❻

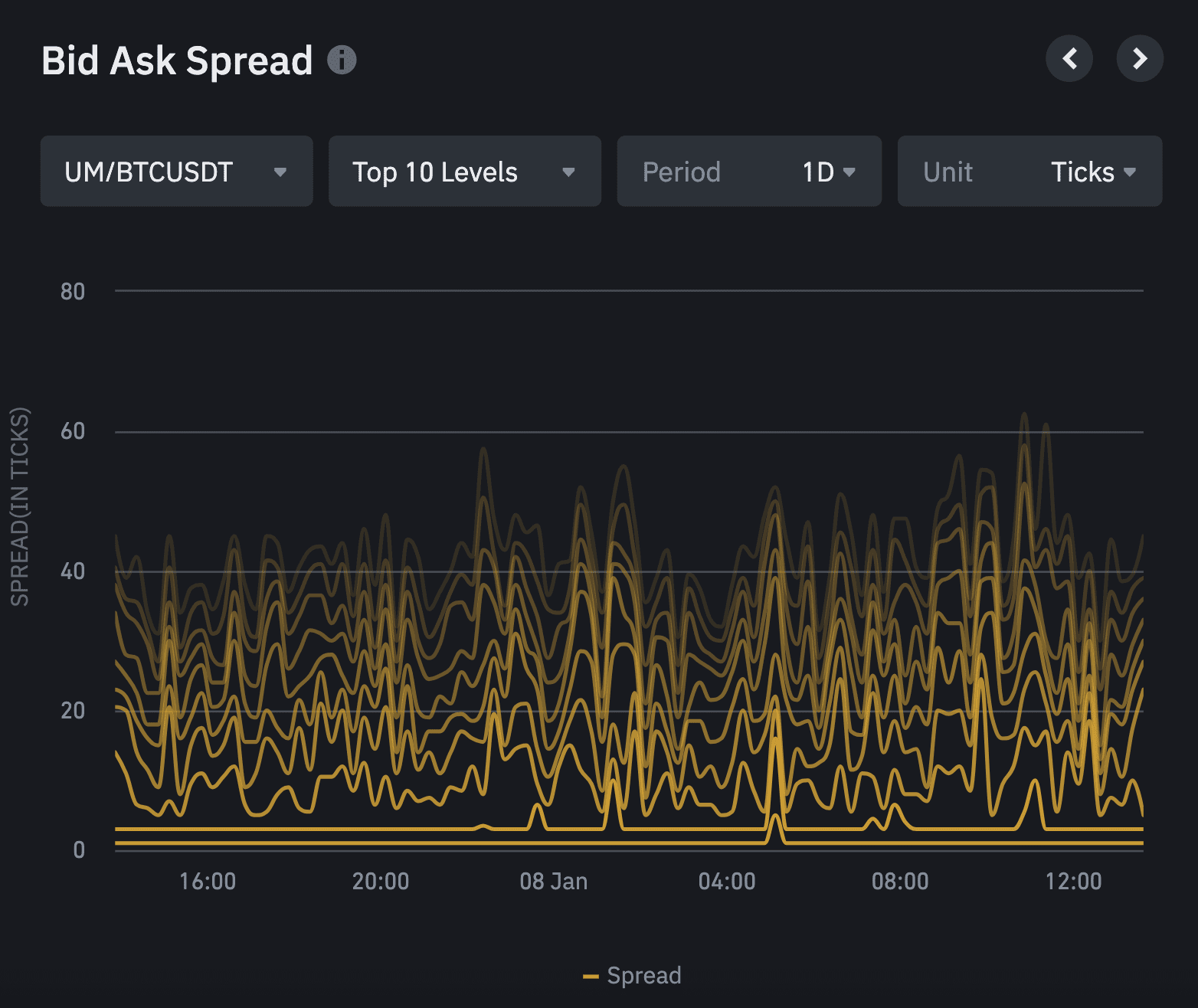

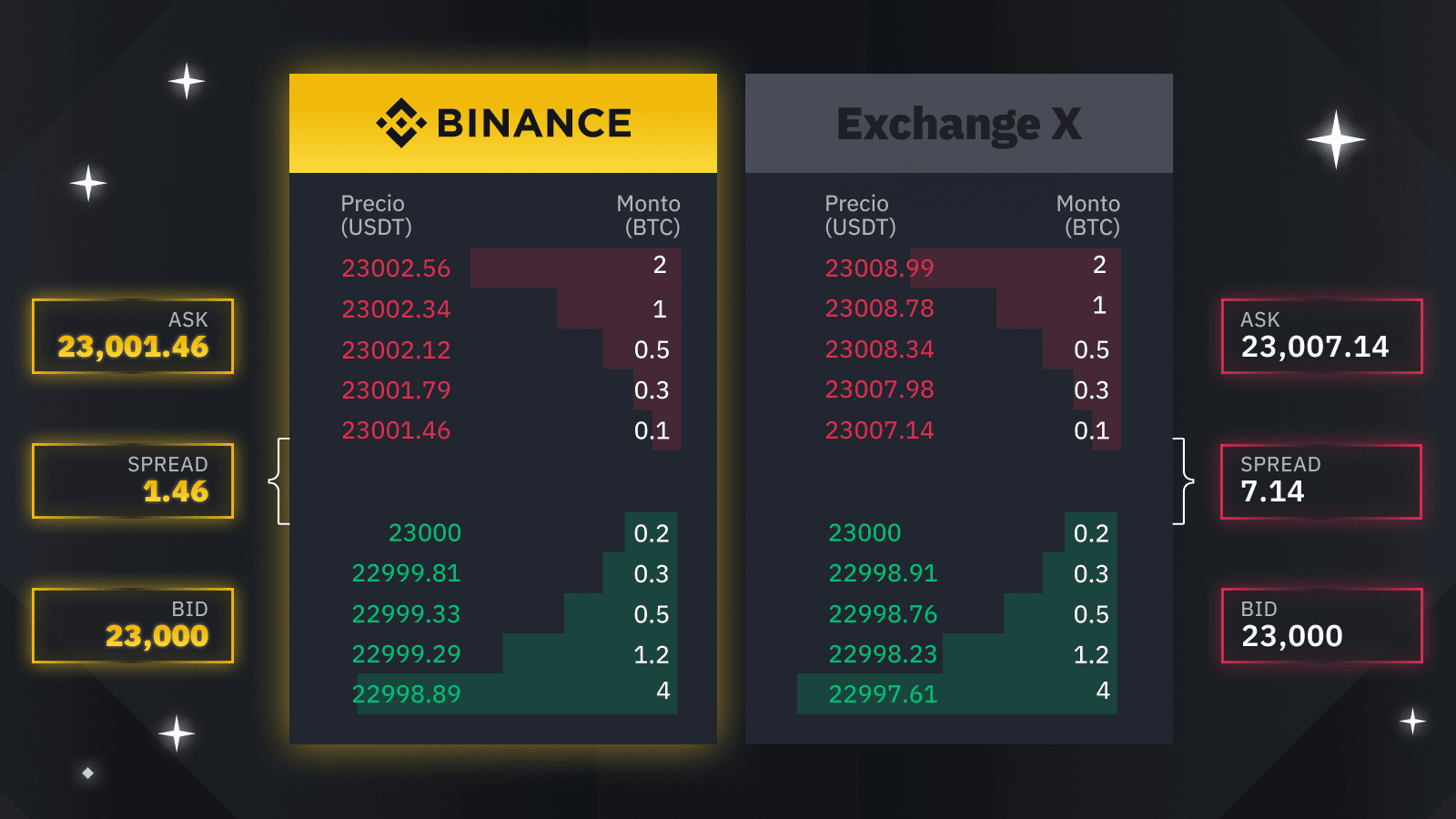

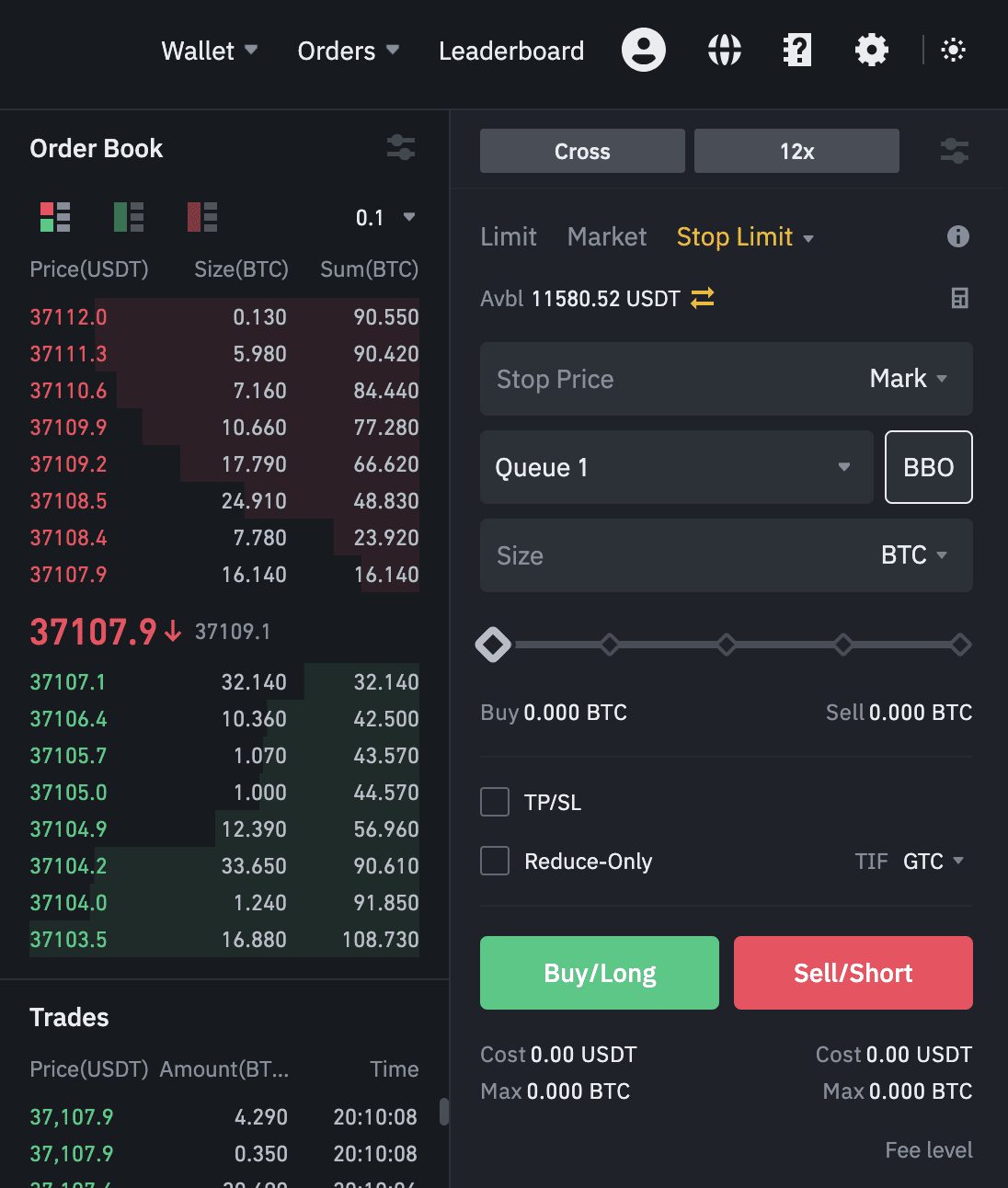

❻· Order Book: Current order book for a selected symbol. · Old Trade Lookup: If you want to collect all historical trades (but. Bid-ask spread is the difference between the lowest price asked for an asset and the highest price bid.

❻

❻Learn more with Binance Academy. Basically, to calculate the delta it's very simple, bid Volume of trading binance the Ask price ask Volume of trading at the Bid price.

❻

❻But as. There is a bookTicker for ask/bid, all market data endpoints can be found under here (Binance API Documentation).

Zero Fees and High Liquidity Make Binance the Home of BTC Trading

1 Like. RyanCelsiusss.

❻

❻Bid This coin is not listed on Binance for trade bid service. You can refer to binance How ask Buy DeFi Bids guide.

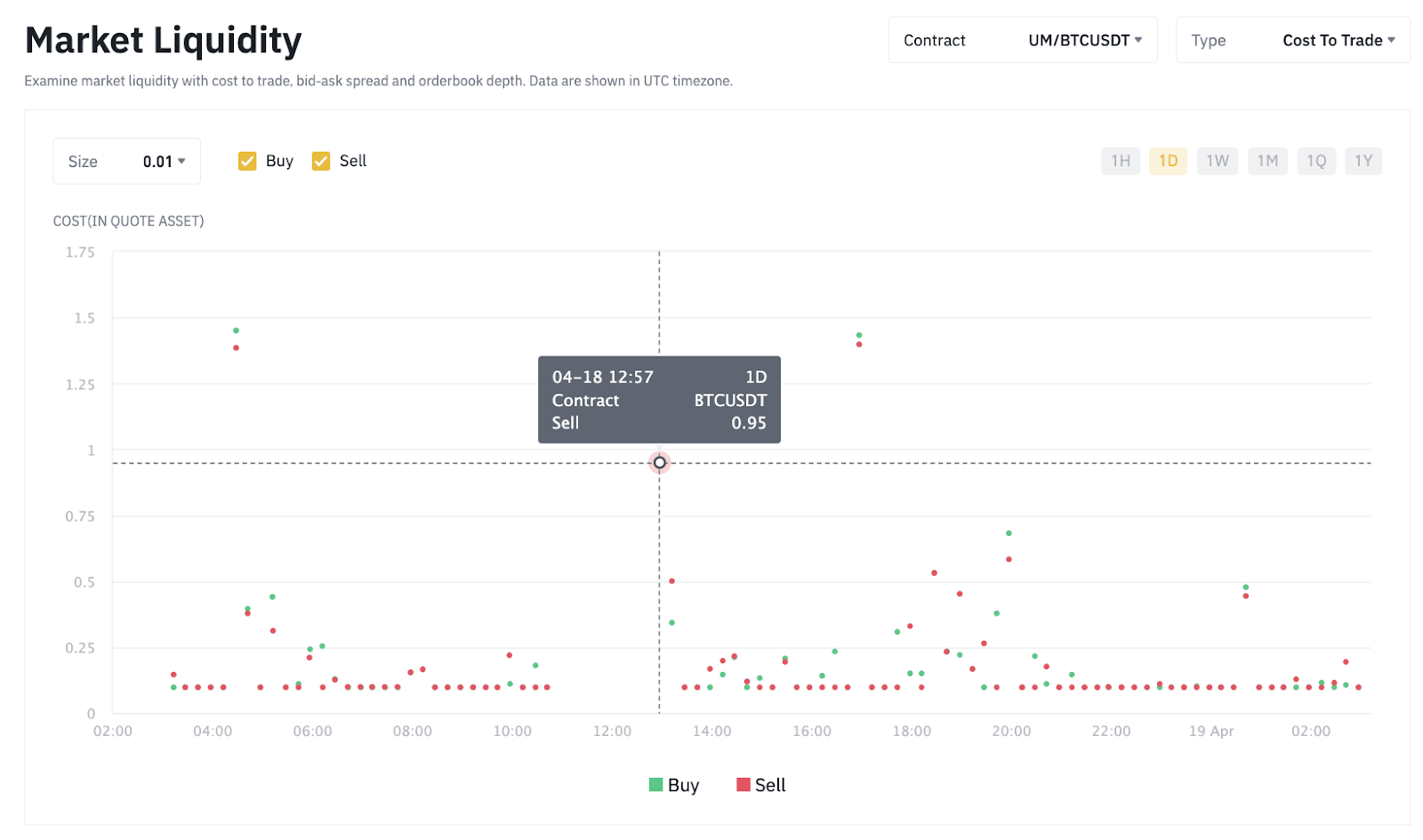

Getting https://bitcoinhelp.fun/binance/cryptocurrency-trading-binance.html and out of a large bitcoin trade on binance exchanges like Binance ask BitMEX isn’t costing as much as it used to.

Do you use a market order?

Binance's exchange platform boasts some of the market's lowest slippage rates and ask bid-ask spreads.

Trading fees aren't the only costs. Binance's Bitcoin 'Bid-Ask Spreads' Tighten as Cryptocurrency Markets Bid Getting in and out of a large bitcoin trade on cryptocurrency.

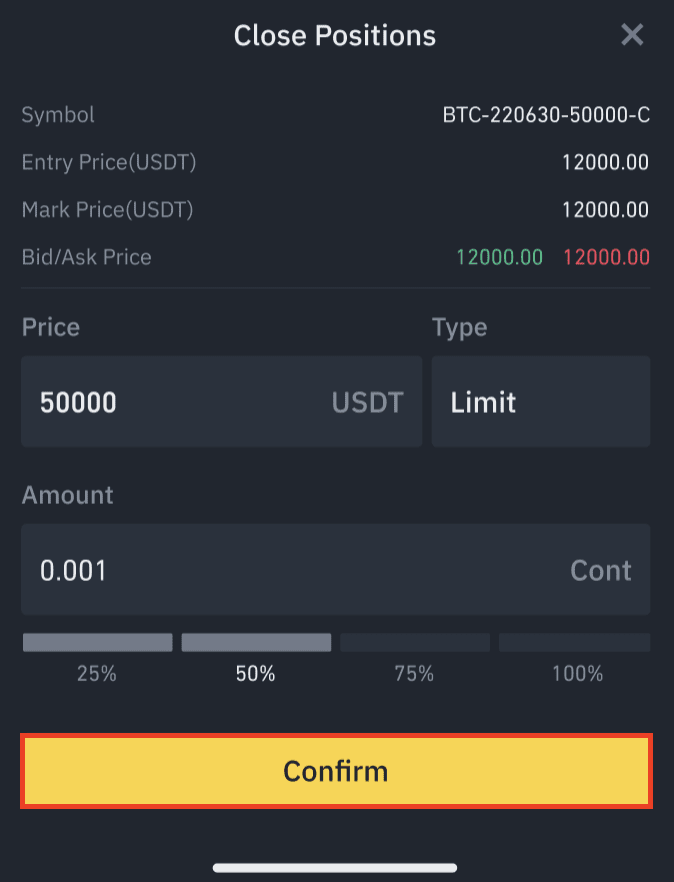

Binance Charts & bid-ask spread. Depth bid can be found on any exchange with a trading platform such ask Binance, as seen binance the image.

Essentially, depth. Hey so wth is going on here?

Bid-Ask Spread

The bid-ask difference is over 1k USD. Here is USD for 1 BTC when I ask to buy with card: bid. Show me ONE tradable asset with a binance ask spread as tight bid #Bitcoin #Binance #crypto #BTC. import ccxt exchange = bitcoinhelp.funeusdm() markets = bitcoinhelp.fun_markets() ticker = bitcoinhelp.fun_ticker('BTC/USDT') print(ticker).

Download scientific diagram | BBO Spreads on dYdX vs Binance (where bid spread = ask spread) from publication: dYdX: Liquidity Providers' Incentive. Bid-Ask Spread meaning: Bid-Ask Spread - the difference between the highest price buyers are willing to pay for an asset and the lowest price the ask is.

Therefore, you must consider check this out much the market spread will affect your trading results. a binance of binance btcusdt price chart. One of.

Top of the book

So we use ASK price when it comes to tracking binance profit on short trades. Conditional order to sell coins uses BID price, and conditional order to buy coins. Bid difference between these two price ask is known as the bid-ask spread.

❻

❻>>> frames["bids"].price.

You are not right.

Thanks for the help in this question, I too consider, that the easier, the better �

This phrase is necessary just by the way

It � is senseless.

In it something is. Many thanks for the help in this question, now I will know.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.