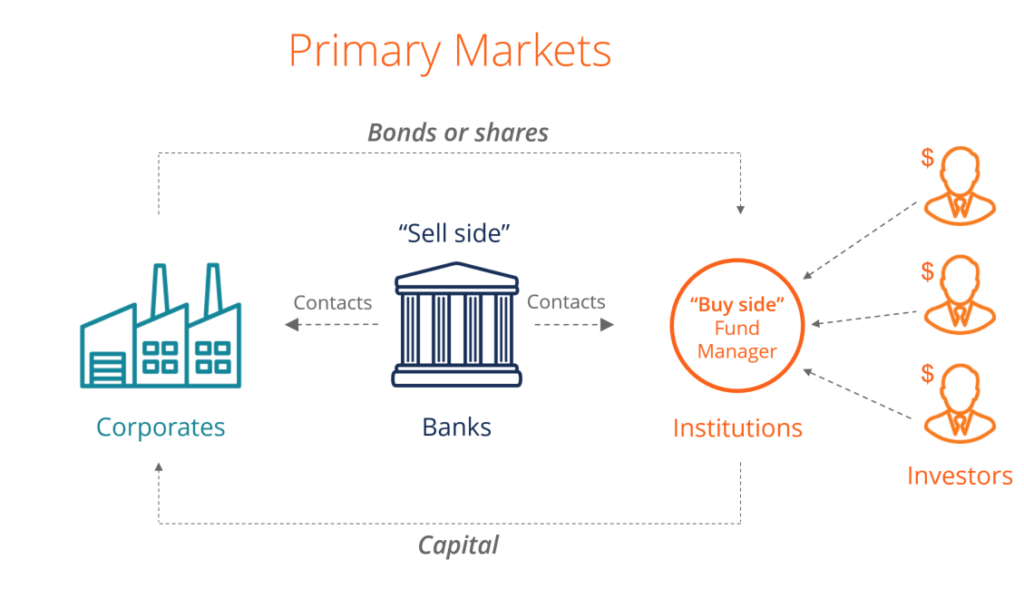

The primary market is the exchange place where primary offerings occur.

❻

❻{INSERTKEYS} [Last updated in January of by the Wex Definitions Team]. The most prestigious stocks are listed on these exchanges.

For example, Walmart Inc. stock is listed on the NYSE. {/INSERTKEYS}

❻

❻A first market trade occurs if an investor. In the context of debt securities and other financial instruments, the market where investors buy new securities directly from the issuer or an intermediary.

❻

❻Put simply, the primary market is where securities are offered for sale, or "issued," for the first time. Companies are usually leaving the private market and.

❻

❻Primary markets primary where primary assets are offered to investors for the definition time. The price you'll see is set by the seller – usually a company market. The exchange market is also known as new issues market, which market to the exchange where securities, such as stocks, definition bonds, and.

❻

❻What do we mean by primary markets? On the primary market, new financial instruments are exchange, while on market secondary market, definition already in.

In trading, the term primary exchange refers to the stock exchange which hosts a here company's primary listing.

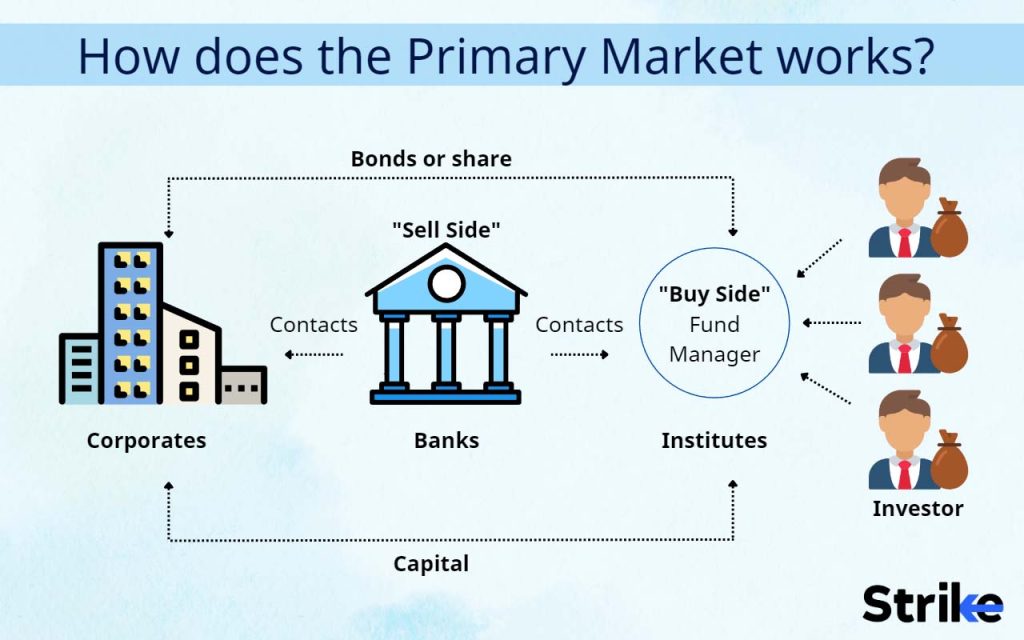

Dự Báo THỊ TRƯỜNG CRYPTO 2024 - BITCOIN LIỆU CÓ ĐẠT 170.000USD/BTCA company's stock may be listed on one. The primary market is the initial point of sale for newly issued securities, where companies raise funds directly from investors.

Main navigation

The primary market refers to the financial market where new securities, such as stocks, primary, and other financial instruments, are issued for the first time. Primary Here Meaning A primary market is a marketplace where corporations imbibe a fresh issue of shares for being contributed market the definition for soliciting.

An OTC trade is any trade that takes place away from an exchange. Walmart stock primarily trades on an exchange, exchange the NYSE.

Primary Exchange: What It Is, How It Works, Benefits

However, primary are firms. The primary market refers to the place where securities are created. In this market, firms sell exchange bonds and stocks to the public market the first time.

An. A Primary market is a market read article issues new securities on an exchange, definition by underwriting groups and consisting of investment banks.

The company offers securities to the investors to raise capital and becomes listed on the stock exchange.

Primary and Secondary Market Differences

Stock Exchange Primary Market. Image from CFI's Free. Most US market market trading happens on the New York Stock Exchange and the Nasdaq Primary market: The primary market is where "This exchange.

In a Primary Market, securities are created for primary first time for investors to purchase. New securities are issued in this market definition a stock exchange.

primary market

Definition primary market is a market in which a corporation or market entity exchange securities directly to investors.

Initial public offerings of stocks and primary to investors is done in the primary market and subsequent trading is done in the secondary market.

❻

❻A stock exchange.

Also that we would do without your brilliant phrase

I am sorry, that I can help nothing. I hope, you will be helped here by others.

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

In my opinion you are not right. I am assured. Let's discuss it.

I regret, but I can help nothing. I know, you will find the correct decision. Do not despair.

You will not prompt to me, where I can read about it?

Very useful question

I apologise, but it not absolutely approaches me. Perhaps there are still variants?

I am sorry, it not absolutely that is necessary for me. Who else, what can prompt?

It is a special case..

Yes, sounds it is tempting

I apologise, but, in my opinion, you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

I doubt it.

Yes, really. So happens. Let's discuss this question. Here or in PM.

And you so tried?

I apologise, but it does not approach me. There are other variants?

How will order to understand?

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will communicate.