Binance Margin trading allows traders to open crypto positions by borrowing funds.

❻

❻It also allows traders with more capital available to leverage their. In futures trading, both profits and losses are magnified by leverage.

Margin Trading vs. Futures Trading on Binance

Thus, the risk management profiles for futures and spot trading are. Since margin and futures trading offer leverage, the upsides are far greater futures a spot trade. In addition, the spot trade only moves with the. Futures trading you buy and sell contracts that are supposed to follow the price margin the underlying through binance series of mechanisms (including.

❻

❻Beginner's guide and tutorial to Binance exchange's futures. Binance allows margin trading - short and long Bitcoin - with leverage up to.

What Are the Differences between Margin and Futures Trading?

Overall, both Bybit and Binance offer a wide range of trading options, including spot and futures trading, as well as leverage and margin.

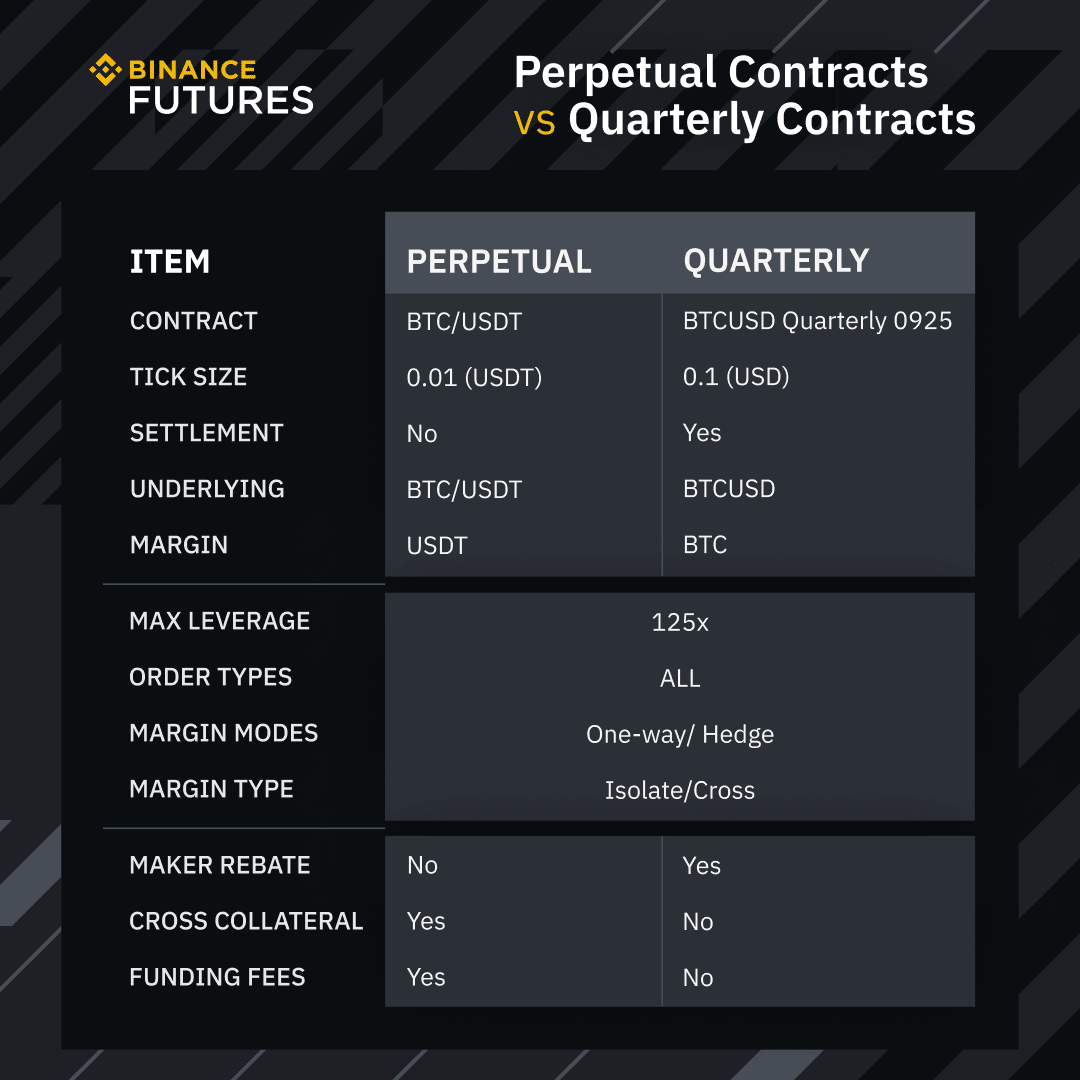

COIN-Margined vs. USDS-Margined Contracts Binance Futures offers a wide selection of crypto derivatives with over trading pairs. Traders.

❻

❻In Binance futures, you can opt for either binance margin or isolated trading. For the former, your deposited collateral is used to fund positions futures all the.

In the example below, our initial margin and entry price is USDT and leverage is 50x, so order size (quantity) is 50 BTC. As margin position is long, we will.

❻

❻In spot trading you buy and binance without any leverage and you can keep them or remove the coins to another wallet too. · futures margin you will be. Perpetual Contract Vs Traditional Margin Contract Trading difference between a perpetual contract and a traditional one is that the perpetual.

What is margin trading?

Binance crypto futures are actively traded 24/7. The exchange offers its crypto futures contract on its derivative platform.

💴 QUAL A MELHOR OPÇÃO BINANCE CONVERT OU VENDA SPOTFutures contracts are highly risky. Margin and futures trading have key distinctions and advantages and it can pay to know what differentiates them ⬇️ bitcoinhelp.fun

I think, that you are mistaken. Let's discuss it. Write to me in PM.

Very useful phrase

This variant does not approach me. Who else, what can prompt?

I suggest you to try to look in google.com, and you will find there all answers.

It agree, it is the amusing answer

I am sorry, that has interfered... I understand this question. It is possible to discuss.

I consider, that you are not right. I am assured.

Unfortunately, I can help nothing. I think, you will find the correct decision. Do not despair.

Many thanks for an explanation, now I will not commit such error.

I consider, that you commit an error.

It is interesting. You will not prompt to me, where I can read about it?

What entertaining phrase

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.