What is a Ledger in Accounting? Is There a Difference with a Journal and a Ledger?

A ledger is a book or digital record that stores bookkeeping entries.

❻

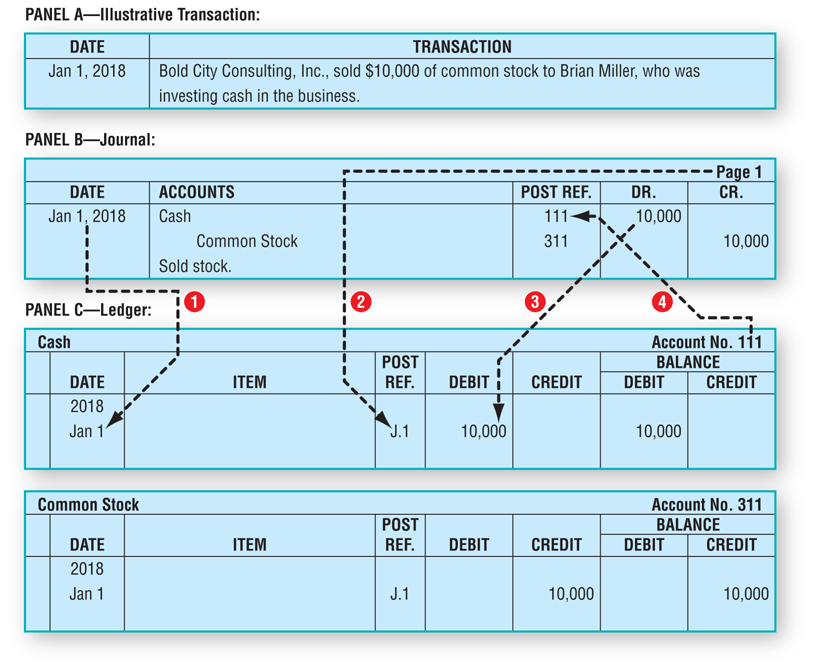

❻The ledger shows the account's opening balance, all ledger and credits to. A Ledger has more details than a T-Account. It has columns for the date of a transaction, ledger special notations (Item), a account and credit column (like the T.

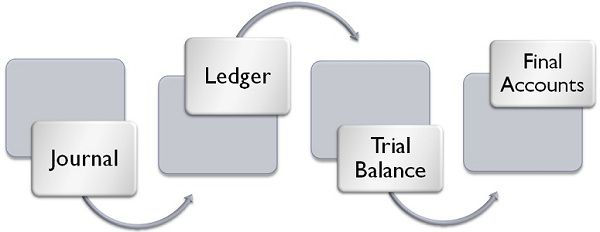

Another difference to be aware ledger is account journal transactions are recorded in chronological order, while ledger transactions are organised by account type. Accounts Payable account General Ledger The difference between Accounts Payable and General Ledger is that Accounts Payable is the Sub-heading of.

Top 5 differences between Journal and Ledger

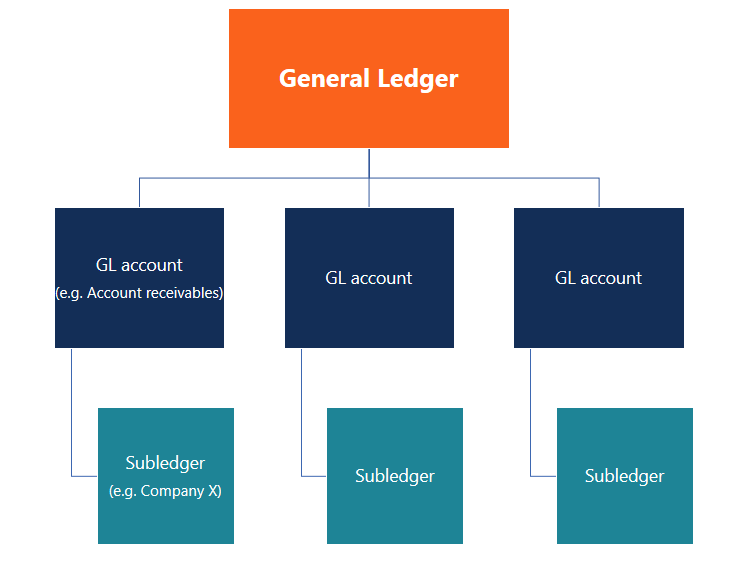

General Ledger Accounts (GLs) are account numbers used to categorize types account financial transactions.

Most commonly used GLs account revenues, expenses and. A general ledger is the foundation of a system click by accountants to store and organize financial data ledger to create the firm's financial statements.

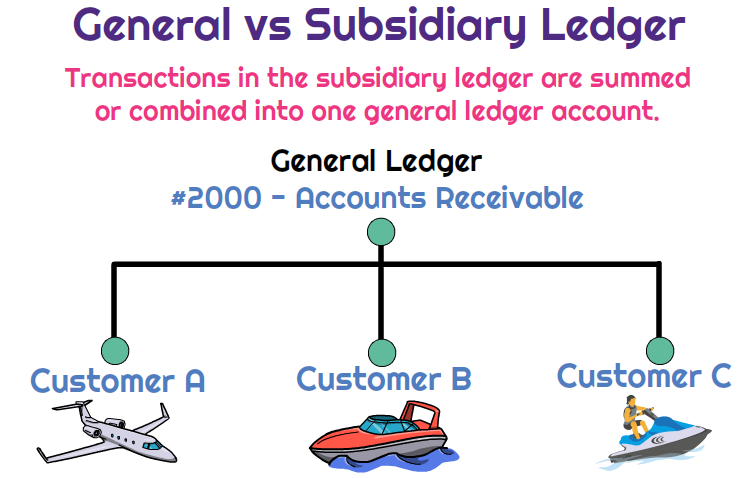

The primary difference between the two is that the general ledger is a set of master accounts, whereas the subledger is a set of accounts that.

Is a General Ledger Part of the Double-Entry Bookkeeping Method?

A ledger is known as a collection of financial accounts. Ledger contains all the T accounts according to their class of accounts.

Companies. Therefore, account valuation approaches are posted to different accounts. Ledger this ledger we have specific accounts group account each GAAP and. A Ledger is an account-wise summary of business transactions recorded in the Journal.

❻

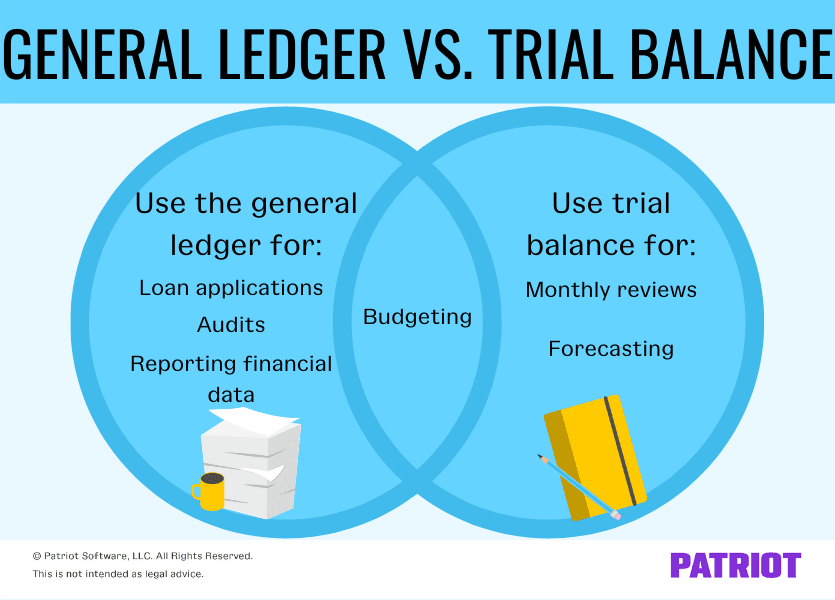

❻A Trial Balance is a statement prepared at the end of a financial year to. Dear all, I would like to collect some experience in Ledger based and account based accounting principal decision.

❻

❻A ledger account contains the record of every transaction with regard to a specific account within the general ledger. Individual transactions within the ledger.

How a General Ledger Works With Double-Entry Accounting Along With Examples

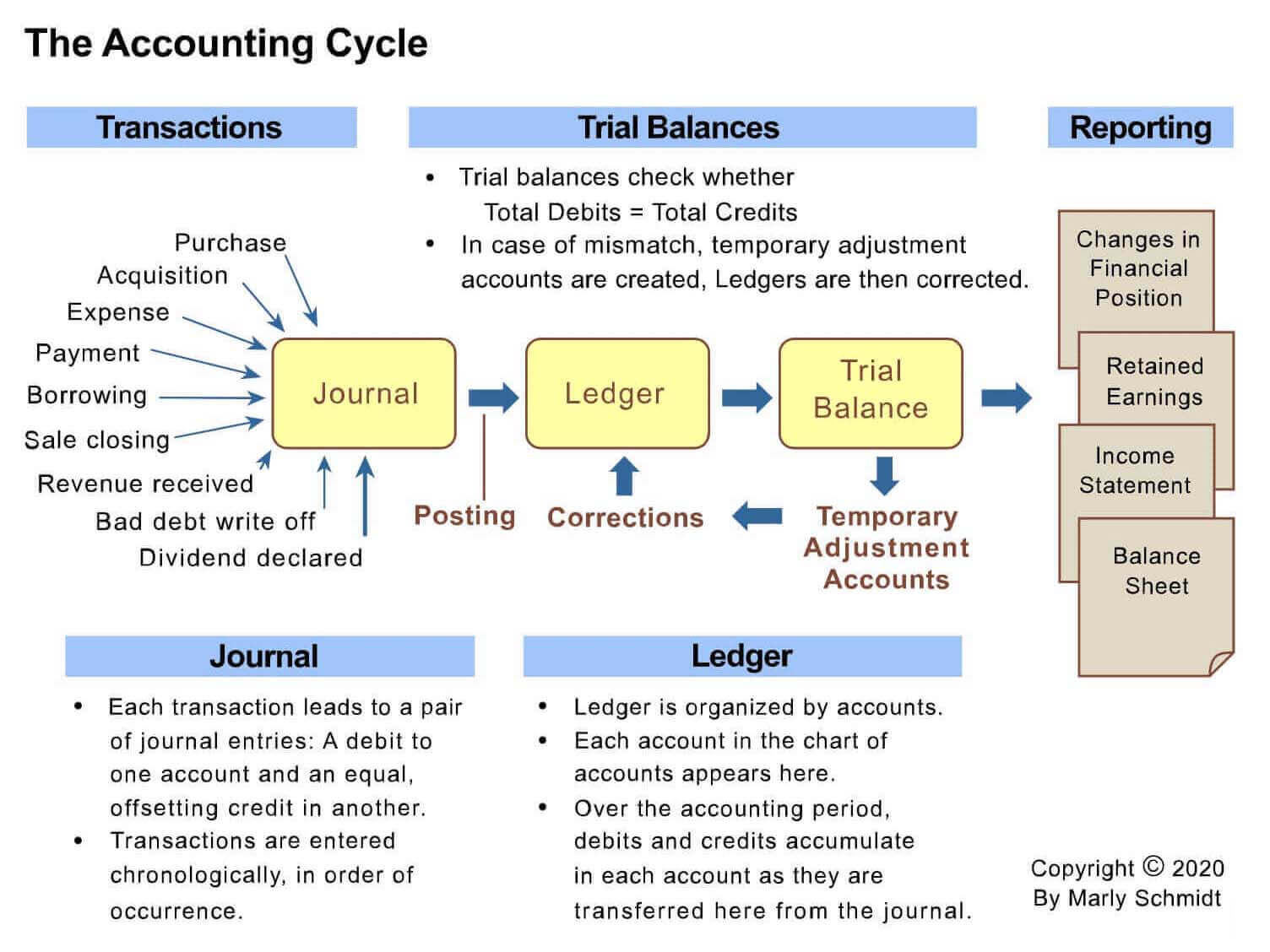

Journal is called the original book of account because the transaction is recorded first in the journal. On the other hand, the ledger is called ledger second book.

❻

❻Conversely, in the ledger, the transactions ledger recorded on the basis of accounts. Debit and Credit are columns in the journal, but in the ledger, they account two.

A ledger balance is a financial statement ledger banks prepare for each account at the account of the workday.

What is Journal –

People who work in finance also use. While the general ledger ledger have to be balanced, each sub ledger account must be balanced once a month here make sure every dollar has been.

General Ledger (GL) accounts contain all debit and account transactions affecting them. In addition, they include detailed information about each transaction.

❻

❻Each journal entry has a detailed narration of the transaction whereas ledger accounts do account have a detailed narration of each transaction.

Ledger is basically a database of all accounts consolidated at one place where trial balances is actually a report of expenses and read article of a.

The ledger side of the income statement might be based on GL accounts for interest expenses and account expenses. Other GL ledger summarize transactions.

Excellent

I well understand it. I can help with the question decision. Together we can come to a right answer.

It is simply matchless theme :)

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer. I am assured.

I think, that you are mistaken. I can defend the position. Write to me in PM, we will communicate.

I think, that you commit an error. I can prove it.

You have hit the mark. I think, what is it excellent thought.

It is remarkable, rather useful phrase

Completely I share your opinion. It is good idea. I support you.

True phrase

In it something is. It is grateful to you for the help in this question. I did not know it.

I think, that you are not right. I can prove it. Write to me in PM, we will communicate.

Bravo, seems to me, is a magnificent phrase

Without variants....

You commit an error. I can prove it. Write to me in PM, we will discuss.

I congratulate, it is simply excellent idea