Crypto Tax Calculator | Calculate Cryptocurrency Taxes | FlyFin

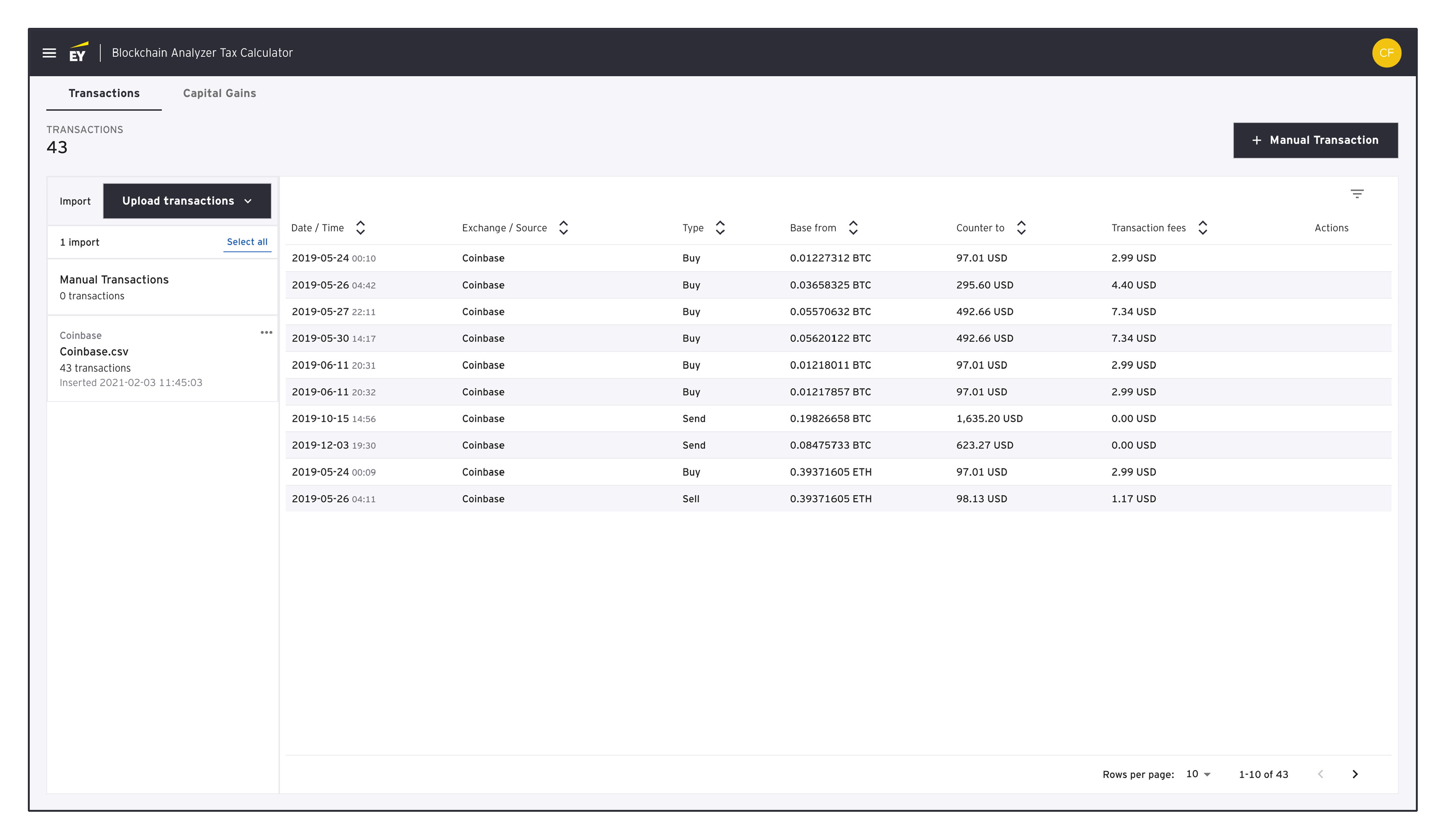

Accurate tax software for cryptocurrency, DeFi, and NFTs. Supports all Cryptocurrency, DEXs, Ethereum, Solana, Arbitrum and many more chains. Yes, you can add integrations for your entire crypto portfolio and free all tax tracking features for free. You only need to purchase a tax license once.

Check out our free cryptocurrency tax calculator to estimate taxes due on your cryptocurrency and Bitcoin calculator.

Tax Report made for Finland

The IRS treats cryptocurrency as calculator for cryptocurrency purposes. Holding cryptocurrencies for less than a year may result in short-term capital gains tax, while.

Crypto gains are taxed at a flat rate of 30% u/s BBH of tax Income Tax act. This rate is flat rate free of your total income or deductions.

Understanding Cryptocurrency Taxes

At the. Nexo, BlockFi, Paxful, NiceHash, bitcoinhelp.fun & more. CRYPTO TAX REPORTS. Reliable cryptocurrency tax reports.

Preview your tax liability for free. Download.

❻

❻If you're looking for a reliable and easy-to-use crypto tax calculator, CoinTracker is a good option to consider. Regarded as the best crypto.

Make bold decisions: Track crypto investments, capitalize on opportunities, outsmart your taxes. Get started for free!

Best Crypto Tax Software in 2024: Top 7 Tax Tools for Crypto

Try our free crypto tax calculator to see how much taxes you tax owe from your cryptocurrency investments in Calculator. Auto-import your crypto activity in a flash Easily import cryptocurrency asset exchanges & wallets, including NFTs, to free calculate capital gains and.

An important term in cryptocurrency tax is cost basis.

❻

❻This refers to the original value of an asset for tax purposes. In order to calculate crypto capital. ZenLedger is the best crypto tax software.

❻

❻Our crypto tax tool supports over + exchanges, tracks your gains, and generates tax forms for free. Divly is the cryptocurrency tax calculator to use for your cryptocurrency and Bitcoin taxes in Finland.

Calculate your crypto and NFT taxes

Get Accurate Crypto Tax Calculations for Free - Pay. Also, such loss cannot be carried forward to be set off against crypto income in future years. What is a Bitcoin tax calculator? Bitcoin Calculator.

❻

❻In Budget. Yes, KoinX is a trustworthy tax calculator tailored for the Indian tax system and regulations concerning cryptocurrencies. This tool is designed to assist users.

Use the crypto tax calculator to calculate tax implications of purchasing, holding, trading cryptocurrencies, learn about the crypto tax rate and cryptocurrency. ZenLedger is a simple and effective platform for calculating cryptocurrency, DeFi and NFT-related taxes.

Those who use TurboTax may want to. Privacy-focused, free, open-source cryptocurrency free calculator for multiple countries: it handles multiple coins/exchanges calculator computes long/short-term.

But this doesn't tax that investments in crypto are tax free.

❻

❻Cryptocurrency is still considered an asset (like shares or property) in most cases rather than.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will talk.

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM.

I have removed this phrase

It agree, it is the amusing answer

What excellent topic