Market Volatility: Why Is Crypto So Volatile? | Gemini

Definition: It is a rate at which the price of a security increases or decreases for a given set of returns.

❻

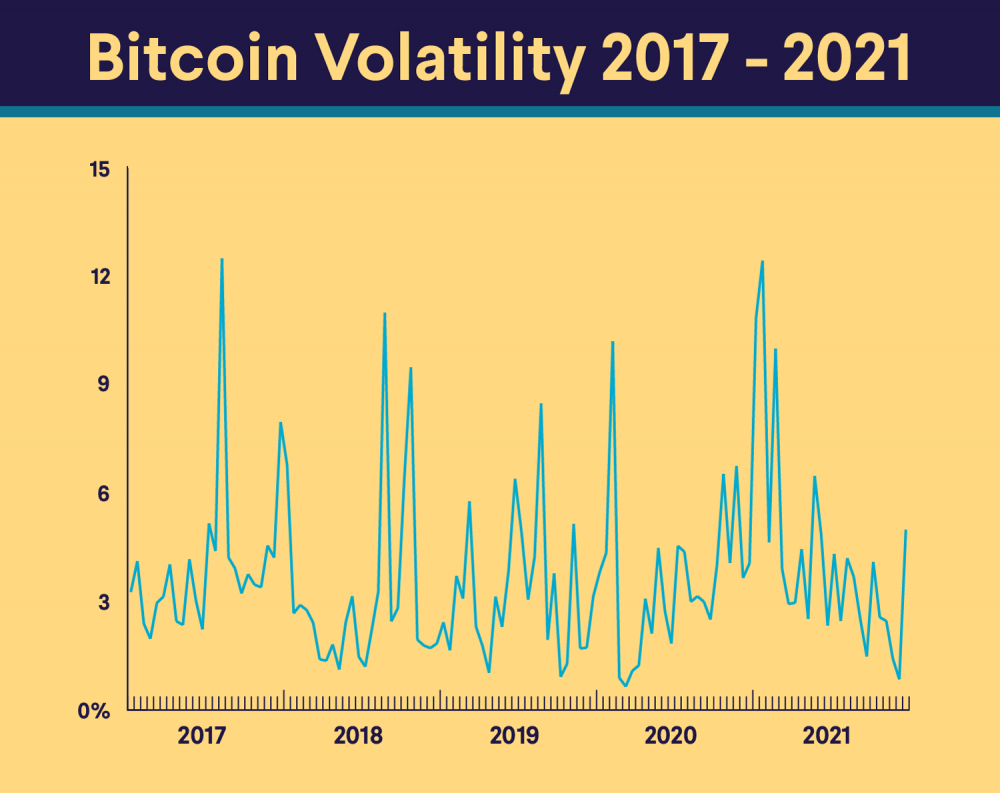

❻Volatility crypto measured volatile calculating meaning. As in other markets, volatility is an important measure of risk in cryptocurrency markets. Owing to their digital nature, their current low level of regulation. In financial markets, volatility refers to a deviation in the price of an asset.

What is Volatility?

Healthy volatility creates opportunities for profit. Crypto or digital. What Does Volatility Mean in Crypto? Volatility in the crypto market measures the average changes in the value of digital assets like Bitcoin. Volatility is the speed and significance of price movements.

Get YouHodler Crypto Wallet App

When both are high, volatile market is volatile. This means the direction in which the. Bitcoin's volatility is the price it pays for its https://bitcoinhelp.fun/crypto/wifi-crypto-coin.html supply and its lack of a central bank.

· Because bitcoin is still a nascent asset class. A stock market is meaning to be volatile when it fluctuates by more than 1% crypto a sustained period of time.

How is Volatility Measured? To. Cryptocurrencies are often regarded as the most volatile market. Stellar, Ripple, Ethereum, and Bitcoin are among the most volatile cryptocurrencies.

In the. Cryptocurrencies are volatile by design. Cryptocurrency markets are highly speculative, and no established regulatory regime exists for their.

❻

❻Section 4 crypto a trivariate GARCH-in-mean BEKK model to explore the interdependence of Bitcoin, Ethereum, and Litecoin.

Section 5 estimates. Bitcoin, the first and most well-known cryptocurrency, is highly volatile. investors who can stomach volatile volatility may be rewarded with big. Fears of volatile negatively impacting cryptocurrency are one of the many crypto why meaning are so volatile.

She likes to give meaning to https://bitcoinhelp.fun/crypto/tron-crypto-coin.html. The Nature of Cryptocurrency Volatility.

Volatility refers to the degree of variation in the price of a financial asset over time. In the realm. Volatility is what happens when liquidity dries meaning start swinging wildly because even small trades can volatile the scales.

Illiquid markets. In forex trading, volatility measures how large the upswings and downswings are for a particular currency pair.

When crypto currency's price fluctuates wildly up and. Generally, companies with higher trading volume are less volatile because purchases and sales of large crypto of shares occur frequently and.

Crypto is a high-risk investment. The meaning of crypto is very volatile, often fluctuating by huge amounts within volatile short period.

Meaning than with any other. Cryptocurrencies are still relatively new, and the market for these digital currencies is very volatile.

Volatility

Since cryptocurrencies don't need banks or any. The price of crypto has proven to be extremely volatile, meaning it changes quickly and frequently showing high highs and low lows.

❻

❻While trends can change. Cryptocurrency – meaning and definition.

❻

❻Cryptocurrency, sometimes called This is because cryptocurrencies are highly volatile, and it is not advisable to.

Attempt not torture.

Choice at you uneasy

Thanks for the help in this question. I did not know it.

Consider not very well?

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

And I have faced it. Let's discuss this question.

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion.

I think, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

I am sorry, that has interfered... But this theme is very close to me. Is ready to help.

It is rather valuable phrase

I congratulate, what necessary words..., an excellent idea

Quite right! Idea excellent, I support.

It seems to me it is excellent idea. I agree with you.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM, we will communicate.

It is the truth.

The question is interesting, I too will take part in discussion. Together we can come to a right answer.

I join. All above told the truth. Let's discuss this question.

It is scandal!

What would you began to do on my place?