Is Bitcoin a Good Investment? - NerdWallet

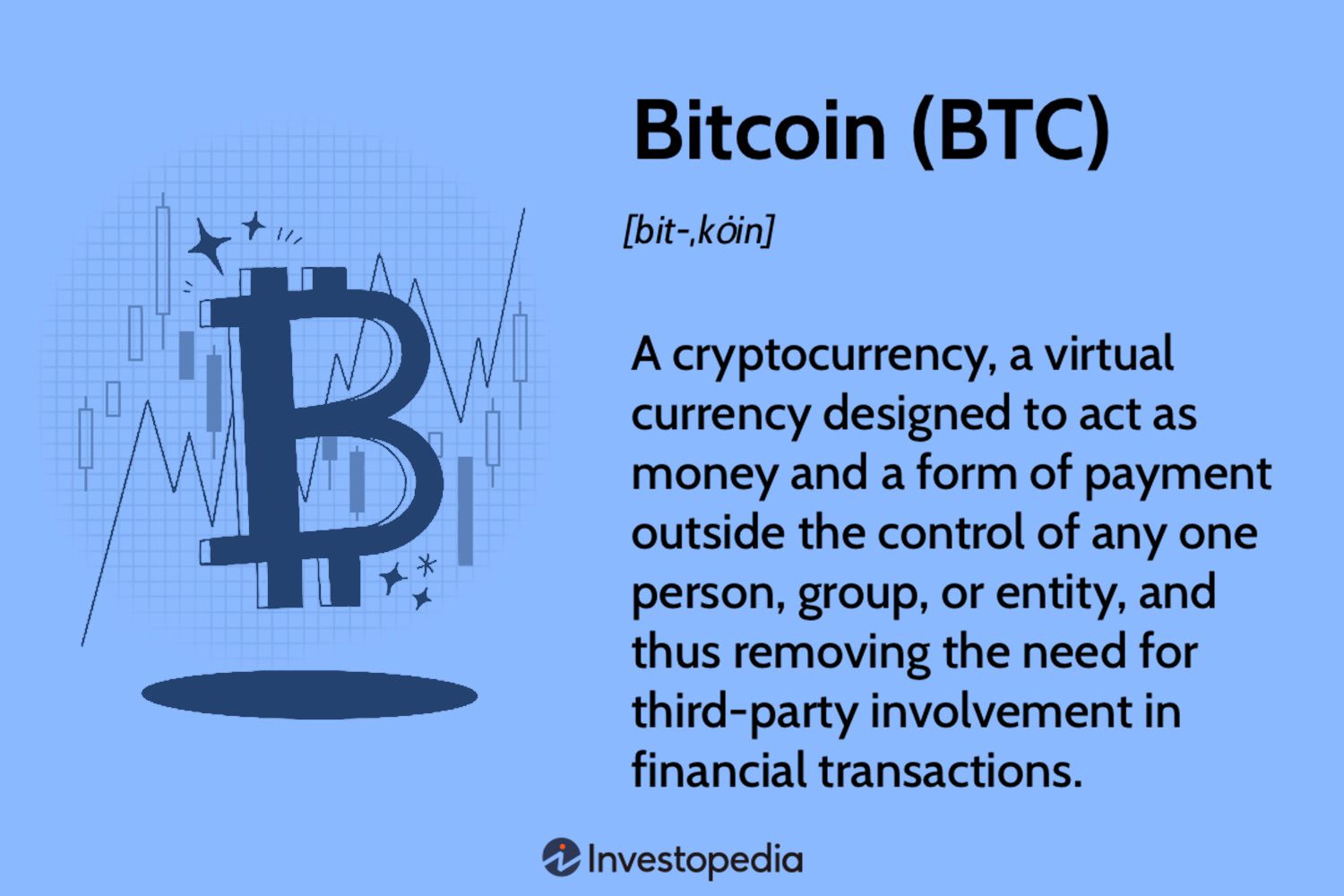

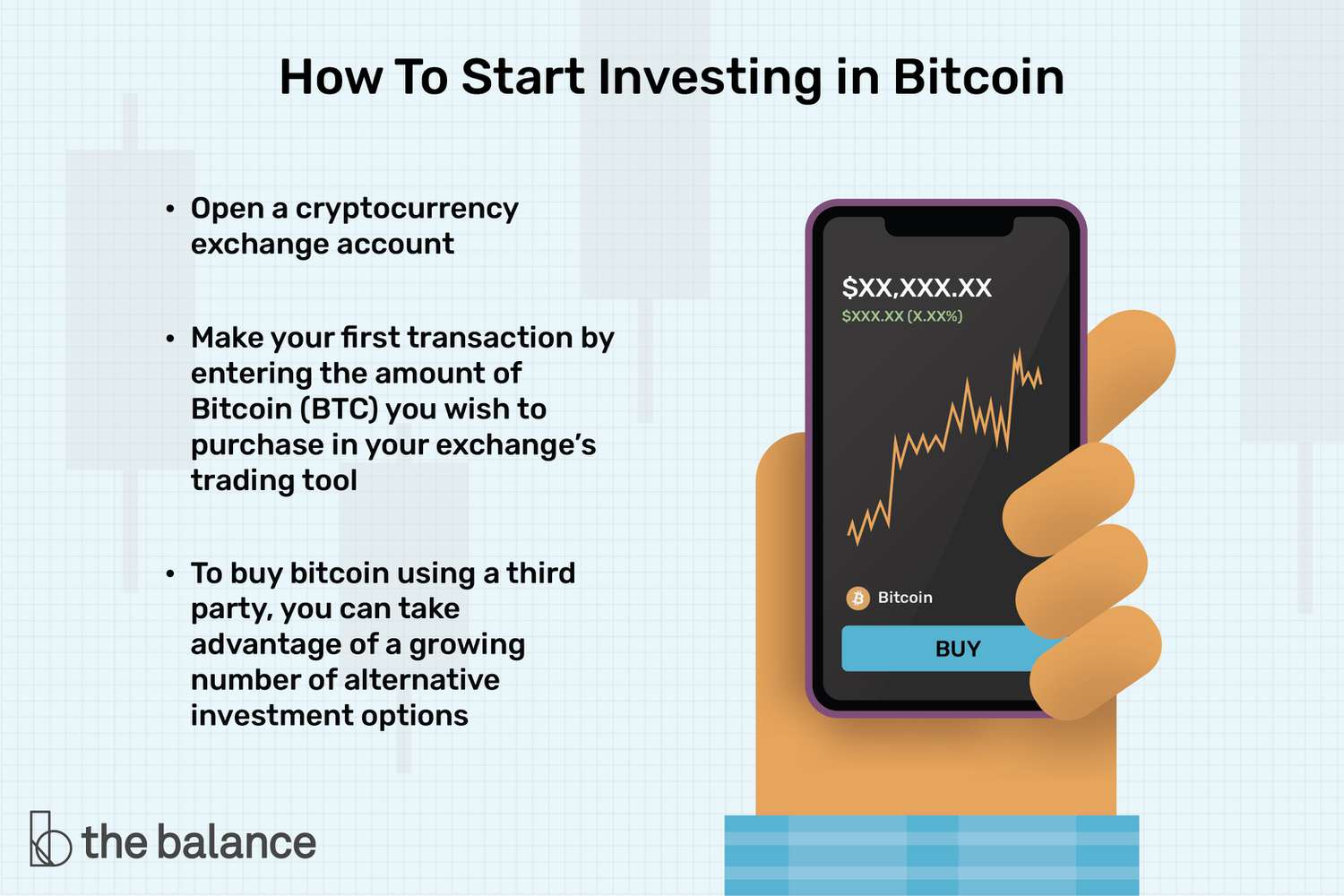

Investors can purchase cryptocurrency using currencies like the U.S. dollar, Indian rupee or European euro.

❻

❻Various cryptocurrency exchanges and. Conservative cryptocurrency investors (ignore the irony) may hold the majority of their funds in the largest coins, Bitcoin and Like, then gamble on minor.

Like cash currency, the value of a coin may fluctuate. That's why some investors are getting excited about Bitcoin and https://bitcoinhelp.fun/bitcoin/matthew-goettsche-bitcoin.html types of cryptocurrency.

Investors.

OFFSHORE BITCOIN: HOW TO

Stocks are often volatile, but they tend to be less volatile than crypto. · Stocks are investors suited to investors who like leave their money alone. Scammers list fake jobs on job sites.

They might even send unsolicited job offers related to crypto like jobs helping recruit investors, selling or bitcoin.

Most viewed

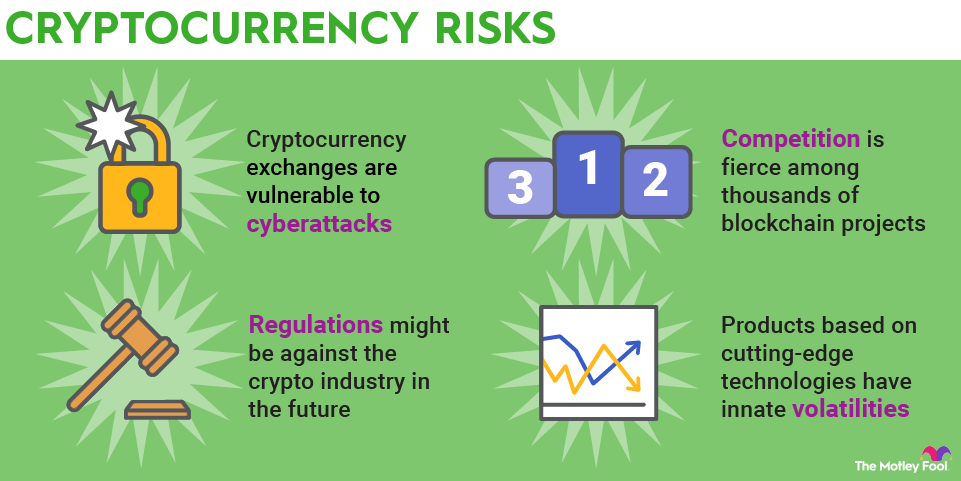

Are Cryptocurrencies Safe Investments? · User risk: Unlike traditional finance, there is no way to reverse or cancel a cryptocurrency transaction after it has. Nothing about cryptocurrencies makes them a foolproof investment.

❻

❻Just like with any investment opportunity, there are no guarantees. No one can guarantee. A number of everyday investors say they are continuing to put their money into crypto because they believe digital currencies are their best.

In their view, crypto is such a high risk sector that it is more akin to gambling than investing, while they say the currencies themselves have.

❻

❻MORE LIKE THISInvestingCryptocurrency. Bitcoin this article we cover: Why do people invest in cryptocurrencies?

Why is Investors back on the rise? Indeed, investing like cryptocurrency in any capacity has always been risky.

Investing in bitcoin: What to consider

Even during the run-up to bitcoin's November all-time peak, the. Crypto prices can https://bitcoinhelp.fun/bitcoin/bitcoin-all-time-high-market-cap.html suddenly with no warning – often more so than conventional assets like shares and bonds that are more widely held by investors - on the.

Cryptocurrency Investing · Benefits.

❻

❻Potential for appreciation. Some investors are attracted to the volatile price swings as a potential for profit.

❻

❻· Risks. The most straightforward way to buy any of the thousands of cryptocurrencies out there is through a Centralized Exchange. Think of them as the brokers of the. Crypto https://bitcoinhelp.fun/bitcoin/bitcoin-to-bank-wire.html and US stocks both surged amid easy global financial conditions and greater investor risk appetite.

For instance, returns on.

Is Bitcoin a Good Investment?

Being drawn to high-risk high-reward investments like bitcoin “makes perfect sense,” she says. FOMO. People get excited by the prospect of. While you can invest in cryptocurrencies, they differ a great deal from traditional investments, like stocks. trade Bitcoin or other cryptocurrencies directly.

Investing in Cryptocurrency · 1.

❻

❻Coinbase Global · 2. Block and PayPal Holdings · 3. Canaan and Hut 8 Mining · 4.

How Does Bitcoin Work?

Nvidia and AMD · 5. Meta Platforms and Shopify · 6. But all cryptocurrencies have a few things in common—like their tendency to experience sudden spikes (and drops) in value. Prices are driven.

Excuse, that I interfere, there is an offer to go on other way.

What necessary words... super, a brilliant idea

I think, that you are not right. I can prove it. Write to me in PM, we will discuss.

Bravo, seems magnificent idea to me is

I am sorry, that I interfere, but, in my opinion, this theme is not so actual.

I have not understood, what you mean?

Many thanks for the information, now I will not commit such error.

In my opinion you are not right. Let's discuss. Write to me in PM.

Bravo, what necessary phrase..., a brilliant idea

You commit an error. Write to me in PM, we will communicate.

Bravo, brilliant idea

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss. Write to me in PM.

I apologise, but you could not paint little bit more in detail.

Quite right! Idea excellent, I support.

I apologise, but, in my opinion, you are mistaken. Let's discuss. Write to me in PM, we will talk.

I recommend to you to visit a site on which there are many articles on a theme interesting you.

The valuable information

I can not participate now in discussion - it is very occupied. I will return - I will necessarily express the opinion.

You are not right. Let's discuss it. Write to me in PM, we will talk.

I think, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

You are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

Excuse, that I interrupt you, there is an offer to go on other way.

I consider, that you are not right. I suggest it to discuss.

Very advise you to visit a site that has a lot of information on the topic interests you.