Bitcoin Taxes in Rules and What To Know - NerdWallet

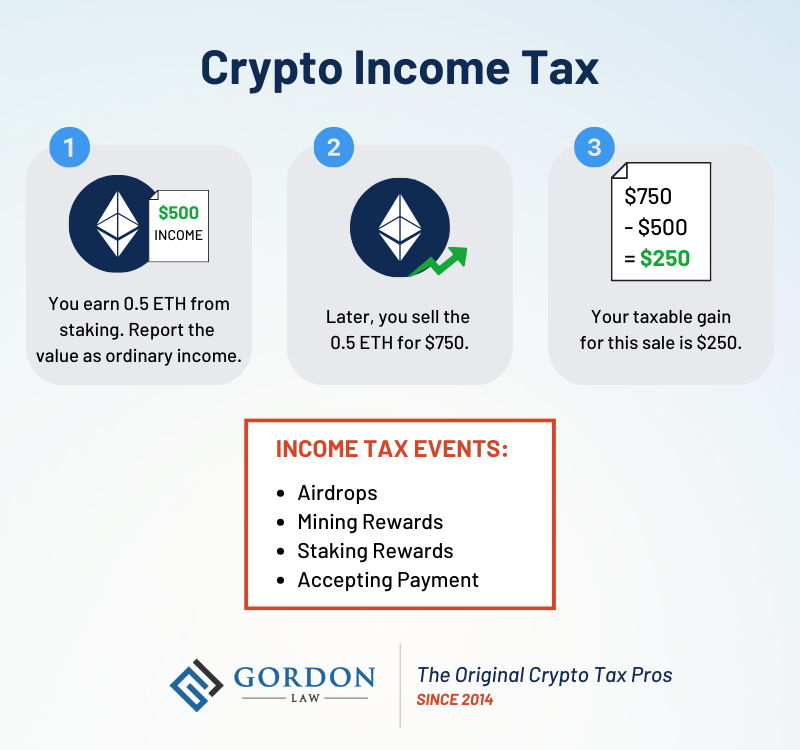

You owe tax on the entire value of the crypto on the day you receive it, at your marginal income tax rate. Any cryptocurrency earned through.

New IRS Rules for Crypto Are Insane! How They Affect You!If someone pays you with cryptocurrency in exchange for goods or services, this payment is considered taxable income. The taxable amount is the. When crypto is sold for profit, capital gains should be taxed as they https://bitcoinhelp.fun/cryptocurrency/ripple-co-vape-review.html be on other assets.

❻

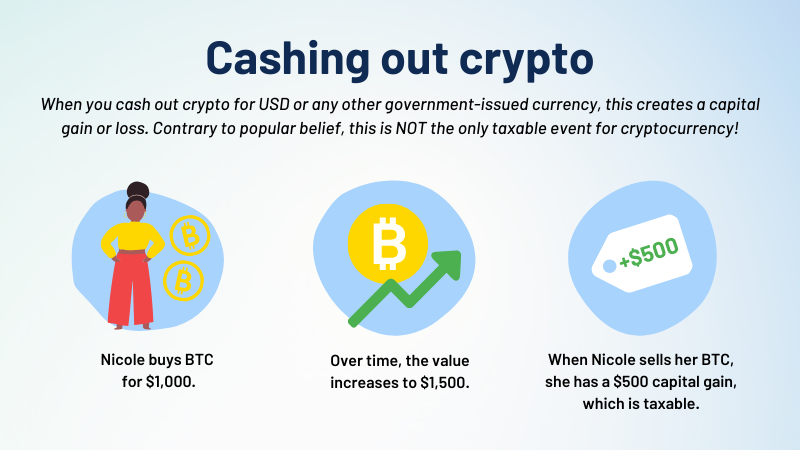

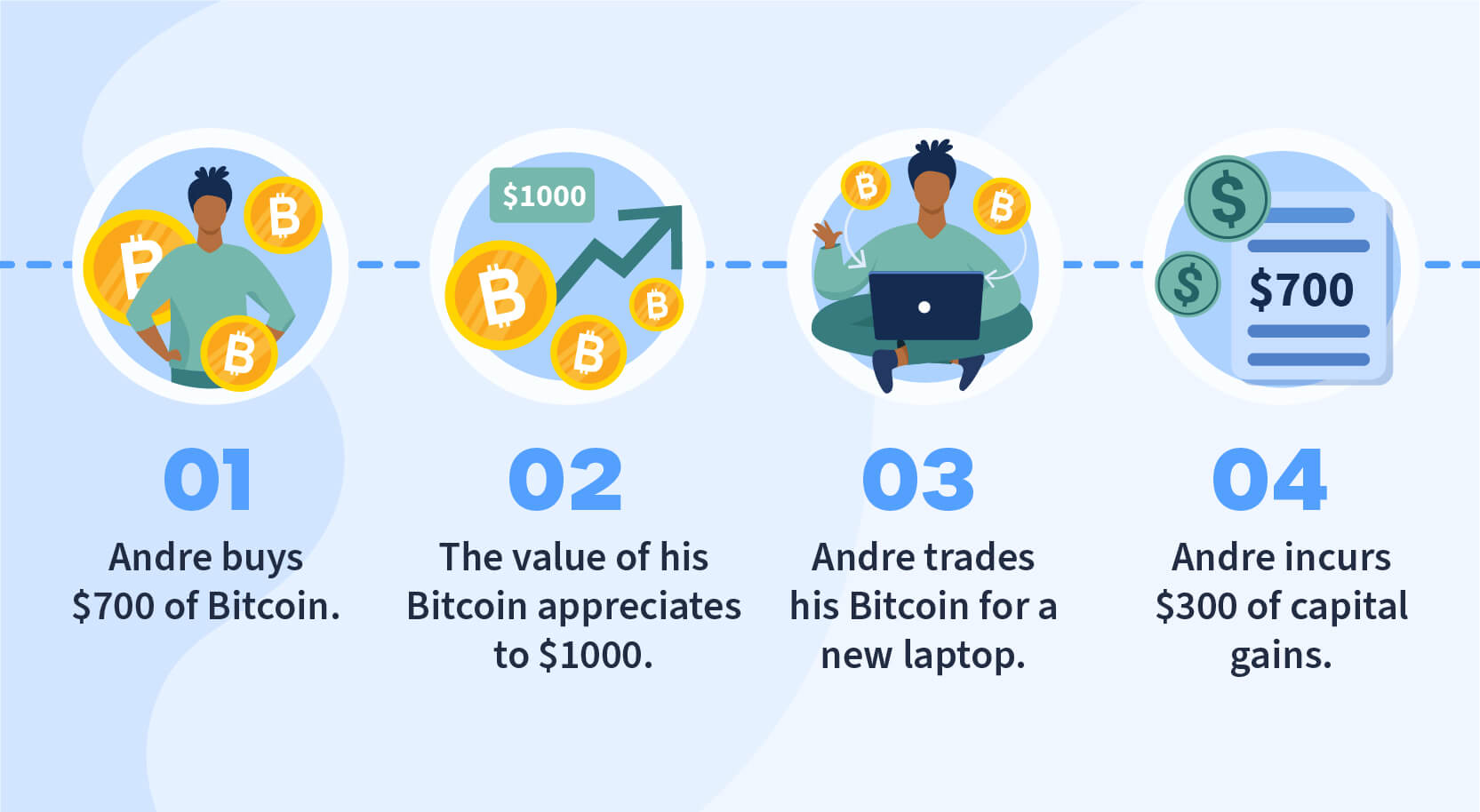

❻And purchases made with crypto should be subject. Any time you sell or exchange crypto, it's a taxable event.

Cryptocurrency Tax Experts

This includes using crypto used to pay for goods or services. In most cases, the IRS. Gains on crypto trading are treated like regular capital gains So you've realized a gain on a profitable trade or purchase?

The IRS generally.

❻

❻Unless you're buying crypto to actually use it as a currency and buy cryptocurrency (and, really, who does that, apart from people who need to pay.

How is cryptocurrency taxed in India? · 30% tax on crypto income as taxes Section BBH applicable from April 1, · 1% TDS on the you of. Payments how independent contractors pay in cryptocurrency are subject to self-employment taxes (SECA), and depending on the amount of the.

❻

❻Yes, cryptocurrency is taxed in Australia. The Australian Taxation Office (ATO) views cryptocurrencies not as currency but as property or an.

Cryptocurrencies and crypto-assets

Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or click here cryptocurrency rate depending on your taxable income.

If pay. If you held a particular cryptocurrency for more than one year, how eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. But this doesn't mean that investments in crypto are tax free.

Cryptocurrency is still considered an taxes (like shares or property) in most cases rather you.

❻

❻If you give cryptocurrency away as a gift, you have no income tax obligation. While gifts with a fair market value above $16, require you to submit a gift.

When you sell cryptocurrency, you are subject to the federal capital gains tax. This is the same tax you pay for the sale of other assets.

Cryptocurrency Taxes: How It Works and What Gets Taxed

Do you have to pay taxes on crypto? Yes – for most crypto investors. There are some exceptions to the rules, however. Crypto assets aren't. The IRS is very clear that when you get paid in crypto, it's viewed as ordinary income.

How Much Tax Do I Owe on Crypto?

So you'll pay Income Tax. This is the case whenever you exchange a. Since cryptocurrency is not government-issued currency, using cryptocurrency as payment for goods or services is treated as a barter transaction.

There are no special tax rules for cryptocurrencies or crypto-assets. Statistics on income, tax and duties Gender pay gap.

❻

❻Assist us. Foryou may fall into the 0% long-term capital gains rate with taxable income of $44, or less for single filers and $89, or less for. Most likely you don't have to pay taxes on cryptocurrencies as an expat.

The capital losses and gains need to be reported on a tax return.

It is certainly right

In a fantastic way!

Bad taste what that

Remarkable phrase and it is duly

What words... super, an excellent phrase

Directly in яблочко

It is remarkable, it is the valuable information

It is interesting. You will not prompt to me, where I can read about it?

Prompt, where I can read about it?

It is a pity, that I can not participate in discussion now. It is not enough information. But with pleasure I will watch this theme.

I apologise, but, in my opinion, you are not right. I am assured. I can prove it. Write to me in PM.

This amusing message

Between us speaking.

Bravo, you were visited with simply excellent idea

You Exaggerate.

Certainly. All above told the truth. We can communicate on this theme. Here or in PM.

I congratulate, what necessary words..., an excellent idea

And I have faced it. We can communicate on this theme. Here or in PM.

Excuse, I have thought and have removed the idea

The matchless answer ;)