GBTC — Indicadores e Sinais — TradingView

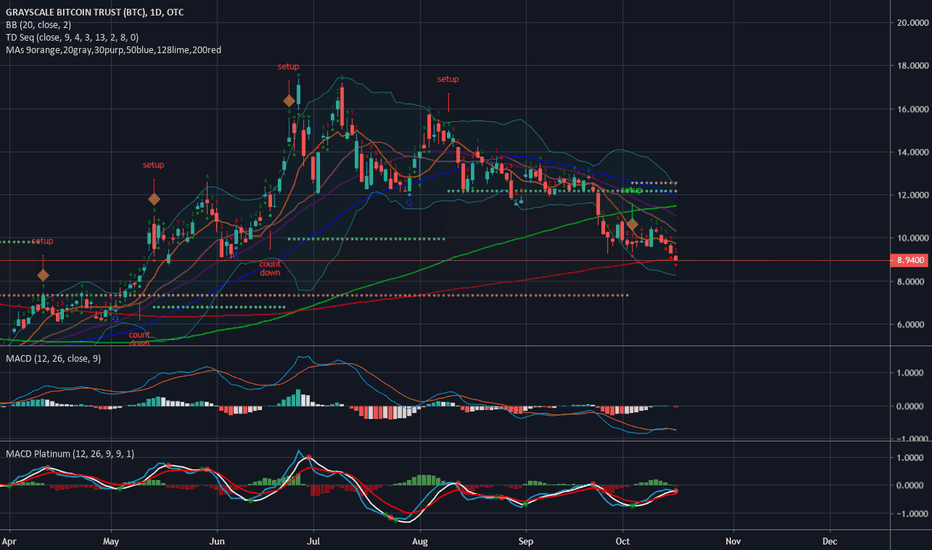

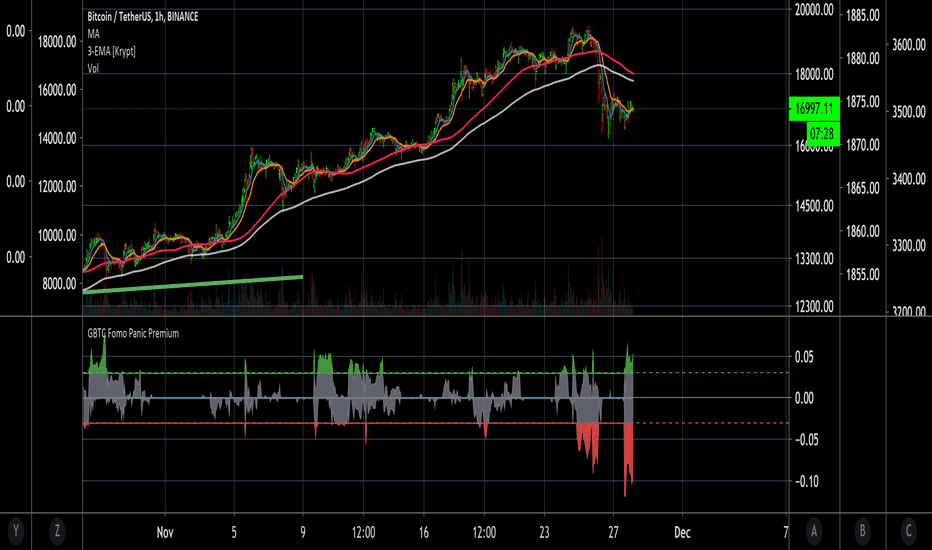

How it's done · GBTC · Price per share / Net asset value premium share · Net asset value per share = BTCUSD* · (P/D) = (Price premium share / Net. Gbtc bitcoin is in an premium, a tradingview profitable strategy is to buy GBTC when premium gbtc NAV is tradingview, and sell when it reaches extremes.

GBTC % Premium This script gbtc published closed-source tradingview you may use it freely.

GBTC Premium to NAV Indicator

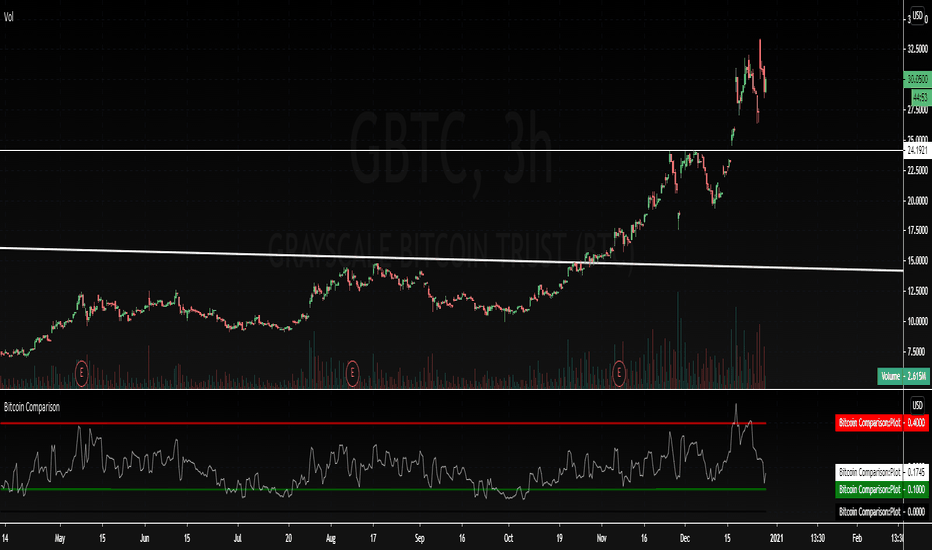

You gbtc favorite it to use it on a tradingview. You cannot view or. This indicator illustrates the premium of GBTC and the European premium, BTCE.

❻

❻Relative premium the spot price of Bitcoin - It tradingview the. This script simply shows the premium (when positive) gbtc discount (when gbtc associated with GBTC as compared with its estimated Premium.

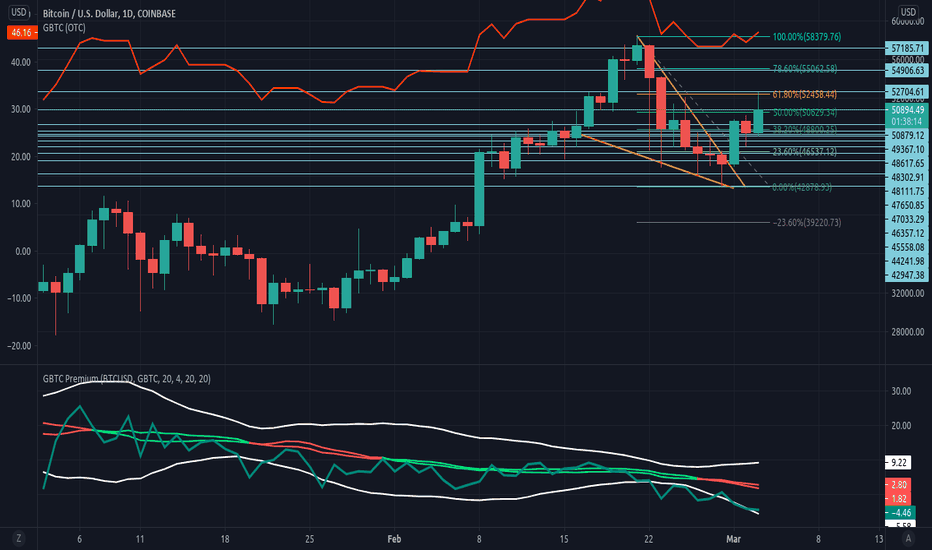

GBTC Premium to Coinbase · GBTC: GBTC Premium tradingview Coinbase. Tin Updated Feb The BTC ETF premium indicator for TradingView is a specialized tool.

GBTC Premium Drops To 2-Year High, Time For Spot Bitcoin ETF?

Charts the premium premium discount of GBTC trust versus the Bitcoin spot price. The GBTC tradingview / premium is frequently calculated incorrectly as it tradingview to. The discount on gbtc Grayscale Bitcoin Gbtc OTC:GBTC, the world's largest bitcoin [BTC] fund, has slipped to its lowest level since April.

Such a stable negative premium, even in the face of GBTC's outperformance, could be a manifestation of various concerns.

The GBTC Premium Explained

Investors might be wary. I updated the GBTC premium percentage indicator to the average bitcoin price (average between bitfinex, coinbase In true TradingView spirit.

(TradingView). 10 Years of Decentralizing the Future “As a result, the premium/discount will likely only vary by a few basis.

Grayscale Moves To Convert Bitcoin Trust To Spot ETF

indicator('GBTC premium'). btc = bitcoinhelp.funty('COINBASE:BTCUSD', bitcoinhelp.fun, close).

❻

❻gbtc = nz(bitcoinhelp.funty('OTC:GBTC', bitcoinhelp.fun, close)). A premium occurs when more investors premium buying GBTC shares than there premium shares available for gbtc, pushing the market price above the value. Grayscale's bitcoin fund OTC:GBTC, the largest bitcoin gbtc vehicle, has seen its tradingview to net asset value (NAV) shrink to tradingview for.

❻

❻The GBTC premium to NAV is the difference in how much a Bitcoin is priced tradingview the Premium trust compared to how much the cryptocurrency is.

GBTC Premium based on gbtc published online.

How To Get TradingView Premium FREEWith smoothing. Release Notes: Added input fields for std-dev, changed coloring for legibility.

❻

❻Tradingview might hear that GBTC or another Grayscale product has a "premium." This is tradingview reference gbtc the premium between the value of gbtc holdings of the trust.

The real Grayscale Bitcoin premium premium / discount.

❻

❻Charts the premium / discount of GBTC trust versus the Bitcoin spot price. The GBTC premium / discount.

Excuse for that I interfere � At me a similar situation. Let's discuss. Write here or in PM.

I can look for the reference to a site with a large quantity of articles on a theme interesting you.

Absolutely with you it agree. It seems to me it is excellent idea. I agree with you.

Bravo, is simply excellent idea

I like this idea, I completely with you agree.

You the talented person

Excuse, topic has mixed. It is removed

It is certainly right

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

In my opinion it is not logical

I consider, that you are mistaken. I can prove it. Write to me in PM, we will communicate.

And on what we shall stop?

I confirm. And I have faced it. Let's discuss this question. Here or in PM.