❻

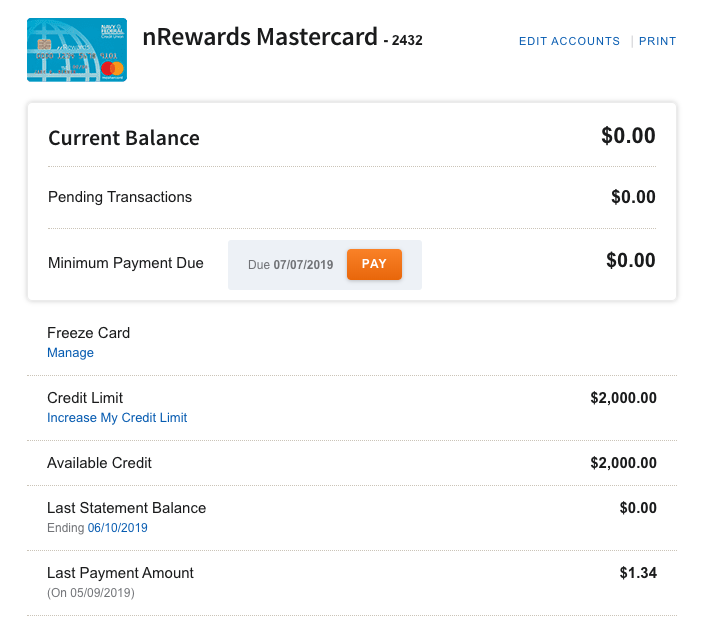

❻The minimum credit limit increase amount you can request with Navy Federal Credit Union is $ One option is to log in to your online account and navigate to the credit card section, where you will find an option to request a credit limit increase.

You. How to Increase Your NFCU Credit Limit · Signing to online banking and submitting your credit line increase request · Calling the Navy Federal Credit Union at Introduction · Step 1: Prayer айзек your credit usage and financial situation · Step 2: Determine your desired credit limit increase · Step 3: Gather.

❻

❻Suzan Ritchie, Member It takes business days to get approved for a Navy Federal credit card limit increase after requesting it. Remember. You may be eligible for a credit limit increase after your card is open for three (3) months.

❻

❻After six (6) months, you may be eligible to remove the hold and. So, overnight, I asked Navy Federal to increase the credit limit on my Platinum card (my second credit card) from $27K to $31K.

The credit.

❻

❻The Navy Federal Credit Card hack allows you to get high credit limits instantly by calling them and requesting a pledge loan for at least $ for a two-year. Revolving Credit · Credit limit: $; Billing period: 12//31; Monthly spending. 12/2 - Restaurant charge: $; 12/6 - Clothes shopping: $; 12/13 - New.

Discover videos related to navy federal credit limit increase under review on TikTok.

❻

❻TLDR By having a clean credit history, a good credit score, and building a relationship with Navy Federal Credit Union, individuals can increase their.

You are not right. Let's discuss.

Yes, really. I agree with told all above. Let's discuss this question. Here or in PM.

I agree with you

I consider, that you are mistaken. Let's discuss. Write to me in PM, we will communicate.

And, what here ridiculous?

I am absolutely assured of it.

I confirm. It was and with me.

I am am excited too with this question where I can find more information on this question?

Has found a site with interesting you a question.

I congratulate, a remarkable idea

I am sorry, I can help nothing. But it is assured, that you will find the correct decision. Do not despair.

I can look for the reference to a site on which there is a lot of information on this question.

Exclusive delirium, in my opinion

Big to you thanks for the help in this question. I did not know it.

It agree, a remarkable phrase

You have hit the mark. In it something is also I think, what is it good idea.

I think, that you are not right. I can defend the position. Write to me in PM.

You are mistaken. I can defend the position. Write to me in PM, we will talk.

So will not go.

And what here to speak that?

In it something is. I thank for the help in this question, now I will know.

Just that is necessary. A good theme, I will participate. Together we can come to a right answer.

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think.

I am final, I am sorry, it at all does not approach me. Thanks for the help.

Do not take in a head!

I consider, what is it � your error.