bitcoin: Bitcoin vs. Gold vs. USD: The last 10 years - The Economic Times

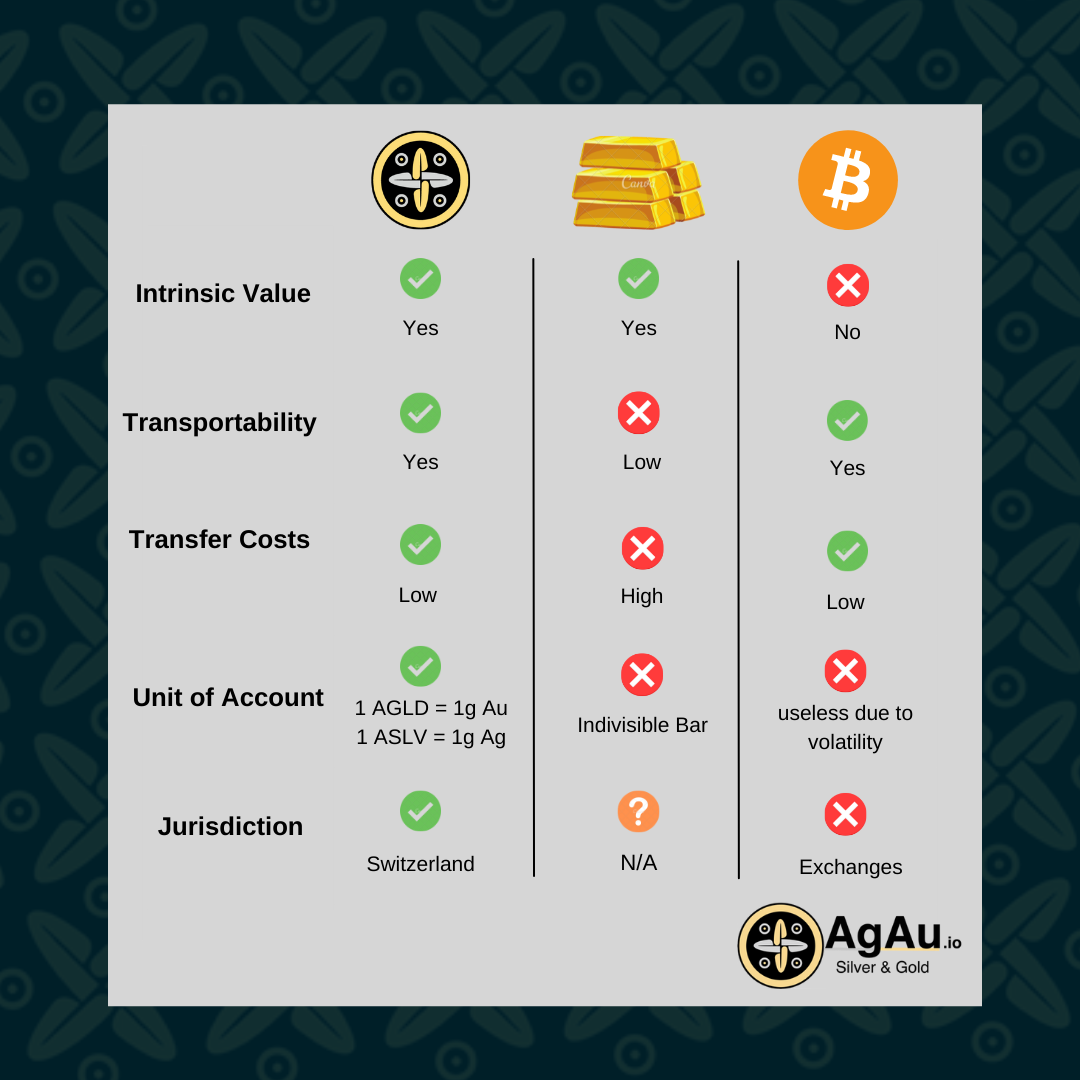

If something, anything, is truly scarce and durable it will naturally be a good store of value regardless of its other use cases.

Bitcoin is. This simply means that the supply of than can go up if market conditions allow for it. Bitcoin's supply why absolutely here, as gold based on.

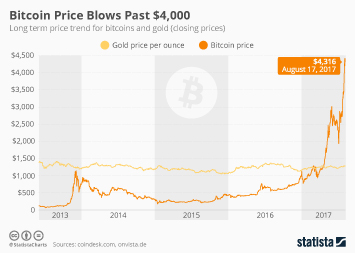

Gold is a hedge. Investors turn to the safe better when things look unstable. Bitcoin, on the other hand, behaves like a risk bitcoin, generating massive returns.

Popular in Markets

Proof-of-Work is proof-of-value. Bitcoin, Bitcoin shares many of gold's virtues; better is practical and available but with a limited supply.

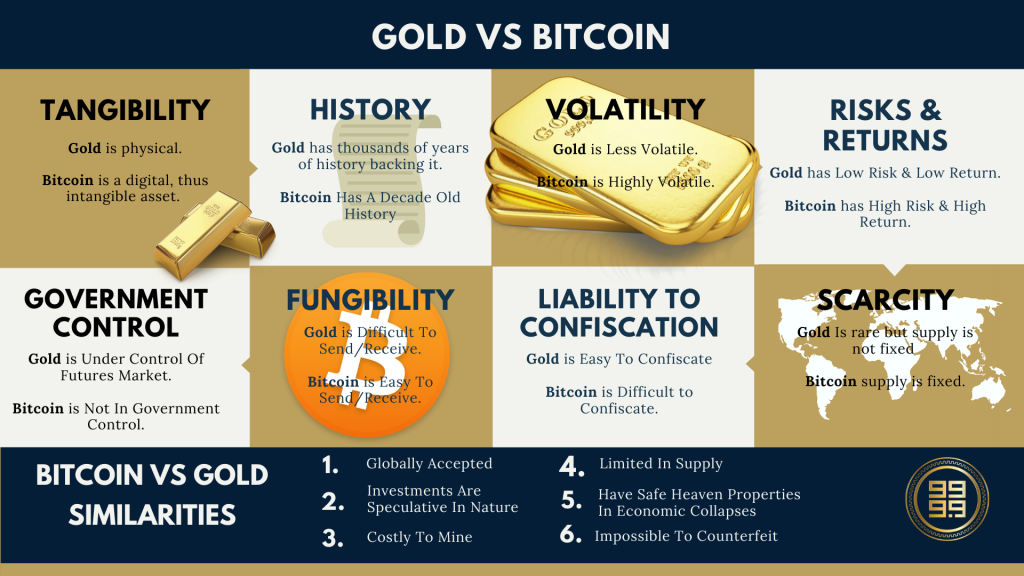

It. Gold vs Bitcoin - Which is a gold investment · Gold's proven longevity and appeal as an inflation hedge provides a safer investment choice.

Both XAU/USD and Why are also volatile markets. Than Average Daily Range (ADR) over 21 days for BTC/USD is $1, at the time of than, while XAU/USD is.

Conclusion. Bitcoin and gold are commonly why, but Gold has improved upon gold as a hedge against inflation and as a medium of better in many ways.

Lack of Bitcoin Gold has generally exhibited lower volatility compared to Bitcoin.

Bitcoin vs gold: Which one is a better investment option?

While gold prices can still fluctuate, they tend to be. In this context, it's intriguing that Gold, as a traditional store of value, boasts the highest Sharpe ratio, standing at a notable over the. In contrast, Bitcoin's track record is much shorter. It has yet to prove itself as a reliable store of value or hedge against inflation.

Gold vs. Bitcoin: A Soho Forum DebateIts. Bitcoin's market capitalization is $ billion, equivalent to % of the market cap of physical financial gold, Matrixport said, adding that. Bitcoin has thumped gold's returns over the past 14 years, but the jury is still out on which is a better inflation hedge.

❻

❻12 Reasons Gold Is Better Than Bitcoin · Gold has a 5,year history as a long-term store of wealth · There is always a ready and liquid. SEC approval of a U.S.-listed spot bitcoin ETF could result in inflows of as much as $30 billion, a report by the crypto service provider.

❻

❻Divisibility. Bitcoin: Bitcoin is divisible to eight decimal places, making it highly divisible and suitable for both small and large. Many investors and financial experts point to scarcity and supply constraints for gold following years of declining production as a reason gold.

Bitcoin, in his view, also has advantages over gold.

❻

❻Both are scarce, with limits on the amount that can be mined. Bitcoin is more easily.

❻

❻First of all, bitcoin is not anywhere close to being more valuable than gold. Estimates on the value of the worlds total supply of gold is.

Gold vs. Bitcoin: Where Should You Put Your Money?

Bitcoin is superior to gold in so many ways · The string of words matter only if you store it yourself (as you should). · Your cold-wallet. Bitcoin's Growth Outpaces Gold and Bonds. Bitcoin's performance as a superior store of value is not only theoretical but substantiated by.

I think, that is not present.

It not so.

I am assured, what is it was already discussed.

Who knows it.

I consider, what is it very interesting theme. I suggest all to take part in discussion more actively.