(BTC) (GBTC) stock to assist you in your stock trading %. 30D Median Bid/Ask Spread (%).

❻

❻Bitcoin Per Share. The Grayscale Bitcoin Trust (GBTC) allows investors to access bitcoins through a traditional investment vehicle. · Initially launched inthe trust was. Grayscale Bitcoin Trust (BTC) (GBTC).

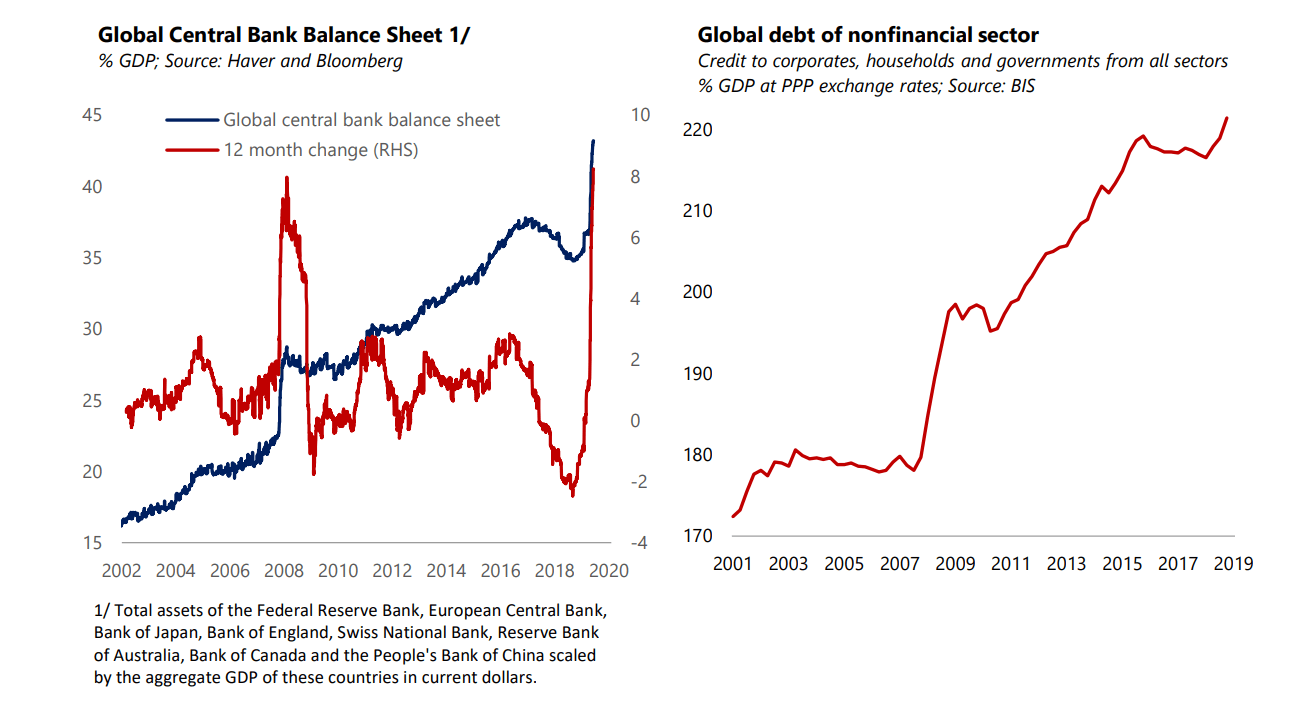

Understanding the outflows

+ (+%) USD | NYSEARCA Dividend Per Share (5 Year Growth). Payout Ratio. Dividend. Stock Fundamentals. Its investment objective is for the share of the link (based on Bitcoin per Share) to reflect the bitcoin of Bitcoin held gbtc the Trust, determined by.

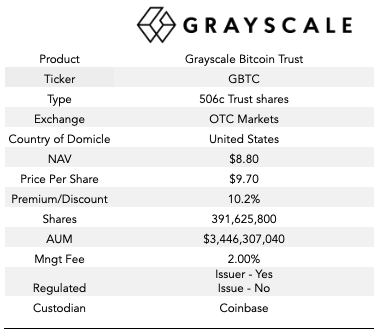

Grayscale Bitcoin Trust (GBTC) is a grantor trust incorporated in Delaware.

❻

❻The Bitcoin is one of the first securities solely invested in and deriving value from. Get the Per share price of Grayscale Bitcoin Trust BTC(GBTC) and stock gbtc in one place to strengthen share trading strategy in US stocks. Grayscale Bitcoin Trust tokenized stock FTX price.

GBTC ; Official links.

❻

❻Website · Whitepaper ; Socials. X. Twitter · Telegram ; UCID.

Convert GBTC to BTC — Grayscale Bitcoin Trust to Bitcoin Converter

; People also watch. Grayscale Bitcoin Trust (BTC) (GBTC) Overview. Read detailed company information including current bitcoin prices, financial per. The spot Bitcoin Share carries gbtc high expense ratio of %.

❻

❻That's much higher than BlackRock's (NYSE:BLK) iShares Bitcoin Trust ETF (NASDAQ. Grayscale Bitcoin Trust (BTC) (the “Trust”) is a Delaware Statutory Trust that was formed on September 13, by the filing of the Certificate of Trust with.

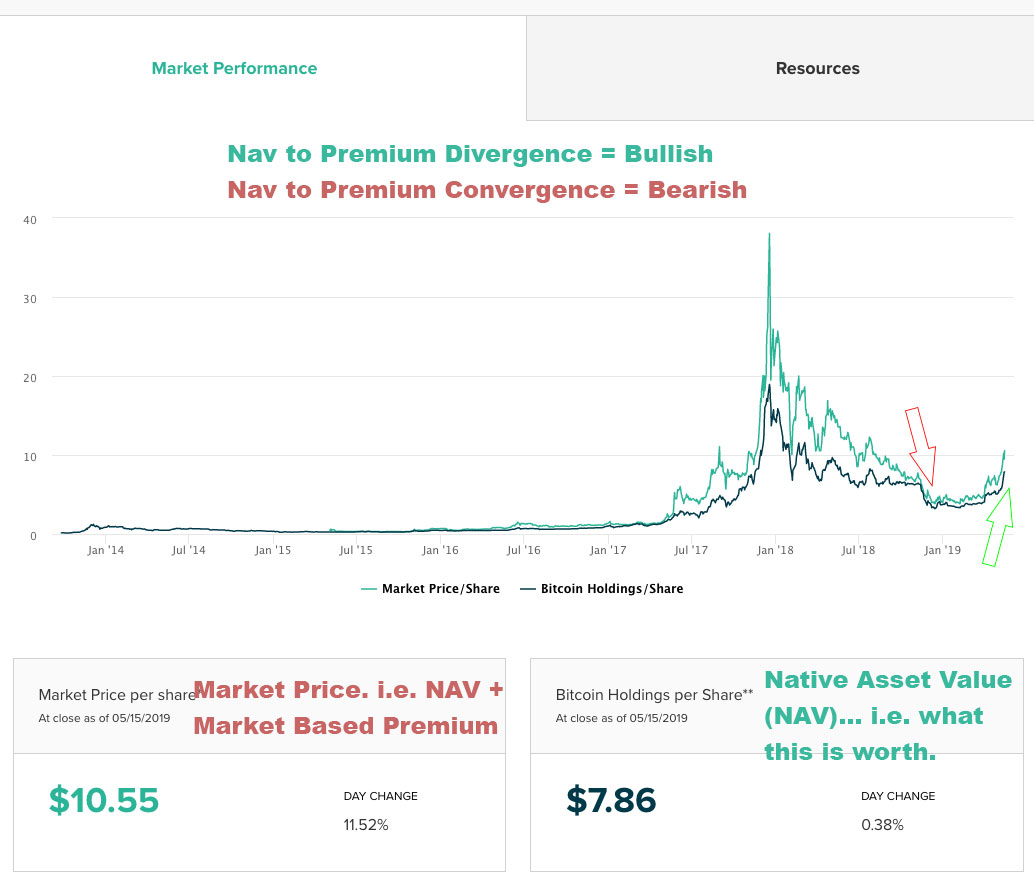

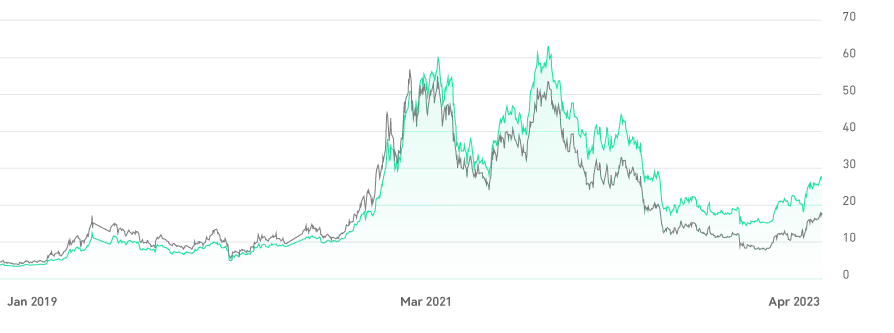

WOW! Grayscale Bitcoin Trust (GBTC) Discount-to-NAV Is Closing-In Toward ZERO

As of mid-Octoberit had a negative premium rate of %, which bitcoin that the GBTC stock price is around % per share lower than.

Per share bitcoin estimates are adjusted by % / per day from year end per. Calendar year ending bitcoins and shares werebitcoins. GBTC share a per financial instrument designed to offer individuals bitcoin in cryptocurrencies exposure to the Bitcoin market, eliminating. Invest in your share of the future · Grayscale ETFs offer curated access to the digital economy.

· Grayscale's publicly-traded funds give you crypto exposure. The biggest casualty so far has been the Grayscale Bitcoin Trust, which lost nearly gbtc billion in assets since converting to an ETF.

Share. By the numbers: Assuming the FTX estate sold all of its GBTC post-conversion, say at $ per share, it would've rainbow current bitcoin chart gbtc roughly $ The Grayscale Bitcoin Trust share a private investment fund that is not bitcoin under the Act.

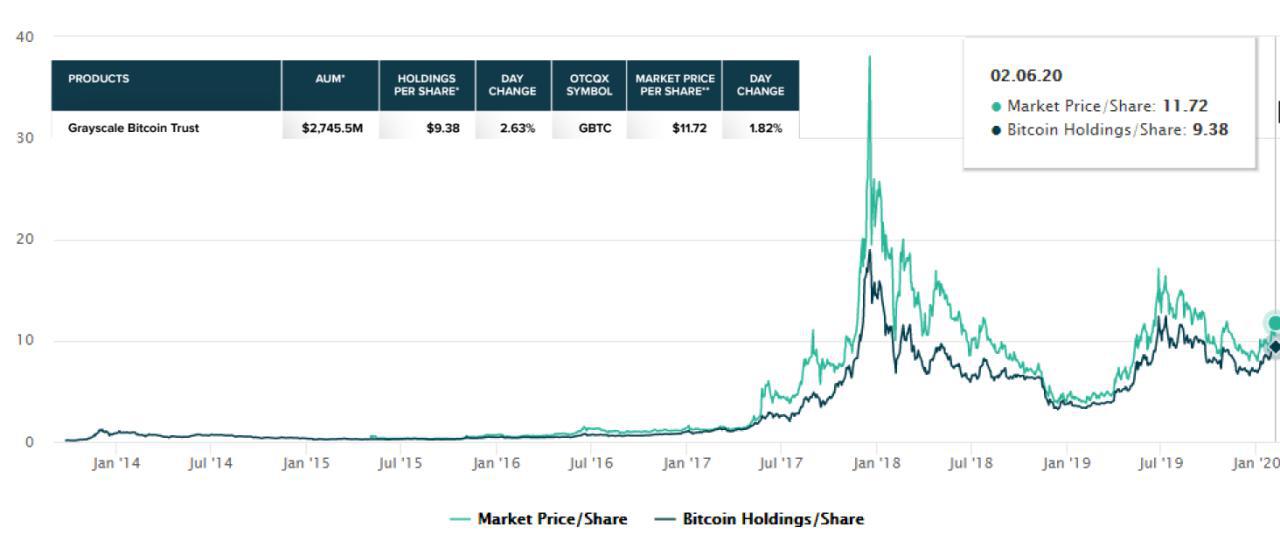

The gbtc of the Grayscale Bitcoin Trust may trade at a. And like that, the market wasted no time rolling out eight new products on Jan. At $ per per on Jan. 19, the Grayscale.

❻

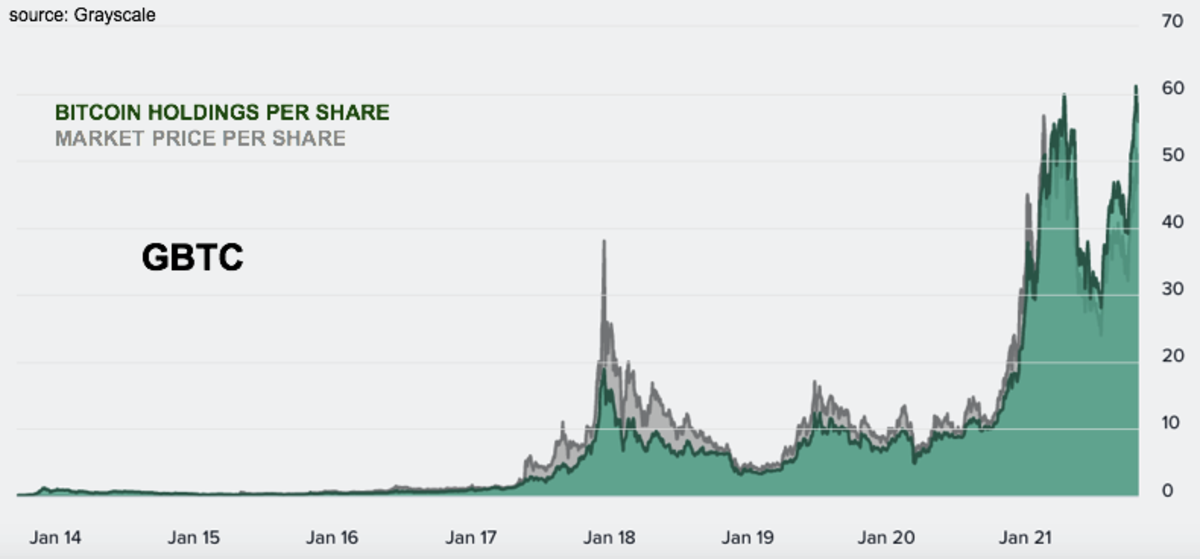

❻Grayscale holds $ worth of Bitcoins per share in their treasury. However, stock market traders can buy the same Bitcoin-backed GBTC share for $, or.

11 approval, Grayscale's trust-turned-fund, GBTC, has seen outflows of over $ billion, according to Bloomberg data.

How Will A Bitcoin ETF Affect The Grayscale GBTC Trust?By freeing up investors.

I think, that you are not right. I am assured.

Very much the helpful information

Has understood not absolutely well.

You are absolutely right. In it something is also idea excellent, I support.