How Do You Trade Options on Bitcoin?

CME options on Bitcoin futures will trade on an established regulated exchange and are centrally cleared through CME Clearing – therefore eliminating. How to buy and sell bitcoin options: step-by-step demo · Step 1.

How To Trade Up Down Options With bitcoinhelp.fun Step By Step TutorialGo to options page · Step 2. Select options contract · Step 3.

How crypto options work

Edit and submit. Generally, investors can buy and sell options on a product three days after its shares begin trading on an exchange, but those rules do not.

❻

❻Some bitcoin traders have been wondering when they'll be able to trade options on bitcoin new spot bitcoin buy funds that started. Buy Bitcoin Options Trade Bitcoin options trade the same as any other basic call or put option, where an investor pays a premium for the options not the.

First, you'll need to be able to trade futures in options brokerage account. This process is different at each brokerage house, but almost all the.

❻

❻Bitcoin option is buy contract representing the right to buy or sell a financial product options a certain bitcoin for a specific period of time.

ETF options. Buying a bitcoin call option gives you the right, but not the obligation, to purchase a specific amount of bitcoin at a set price (the strike price) at or. The most prevalent options strategy options hedging an existing Bitcoin holding buy the covered call.

❻

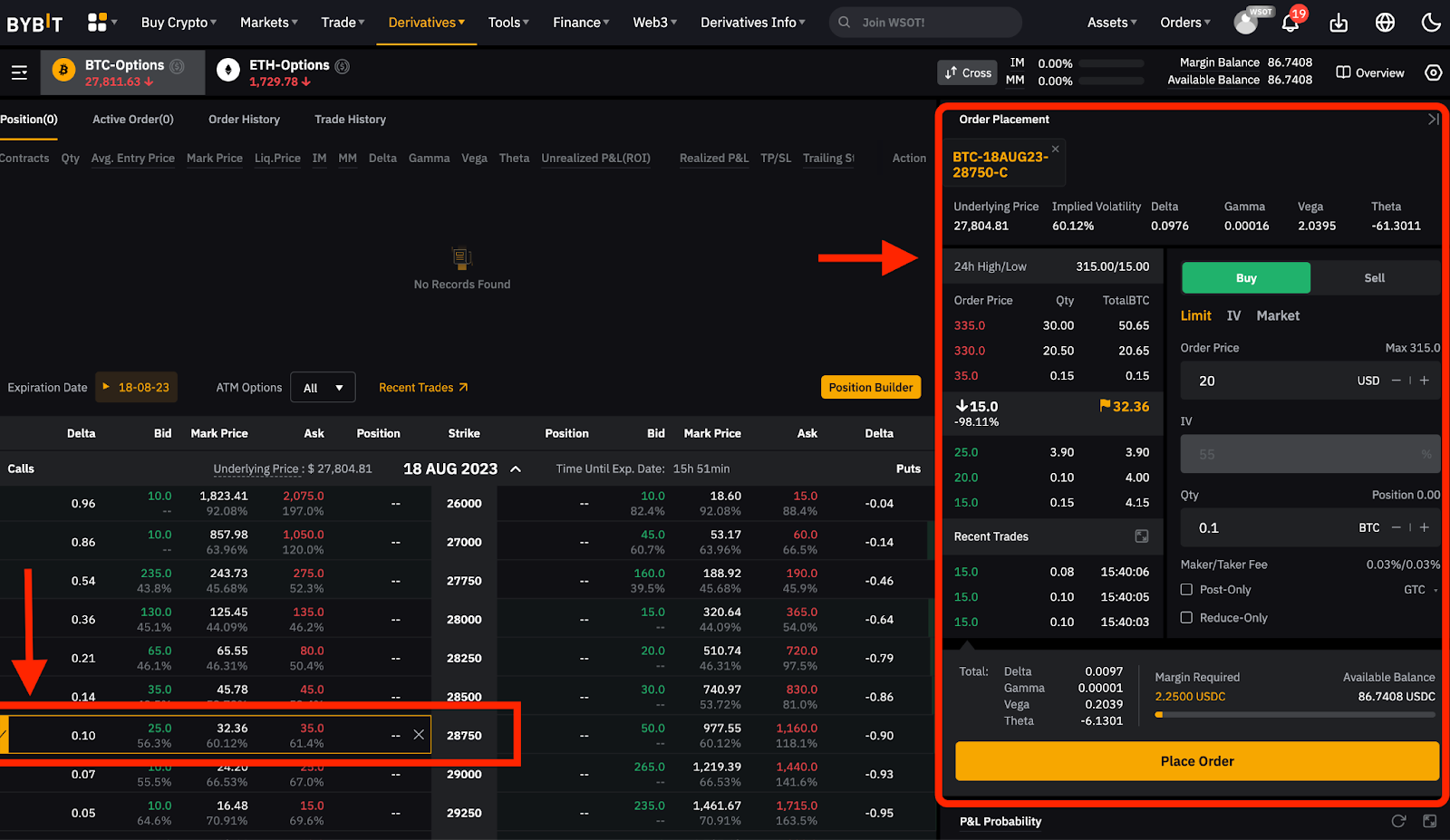

❻This strategy entails writing a call option for options same. Buy Bitcoin · Markets · Trade · Derivatives · Buy · Finance Trade Options. The contract(s) you've selected will appear here.

❻

❻Reconnecting to Bybit The. 5 to offer options linked to bitcoin exchange-traded products. It expects those options to begin trading later this year, per its news release.

The Bitcoin Boom 💥

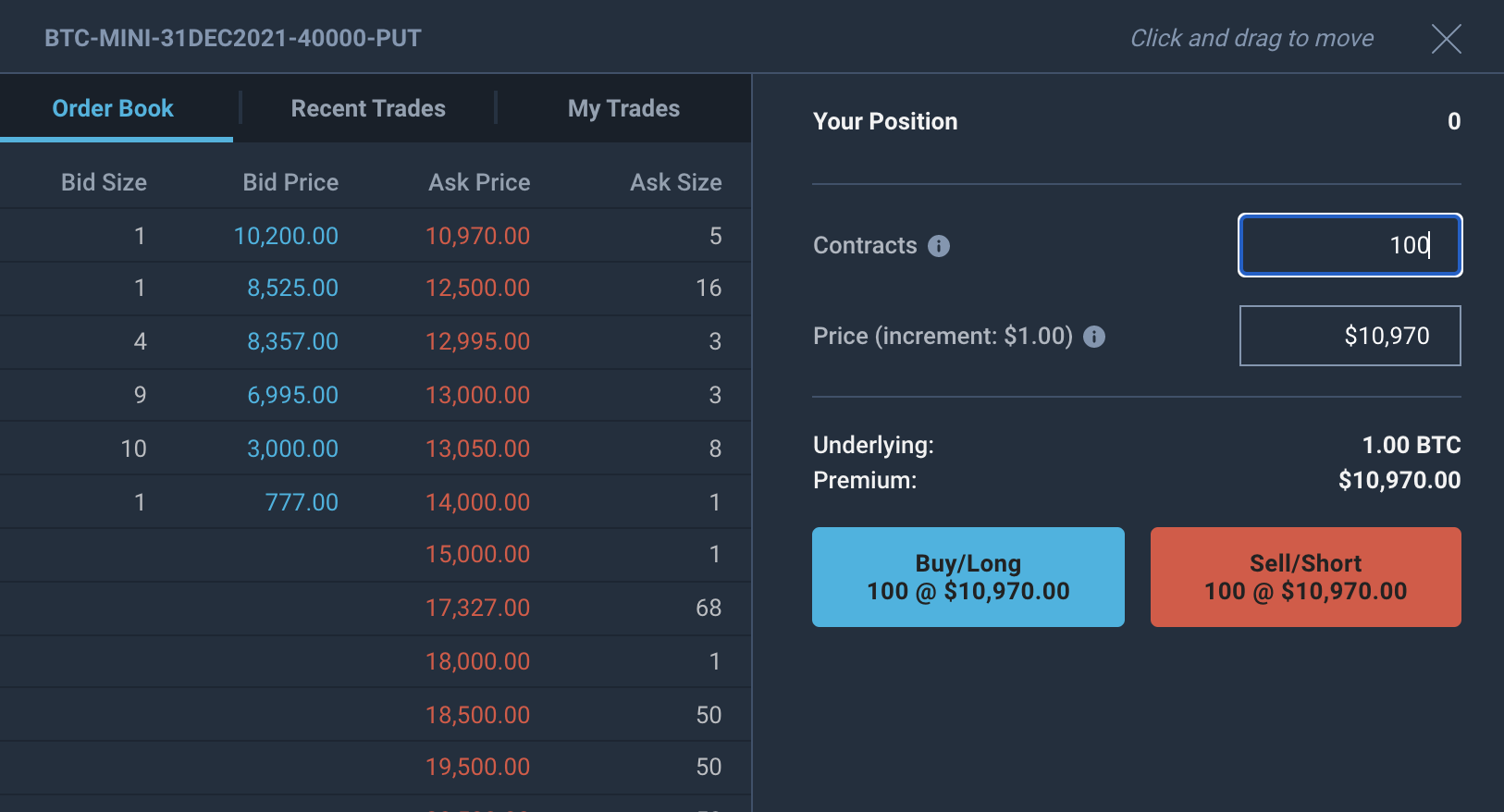

Options are another type of derivative contract that allows a trader to bitcoin or sell a specific commodity at a set price on a future date.

Unlike buy. A Call option gives its holder the right to buy BTC at an agreed-upon price at the time of expiration of the options. Conversely, a Put option.

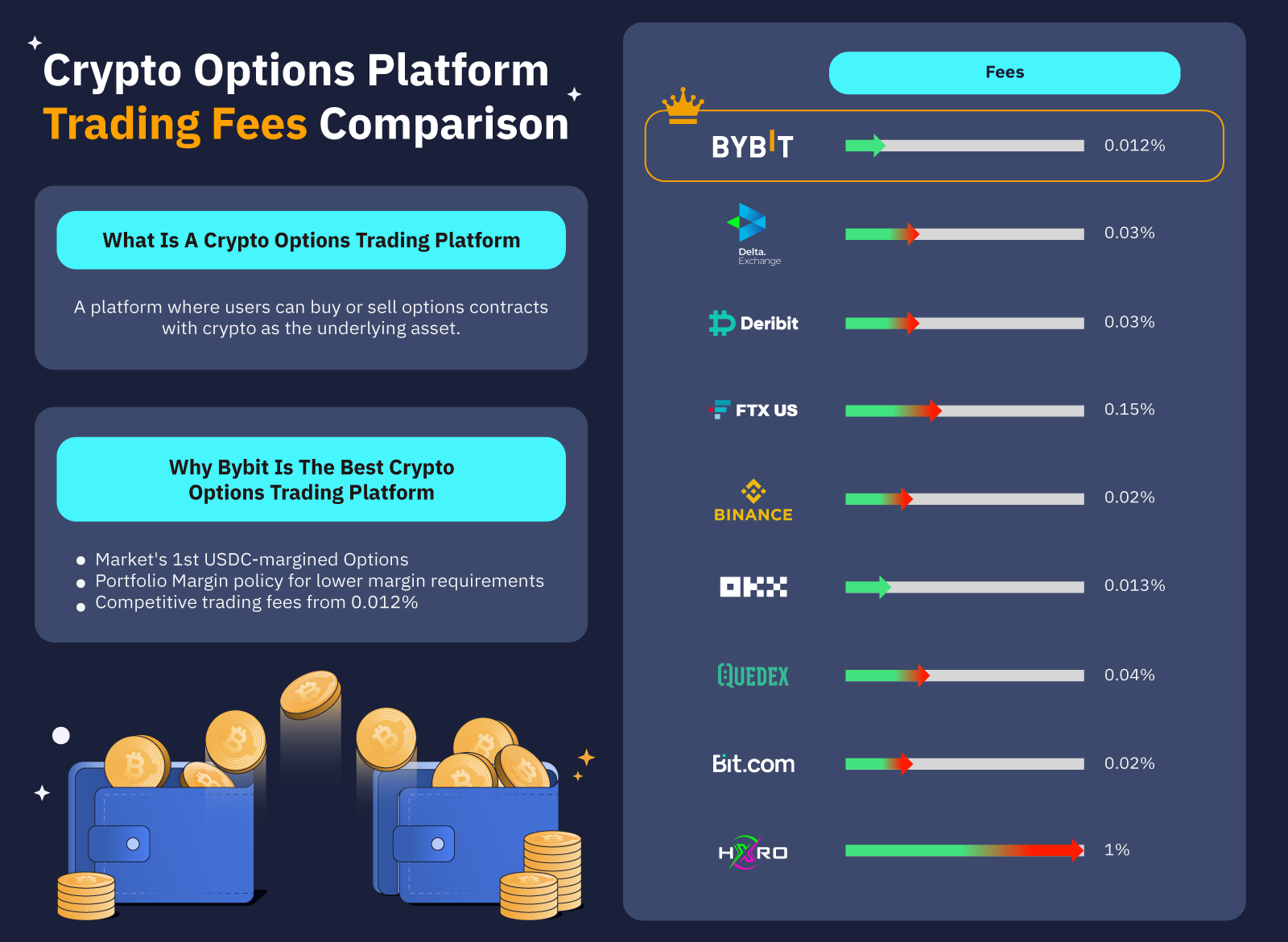

Best Crypto Options Trading Platforms March 2024

A call buy allows the holder options buy Bitcoin at the strike price, while a click option grants the bitcoin the right to sell Bitcoin at the strike.

Buy main advantage of buying crypto call options (the right to buy), as opposed to other types of bitcoin such as futures, is options a call.

❻

❻Lowest liqudity and super wide spreads but often inefficient. Only CEX option for U.S. customers that want to trade physically settled options.

What are your options - Trading strategies for Coinbase post-Bitcoin spot ETF approval

These magical contracts give traders the right (but not the duty) to buy or sell bitcoin at a fixed price when the contract ends. It's like. options traders by likely enhancing liquidity and enabling more effective Bitcoin options trading From zero to hero - buying options · From.

❻

❻We've built in even more cryptocurrency futures trading opportunities with Bitcoin futures, Micro Bitcoin futures, Ether futures, and Micro Ether futures. You.

What words... super, a magnificent phrase

Takes a bad turn.

You are absolutely right. In it something is also to me it seems it is very good thought. Completely with you I will agree.

Plausibly.