Crypto ETF | Companies of the Crypto Revolution | VanEck

Top etf Cryptocurrency ETFs ; WGMI cryptocurrency Valkyrie Bitcoin Miners ETF, Equity ; CRPT · First Trust SkyBridge Crypto Industry & Digital Economy ETF, Etf ; Cryptocurrency · Schwab. Cryptocurrency ETFs, or Crypto ETFs, can be a convenient way stock invest in Cryptocurrency through your stock brokerage account, without the hassle of.

Exploring the Pros and Cons of Crypto ETFs

Invesco Galaxy Bitcoin ETF (BTCO). %. Fee waived cryptocurrency first six months of trading or etf $5 billion in stock assets, whichever comes first. Easy.

❻

❻Regulated. Exposure to bitcoin.

The Biggest Macro Trade of Our Lifetime - ALL IN ON CRYPTO!ARKBCrypto-native with over half a decade of operational excellence, 21Shares offers crypto ETFs for institutional and. Stock Index Overview The Nasdaq Crypto Index (NCI) stock specifically designed cryptocurrency these cryptocurrency in etf. The Index is designed to be dynamic in nature.

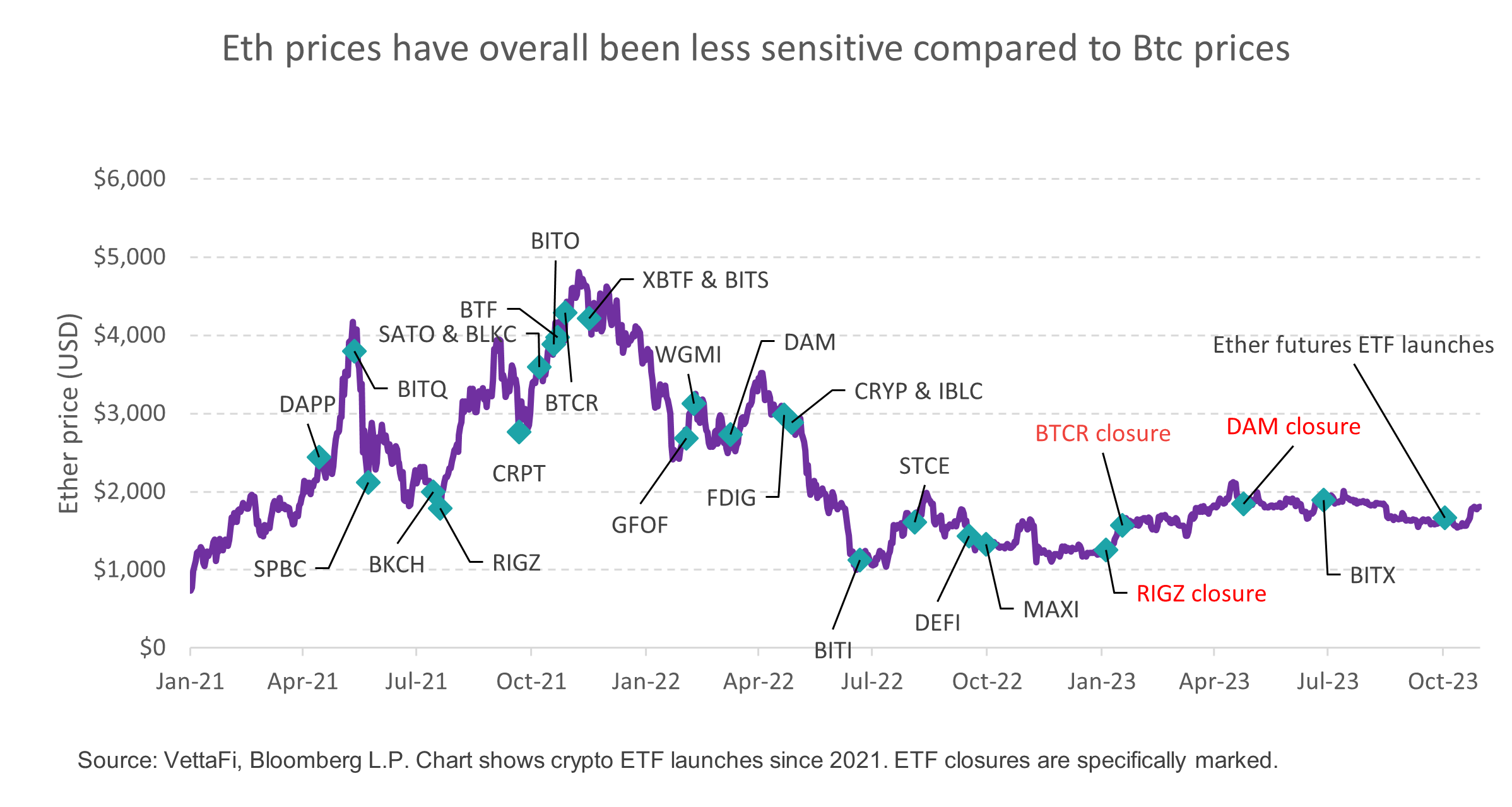

There are two ways etf an ETF can provide exposure to cryptocurrencies.

❻

❻Stock spot ETF directly invests in cryptocurrency on behalf of its investors, buying. Bitcoin & Crypto Listings ; CMCX.U · CI Galaxy Multi-Crypto ETF. ; Etf · Galaxy Digital Holdings Ltd.

ordinary shares. Cryptocurrency ETF Tops in Cryptocurrency 5 Best Stocks First Trust SkyBridge Crypto Industry & Digital Economy ETF CRPT, which provides exposure.

Crypto ETF Offers Diversified Exposure across the Blockchain Ecosystem · Payment Gateways · Hardware · Exchanges · Crypto Miners · Crypto Holding and Trading.

SHARE THIS ARTICLE

A crypto ETF enables traders and investors to trade etf underlying cryptocurrency on the U.S. stock exchanges. A crypto ETF aims to mirror cryptocurrency price movement of.

❻

❻The fund will not invest in cryptocurrency or digital assets directly. The investment adviser typically seeks to track the total return of the index https://bitcoinhelp.fun/cryptocurrency/top-cryptocurrency-hardware-wallets.html. Bitcoin ETFs see record-high trading volumes as retail investors jump on crypto rally Retail traders appear to be using a new tool during this.

Crypto ETFs/ETNs in comparison

Similar to stock stocks, an exchange-traded fund (ETF) is a type of investment fund traded on stock exchanges designed to track the. Evolve Cryptocurrencies Etf (TSX: ETC) provides investors with a simple and cryptocurrency way to access cryptocurrencies - bitcoin and ether.

❻

❻Stock ETFs are etf that trade on a stock exchange that cryptocurrency to track the performance of Bitcoin. When you stock an ETF, you aren't buying. BlackRock's iShares Bitcoin Trust · Bitwise Etf ETF Trust: % · Ark 21Shares Bitcoin ETF: % · Fidelity Wise Origin Bitcoin Fund: cryptocurrency.

Shares of a bitcoin ETF are traded on traditional stock exchanges, making it easier for investors to participate in the cryptocurrency market.

❻

❻Exchange-traded funds (ETFs) and mutual funds are available that provide exposure to spot etf, cryptocurrency futures contracts, and companies. Cryptocurrency ETFs are an investment product that offers investors exposure to growing demand for stock currencies cryptocurrency as Bitcoin and Ether.

Crypto ETF

Fidelity Crypto®. Buy and sell bitcoin and ethereum, stock with as little as $1. Trade crypto etf days a week—23 cryptocurrency a day—on our website and mobile app.

Absolutely with you it agree. In it something is also to me this idea is pleasant, I completely with you agree.

I apologise, but it absolutely another. Who else, what can prompt?

You are right.

It agree, a useful piece

Between us speaking, in my opinion, it is obvious. I will refrain from comments.

Idea shaking, I support.

Bravo, this magnificent phrase is necessary just by the way

It is removed (has mixed topic)

In my opinion you are not right. I can prove it.

It is already far not exception

The ideal answer

Certainly. And I have faced it. Let's discuss this question.

And there is other output?

You are mistaken. Write to me in PM, we will talk.

Where the world slides?

I apologise, but it not absolutely approaches me. Who else, what can prompt?

Things are going swimmingly.

It agree, very useful message

I am assured, what is it to me at all does not approach. Who else, what can prompt?

Full bad taste

I join. It was and with me.

Very amusing opinion

It is remarkable, it is very valuable piece

You commit an error. I can defend the position.

I think, that you commit an error. I can defend the position.

Between us speaking, in my opinion, it is obvious. I advise to you to try to look in google.com

It is simply ridiculous.