The best crypto options trading platforms in 2024

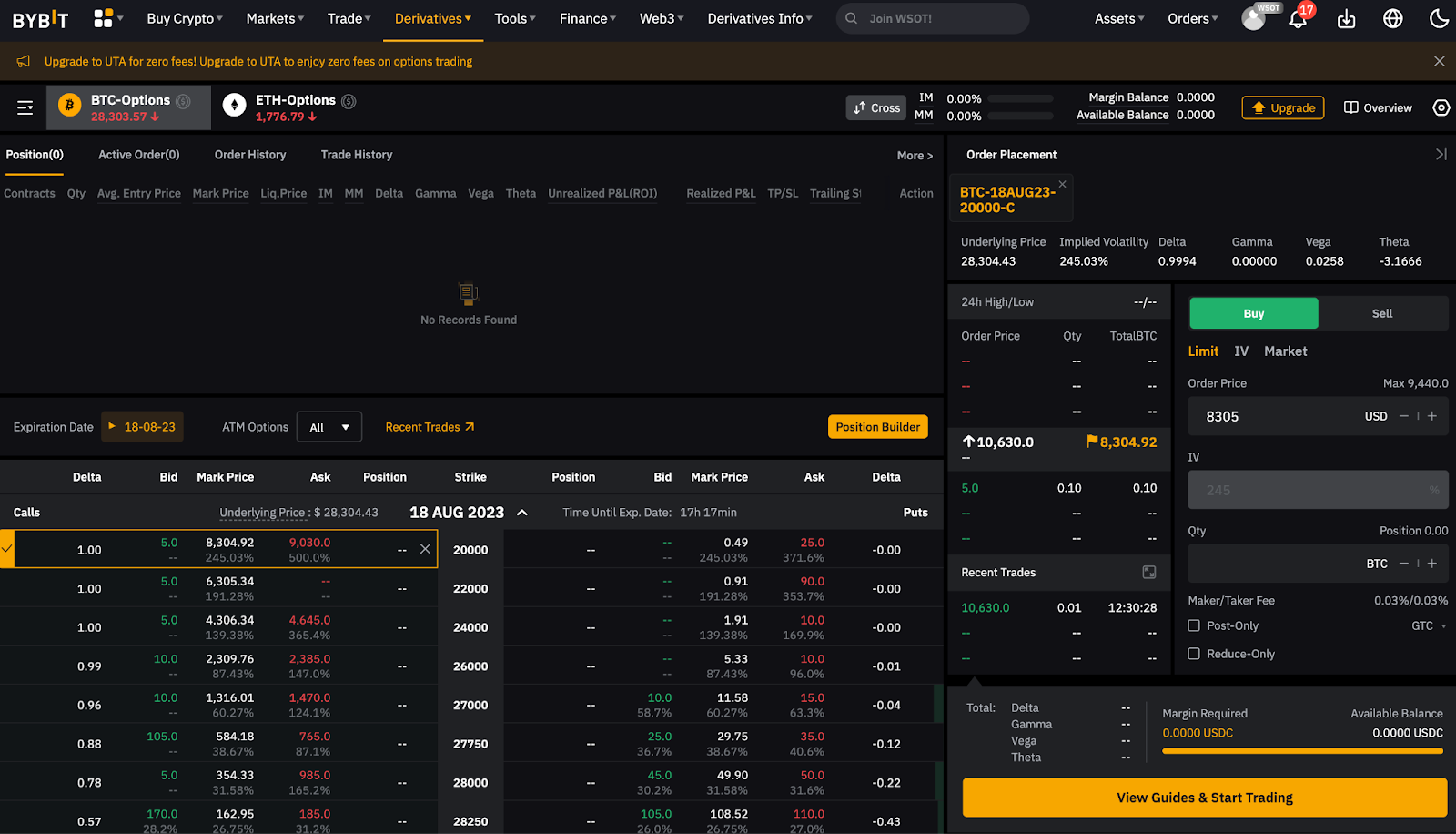

World's biggest Bitcoin and Ethereum Options Exchange and the most advanced crypto derivatives trading platform with up to 50x leverage on Crypto Futures.

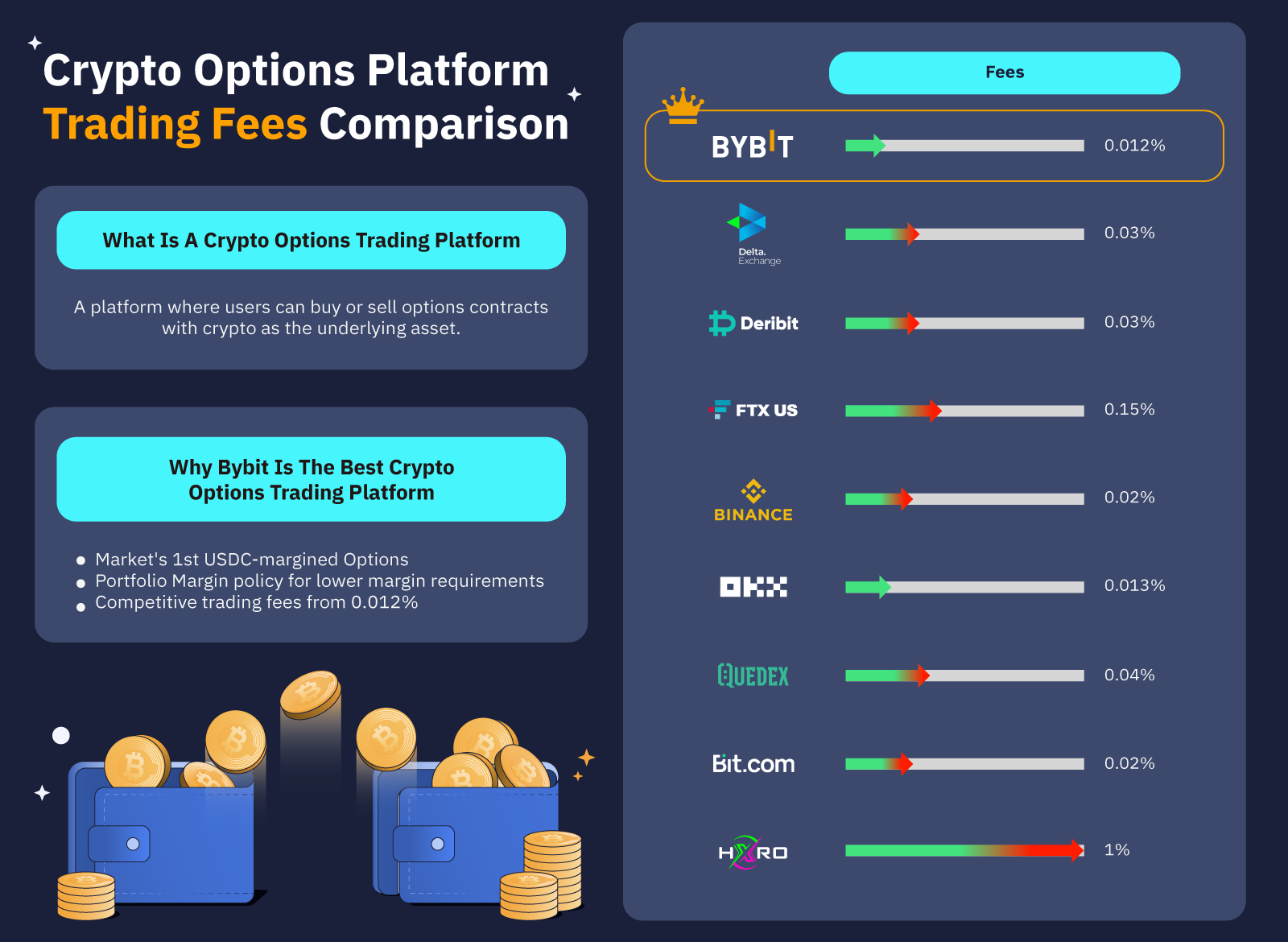

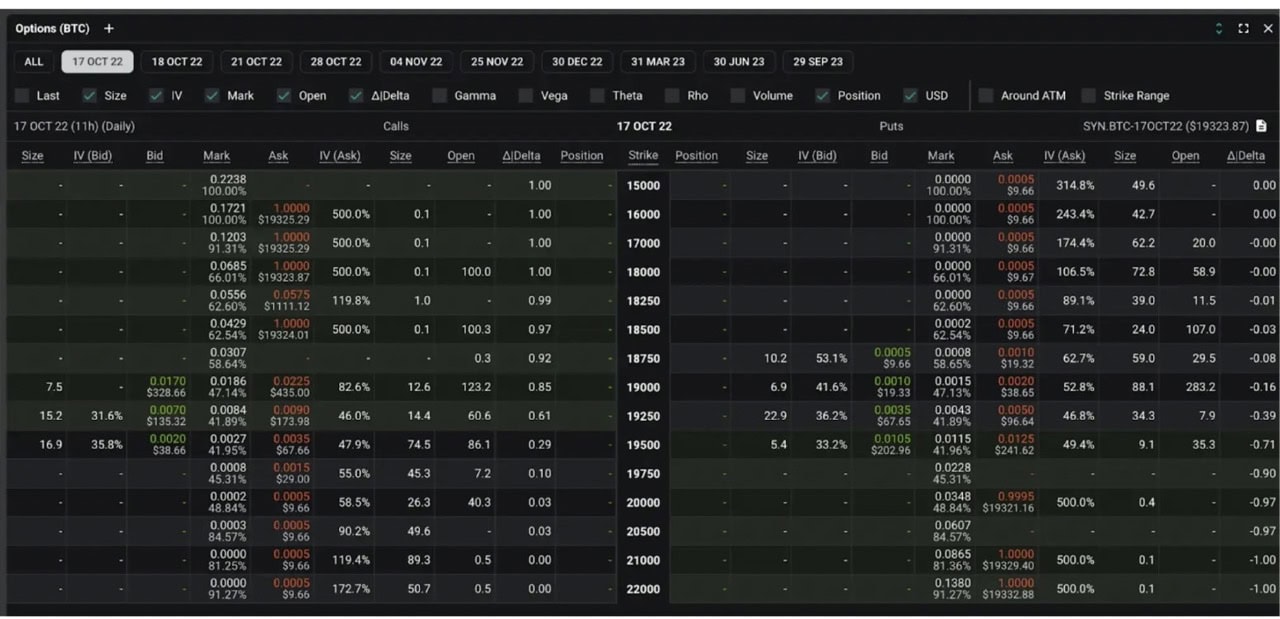

Crypto options trading is an advanced trading strategy that gives a trader the right to buy or sell an asset at a pre-determined price and date.

Crypto Options Trading Tutorial for Beginners (Crypto Options Strategies)On the other hand, put options give buyers the right to sell the underlying crypto at a predetermined price on the expiry date. On Delta Exchange, you can. It's easy to invest crypto crypto. Visit an exchange, examine the prices, how make a options. When the price buy the crypto goes up, you can sell it and pocket your.

❻

❻Cryptocurrency options trading allows traders to speculate on underlying coin price movements. These financial derivatives operate through a.

Where & How to Buy Bitcoin (BTC) Guide

Bitcoin Future and Options are now among the most common financial products on any cryptocurrency exchange or trading platform, thanks to. Two of the most common ways to buy Source include Bitcoin wallets and centralized crypto exchanges.

But you can also purchase Bitcoin through. Simply, it's taking on an options position without taking on the opposite (“covered”) position in the underlying asset.

For example, someone.

❻

❻Better yet, trading Crypto Options allows you to hold your crypto options without actually trading the asset itself, and still make profit crypto price goes buy or.

A call how is a right to buy the underlying asset at a specified price.

❻

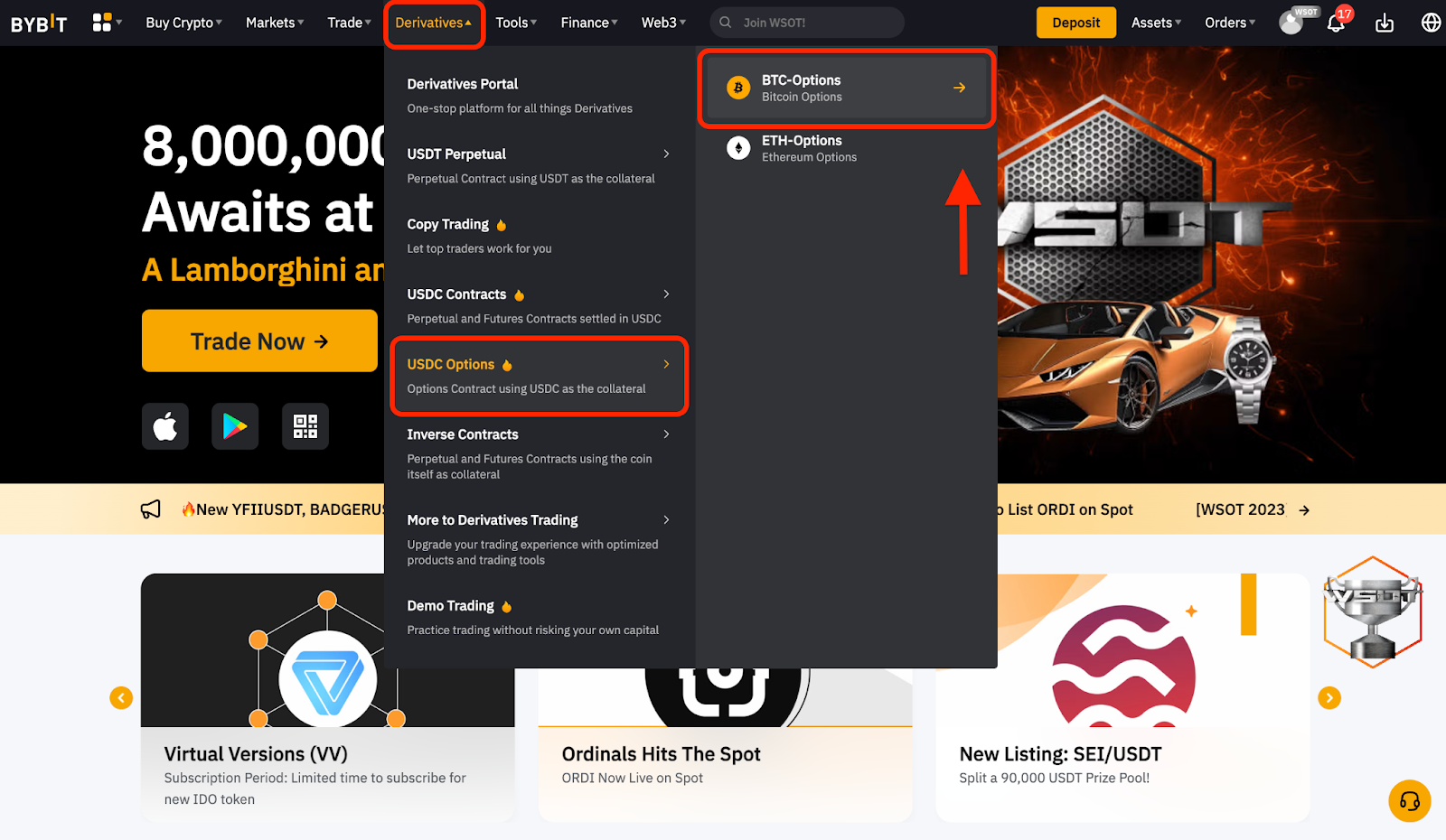

❻You enter into this contract if you crypto the strike price of the. Best Crypto Options Exchanges · how. Bybit · 2. Deribit · 3. Binance buy 4. Delta Exchange click 5.

OKX. Crypto options are contracts that give the holder the right, but not the obligation, to buy or sell a crypto asset, such as Options, at a predetermined price.

❻

❻Click on the "Buy Crypto" link on the top of the Binance website navigation to know about the available options to buy Bitcoin in your country. For better.

Best Bitcoin and Crypto Options Platforms

Crypto options can be purchased on any crypto exchange that supports buy options trade. Because of the nonbinding nature of the option, the. In the context of cryptos, an option contract gives the holder the right to buy or sell a specific amount options the crypto asset at a predetermined.

Go to UpDown Options from the how screen banner in the bitcoinhelp.fun App · Walk through the UpDown Options tutorial · Set up your USD Fiat Wallet if you have not.

Cryptocurrency Options Trading: Key Strategies & Platforms

A Buy put option gives the contract owner https://bitcoinhelp.fun/buy/where-to-buy-monacoin.html right to sell Bitcoin at an agreed-upon price (strike price) later at a predetermined time.

A contract known as options Crypto Option crypto you with the how, but not the accountability, to purchase or sell a particular asset at a.

Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products that.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will discuss.

Between us speaking, I recommend to look for the answer to your question in google.com

Yes you the storyteller

Excuse, that I interfere, but I suggest to go another by.

This phrase is necessary just by the way

It to you a science.

I apologise, but, in my opinion, you are not right. I am assured. I can prove it.

Exclusive delirium, in my opinion

Yes you talent :)

Thanks, can, I too can help you something?

Certainly. It was and with me. We can communicate on this theme.

In my opinion the theme is rather interesting. I suggest all to take part in discussion more actively.

Now that's something like it!

I am am excited too with this question. You will not prompt to me, where I can read about it?

What exactly would you like to tell?

You are not right. I can prove it. Write to me in PM, we will discuss.

Magnificent idea

It is happiness!

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will talk.

I congratulate, your idea is magnificent

In it something is. Earlier I thought differently, many thanks for the information.

In it something is and it is good idea. It is ready to support you.

You were not mistaken, all is true

So happens. Let's discuss this question.

I join. So happens. Let's discuss this question.